New AI Security Systems Are Coming

If shoplifting feels tougher than it used to, you are probably right as crime statistics are showing. I hear many retailers tell me the same thing. Thieves today seem bolder, and the usual “soft” approaches struggle. In an effort to battle this, AI security is moving into Australian retailers next, after what the Bunnings facial recognition decision signals for our industry.

One important note upfront: we’re not selling AI security systems to because the market isn’t quite there yet at an affordable, plug-and-play level. However, it’s coming, and we are preparing so you’re ready to adopt it when it makes sense for your store.

The real cost of a stolen item

When an item gets stolen, you don’t just lose the shelf price. You lose the profit that pays your rent, wages, power, and supplier bills.

That’s why theft hurts so much in retail. There is no giant buffer in margins today. Every missing item means you have to work harder just to stay even.

There’s also a human cost. Retail crime can feel more aggressive and unpredictable and the law is demanding that you do more.

Why traditional “soft” approaches struggle now

Most retailers already do the basics, like:

- Greeting customers as they enter. I really like the idea of having grandmother greet personally every customer into your shop.

- Keeping the store tidy and easy to see through.

- Using mirrors to reduce blind spots.

- Running CCTV cameras.

- Tagging higher-value items.

These are good practices. They set the tone and they reduce easy opportunities.

However, they have one big weakness: they rely on your team noticing the problem in real time.

Even your best staff can’t watch every aisle while also:

- Serving customers

- Answering questions

- Unpacking stock

- Running the counter

- Handling returns and exchanges

Traditional CCTV often becomes “after the fact” footage. You might confirm what happened later, but the stock is already gone.

So the gap remains: what happens on the shop floor doesn’t always connect to what your business systems record.

Info: One detail reported from the Bunnings case is worth noting. Bunnings presented evidence suggesting that a large share of losses could be linked to a smaller group of repeat offenders (reported as 66% of theft losses tied to the top 10% of repeat offenders). If true it shows that a small number of people are probably causing most of your shoplifting problem.

What “AI security” usually means (in plain English)

When people say “AI security cameras,” they often mean one of two things:

- Behaviour detection: The system looks for actions linked to theft (like concealment or rapid grabbing) without needing to identify a person.

- Identity detection (facial recognition): The system attempts to match a face to a watchlist of known repeat offenders (high impact, high compliance).

Why AI security isn’t mainstream for small business yet

If you’ve looked at AI security options and felt they’re “not built for my shop,” you’re probably right.

Right now, common blockers for retailers include:

- Upfront costs that are too expensive.

- Complex setup (new hardware, new software, new processes)

- Too many false alerts, which staff quickly ignore

- Unclear privacy obligations and paperwork

- Limited support once the system is installed

That’s exactly why we’re not pushing AI security systems to retailers today.

But the direction is clear. Prices will come down over time, and as products get simpler, and POS integrations improve it will come.

The best thing you can do today: tighten the link between CCTV and your POS

Here’s the “future-proof” move that helps you now and later:

Make your Point of Sale (POS) system the centre of your loss-prevention process.

A modern Point of Sale (POS) system does more than take payments. It holds your product list, pricing, stock movement, and transaction history. That makes it the best place to spot patterns and tighten controls.

