Make it your Afterpay day 2022

Here is a marketing idea that you may want to consider.

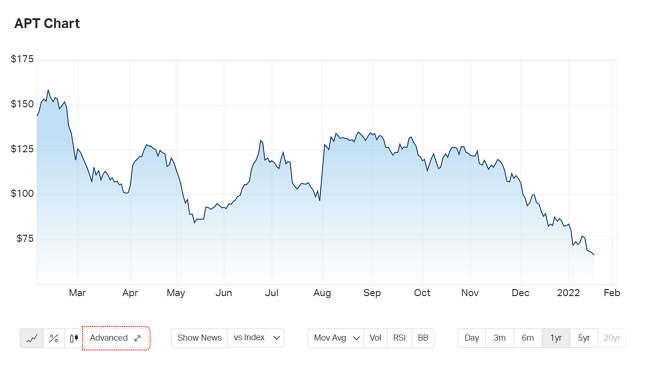

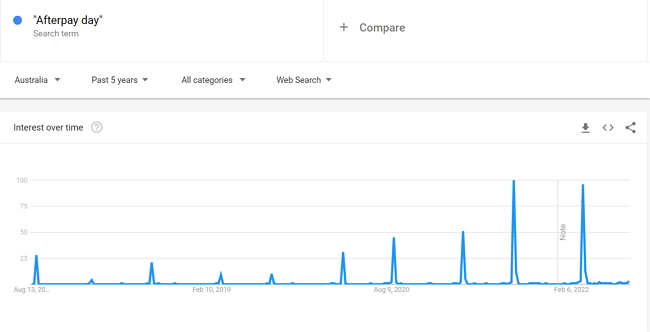

Afterpay day is twice a year, and interest in it has rapidly grown, as you can see below.

Today it is a massive shopping event. The last one was in March; it went well. On indications, the next one will be bigger. After all, Afterpay has a rapidly growing user base. Currently, they have over 3 million Australians in their system who are considered good customers. So Afterpay will be actively promoting to a lot of potentially good customers. There are also 63,000 shops in the Afterpay system, including most majors, e.g. David Jones, the good guys, Kmart, etc., and most will be pushing it too.

There is no reason why you cannot join in. The next Afterpay Day sale will occur between Thursday, 18 August and Sunday, 21 August, as long as you have Afterpay, which is easy to do in our POS system and does not take long to set up. If you have not got Afterpay yet, I recommend getting it. Consider it a virtual lay-by where you don't have to wait until the customer pays in full, with fewer hassles.

Now all you need to do to take part is make a stand of specials and stick an Afterpay day sign on top. Before you ask, no, you are not obligated to ensure they use Afterpay to buy this stock.

Want some ideas on what to put on the stand?

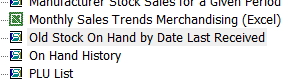

As a minimum, you can do this, go to the register reports > stock titled "Old Stock on hand by Date last received"

Put in a date of a year ago; now, this will give you a listing of your old stock.

Why not use Afterpay Day to get rid of this stock now?

Start your search here if you want to make it official and do much more.