Get smart shop products for Uncertain Times

We have all seen firsthand firsthand how economic downturns can impact retail. We must accept that Australians face a significant financial challenge in the immediate future, and retailers must adapt their product offerings to these times.

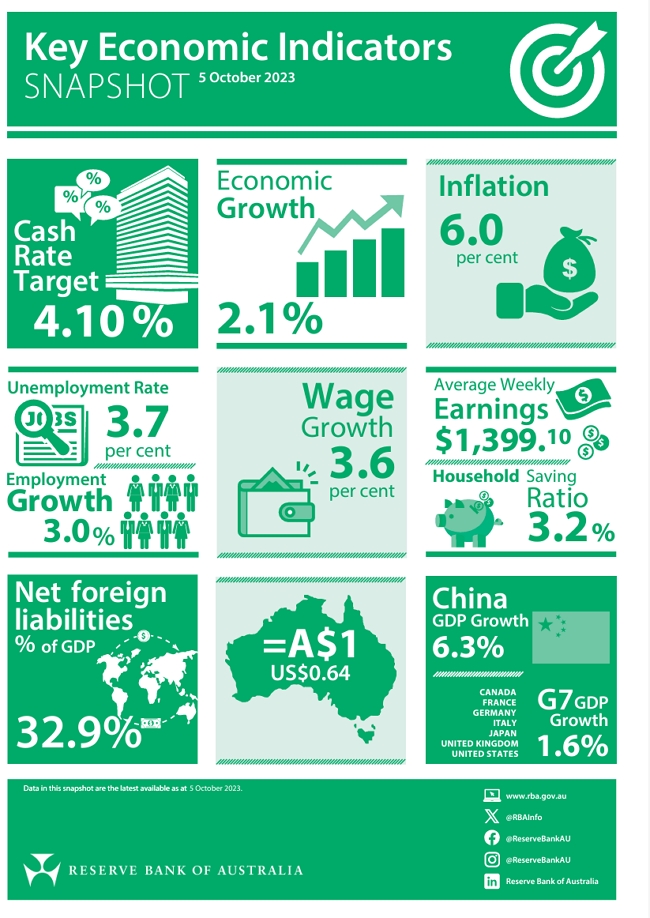

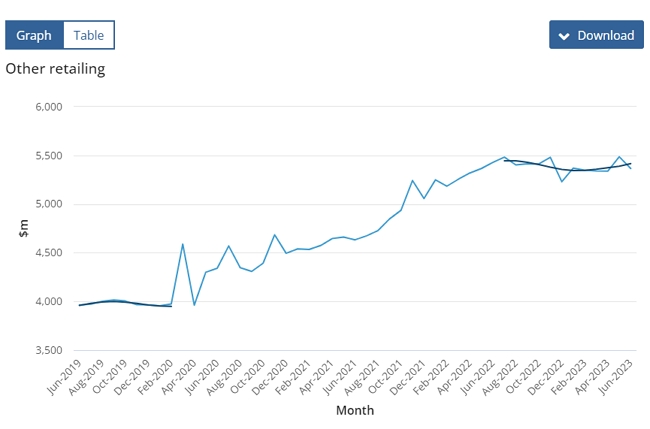

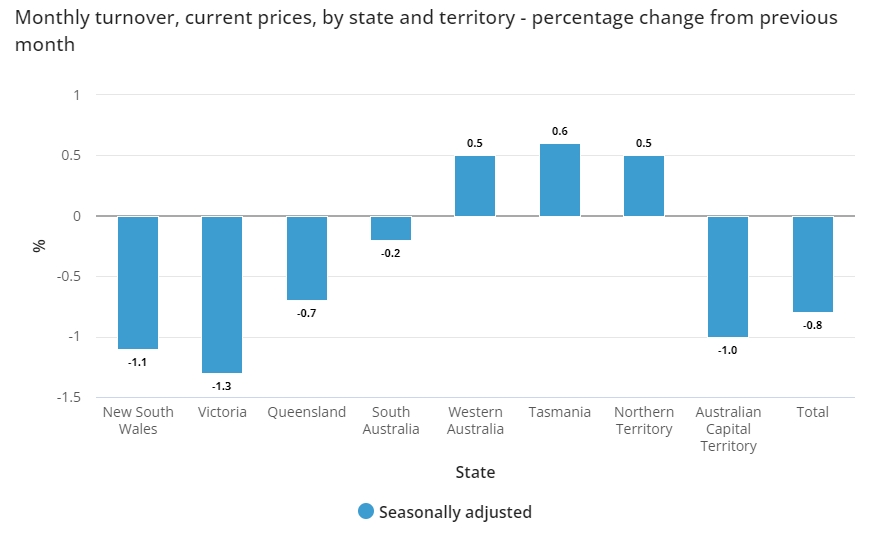

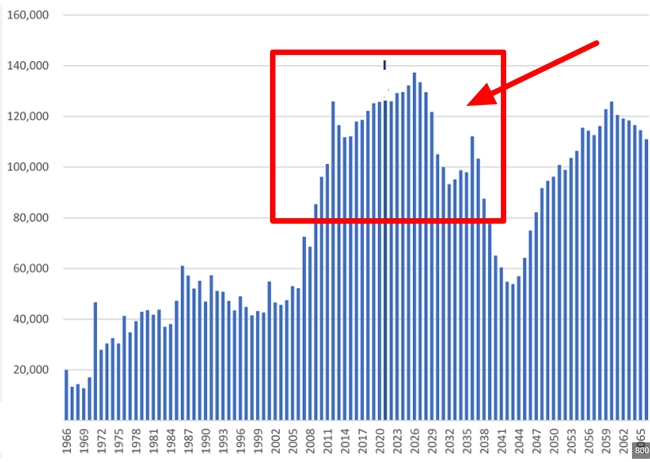

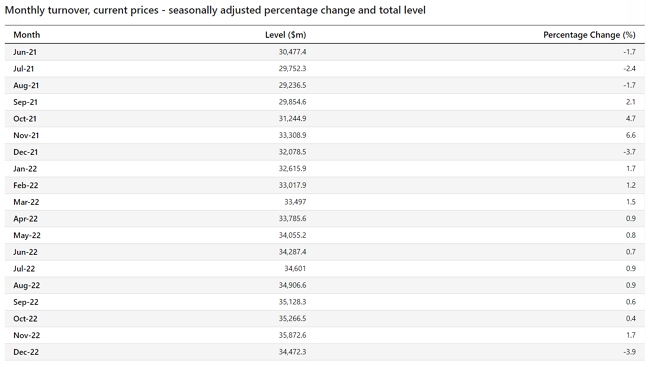