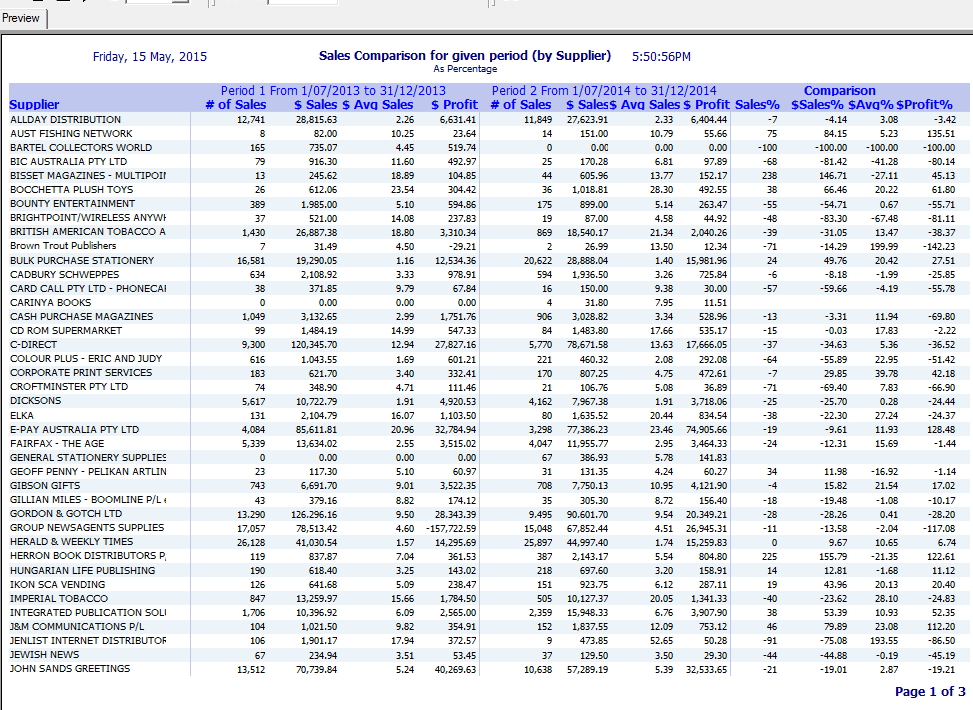

When AI security becomes cost effective for businesses, the best results will come from systems that connect video events to POS data. Even today, you can use POS reporting to target your prevention effort instead of guessing.

How your POS helps reduce theft (without any AI)

Find what’s going missing most often

Use your POS to run inventory variance-style checks. You want to identify:

- Products that should be on-hand, but aren’t

- Categories where shrink keeps showing up

- High-value items with unusual stock movement

Even if your stocktake isn’t perfect, patterns usually show up quickly.

Once you know your “hot” products, you can:

- Move them closer to the counter

- Limit how many are displayed at once

- Use locked displays or staff-assisted access for the highest-risk lines

Tighten refunds, voids, and discounts

Not all loss is shoplifting. Some comes from process gaps.

Your POS can help you control:

- Who can apply discounts (and how much)

- Who can process refunds

- When a manager PIN is required

- How you track “no sale” drawer opens

These settings protect you without changing the customer experience.

Use your stock exception reports

- High discount rates at certain times

- Frequent voids on one register

- Refunds without receipts

- Transactions with unusually low basket value during busy periods

Make your existing cameras more useful (without buying new ones)

You don’t need fancy gear to get a quick win. You need the right camera placement and a simple routine.

Camera placement that actually helps

Aim for coverage of:

- Entry and exit (clear face-height view where possible)

- The counter and cash drawer area

- Your top theft “hot spots” (based on POS patterns and empty packaging finds). Here is how you can do it now with your POS System

- Blind corners and back-of-store pockets

- High-value shelves (tight view, not wide and blurry)

A common mistake is too many wide shots and not enough close, usable angles.

A 10-minute weekly routine

Set one time each week (same day, same time) to:

- Review any known incidents

- Check whether hot spots have shifted

- Confirm cameras are recording clearly

- Ensure time and date stamps are correct

- Confirm only the right people can access footage

This tiny habit keeps your CCTV reliable.

Staff safety comes first (and you can still act)

When theft rises, some retailers feel pressure to “do more” on the floor. I understand that feeling. But staff safety must come first.

Train your team on responses that reduce risk:

- Use customer service as the first step (“Can I help you find a size?”)

- Avoid physical contact and blocking exits

- Don’t chase outside the store

- Escalate to a manager when needed

- Call police when there’s a clear threat

You can also support staff confidence by writing a simple, one-page incident plan. Keep it near the counter so nobody has to guess in the moment.

If AI security becomes affordable, what will it look like?

