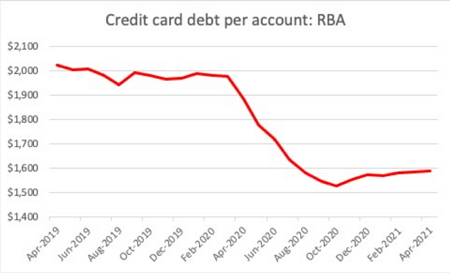

Although we have used our cards more than ever what is interesting is that our debt has dropped. In March 2019, we owed to the banks $40 billion, today it's a third less about $27 billion. It appears that we have been since March 2020 banking our extra money. They have not been eating out, driving less, not going on vacations, no casinos, etc. Maybe also using buy now and pay later (BNPL) cards more although that would be enough to make such a dent on this debt.

What it does show is that the Australians do have the money and credit, now are they going to spend it on Christmas or keep spending it on real estate?

Still, the reason most retailers are positive that it will be a good Christmas is that early sales from Black Friday are good, people do want to make up for the disappointment of 2020, people have big savings in the family and our workforce participation rate is good.