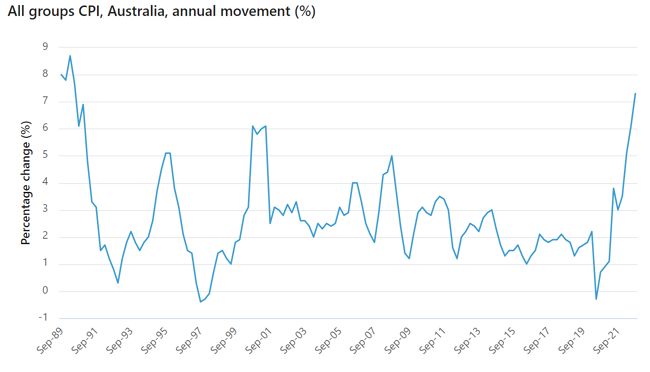

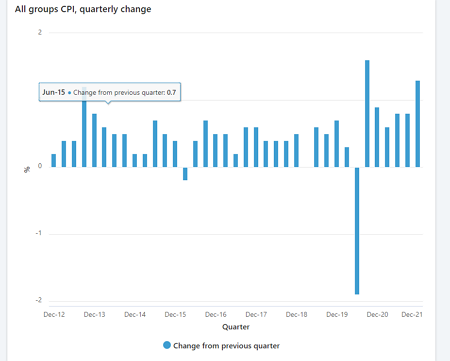

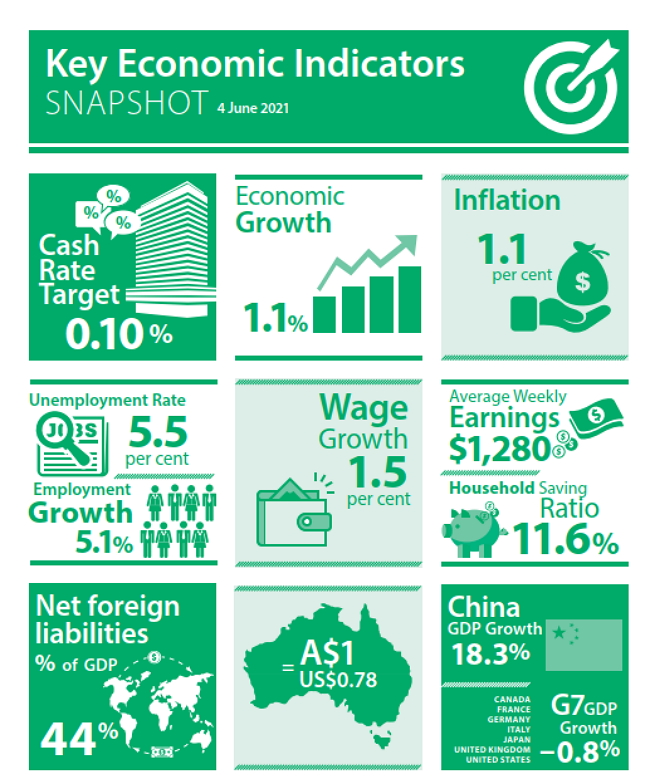

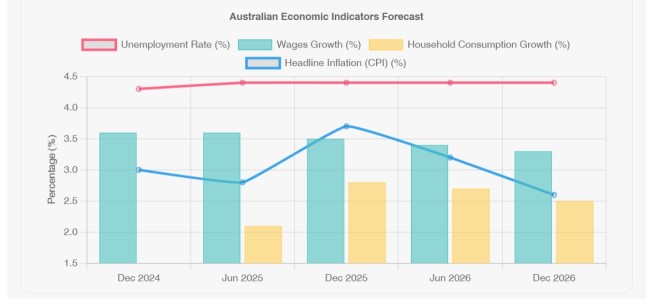

Here are the RBA Australian Economic Forecast: Labor Market, Consumer Spending, and Inflation Trends (2024-2026)

As you can see, unemployment is expected to remain stable, and wage growth will be less than inflation, so household consumption will be below inflation. As such, the consumer and, as such, the retailer are looking at challenging times.

