Let us discuss the BNPL for SMB retailers, with Afterpay the biggest, Zip second and then a lot more. Most retailers are not keen on it but accept that the public often loves BNPL over traditional credit cards. Why not? Usually, they do not pay any surcharge as the BNPL are vocal about no-surcharges. The public also does not pay many fees as the merchant pays them. Besides, many people cannot get a credit card anyway, e.g. they are on a low income, insecure at work, and/or have a bad credit rating. 17% of BNPL customers stated they would cancel the purchase if they may not make the payment utilizing a BNPL service.

BNPL encourages people to spend more.

This results in the merchant having to pay high fees on sales except maybe in Lay-bys. Lay-bys are probably the most significant use by retailers in my market space for BNPL.

The big plus is that if you are dealing with a BNPL like Afterpay, they promote your business to millions of people. It helps you get a customer you have never had and would never have had to buy something in the shop even if you are paying high fees.

A smaller percentage of something is better than 100% of nothing.

We switched our support from Zip, as our clients seemed to do better with Afterpay.

The bigger the BNPL is, the better. Besides, from an administration view, the fewer suppliers for BNPL, the fewer headaches in the shop.

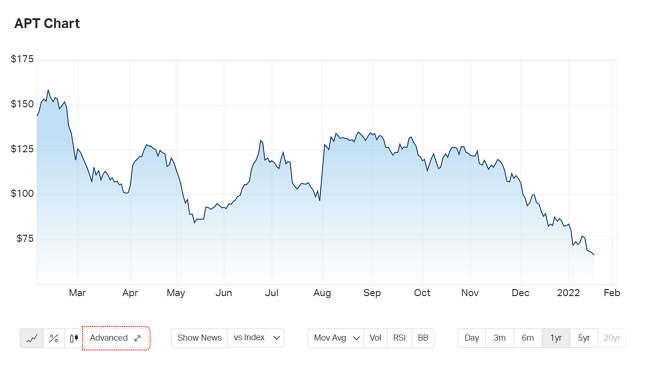

So what is happening now, I think, is a good thing. The last 12 months have seen some massive falls in share prices for BNPL. Afterpay had a 58% drop (see graph below), and the next biggest Zip was about 87% drop. The rest are following pretty much the same pattern. The problem appears to be that BNPL can't charge enough fees to cover bad debts and borrowing costs, plus the big banks are moving into this space. This is driving the share price down. If it goes down like this, we often see a period of consolidation when those with money and a desire to expand try to grab others. This is what we see happening with Humm here. The shareholders have a choice as their business has been unprofitable for the past four months. They are now looking at a share price declining more if they do not sell.