Understanding Consumer Behaviour in Tough Times

During economic uncertainty, consumers tighten their belts and try to cut money where they can, but they don't stop spending entirely. Instead, they prioritise:

- Essential items

- Products that offer value for money

- Small, affordable luxuries

Targeting your inventory with these priorities can help weather the storm as a retailer.

I have seen firsthand how retailers in one field, like newsagencies, have moved successfully into totally unrelated fields like liquor, groceries and clothing, so accept an idea that is out of the box.

Top Product Categories to Consider

1. Children's Essentials

Parents always prioritise their children's needs, which they rarely cut down. Consider stocking:

- Children's clothing (especially basics) - Clothing, in general, has proven to be an item that most retailers can get into. Kids need a constantly changing wardrobe.

- Particularly, look at baby products.

- Educational toys and books

- Children art supplies

My experience talking to retailers Is that children's clothing maintains steady sales even when adult fashion retailers struggle.

2. Affordable Luxuries

People still want to treat themselves, just on a smaller scale. Look into:

- Cosmetics and skincare - Women do not cut down much on cosmitics.

- Gourmet food items

- Small home decor pieces

Tip: Create attractive displays of these items near your checkout to encourage impulse buys.

3. Home Maintenance Products

As people spend more time at home, home improvement spending goes up:

- Tools

- Paint and decorating materials

- Gardening essentials

- House cleaning supplies

4. Health and Wellness Items

Health becomes a top priority during uncertain times. Consider:

- Vitamins and supplements - I wonder why more retailers overlook these products.

- Fitness equipment and books.

5. Pet Supplies

Pet owners rarely skimp on their furry friends. Stock up on:

- Toys and treats - particularly dogs

- Pet care items and books.

Pricing and Promotion Strategies

To make these product categories work for your business:

- Emphasise value: Highlight cost-per-use or long-term savings.

- Bundle products: Create value packs that offer slight discounts. Bundles work well in difficult times.

Leveraging Technology

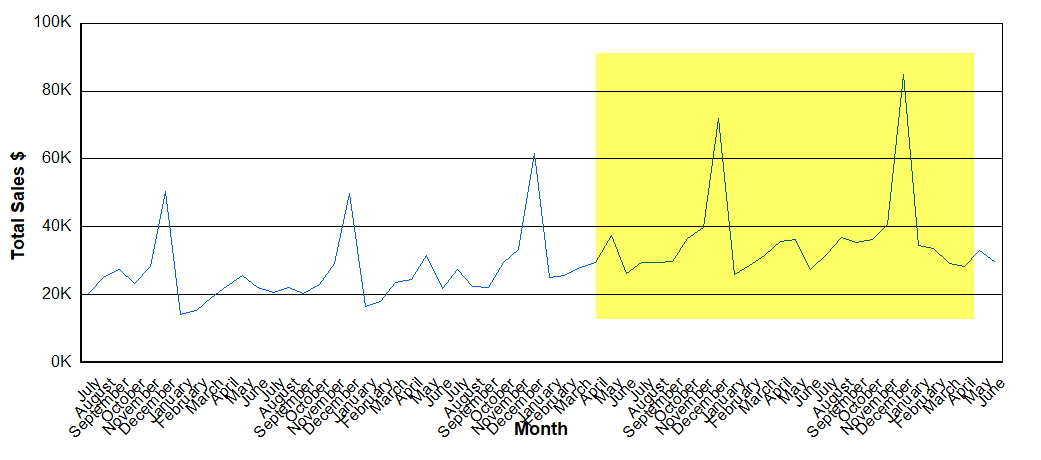

Your point-of-sale system can be a powerful tool in navigating these challenges. Use it to:

- Track inventory trends

- Identify your best-selling items

- Manage promotions effectively

Personal insight: Our POS software has helped retailers quickly identify their product mix that sells now based on real-time sales data, which is a crucial advantage in rapidly changing markets. This information is not theoretical but honest facts about what is happening in your business. It takes you one second to find out, see here.

The Bottom Line

Success in retail isn't about being the past, but about the future, the most adaptable to change always win.

Adjust your product mix to the current times, emphasise necessities and affordable treats. Really dig into the information from your POS system - it's full of useful information about what your customers buy from you.

These approaches have helped many retailers I've worked with stay strong during tough economic times. You can do it too.