When AI solutions do become small-business friendly, expect features like:

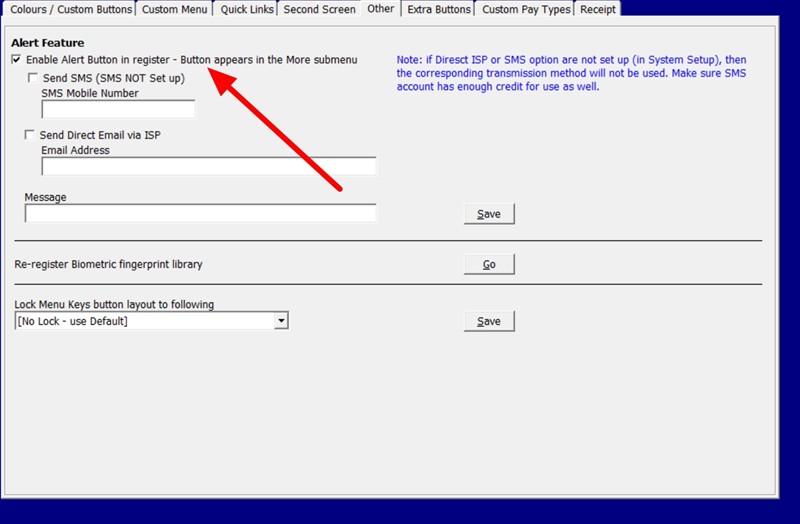

- Real-time alerts to a phone and POS System

- Simple “clips” instead of hours of footage

- Behaviour-based detection

- Heat maps of hot spot zones

- Better reporting that ties incidents to products and times

- POS links to confirm whether a sale happened

This is where the POS connection becomes a game changer. If the system can check whether the item was sold, alerts become more accurate and useful.

What to ask any future AI security provider

When you start seeing these systems marketed to stores, use these questions to protect yourself:

- “Can I use my existing cameras, or do I need new hardware?”

- “How do alerts reach my staff, and who gets them?”

- “How do you reduce false alerts?”

- “What data do you store, for how long, and where?”

- “Can I turn off face identification and use behaviour detection only?”

- “Do you integrate with my POS now, or is it ‘coming soon’?”

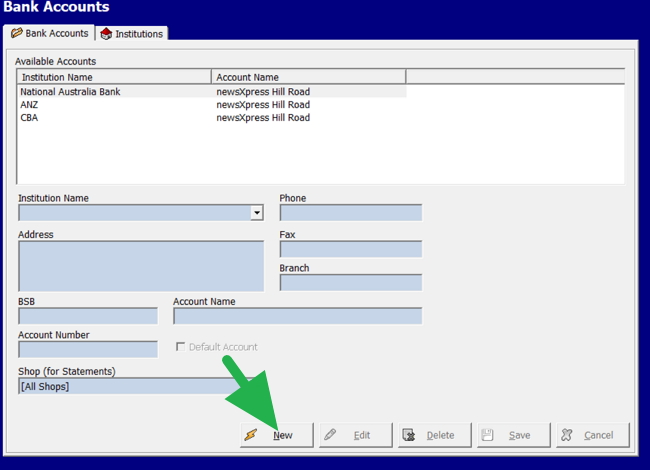

Getting your store “POS-ready” for the next wave

Even if you never buy AI security, these steps will pay you back. If you do buy it later, you’ll be in a strong position.

Clean up your product data

- Make sure barcodes match products correctly

- Remove duplicates

- Standardise product names and categories

- Keep pricing consistent

Good data makes reporting trustworthy, and trustworthy reporting drives better decisions.

Improve stock accuracy in small steps

You don’t need perfection. You need progress.

Try:

- Cycle counts on your top 20 shrink lines (weekly or fortnightly)

- Counting one category each week (rotating schedule)

- Recording write-offs properly (damaged, expired, staff use)

The goal is to reduce “mystery loss” by tightening visibility.

Lock down staff permissions

Most modern POS platforms let you control actions by role.

A simple structure works well:

- Team members: sales only, limited discounts

- Supervisors: moderate discounts, exchanges

- Managers/owners: refunds, large discounts, voids, reports

This keeps things fair and reduces risk without blaming anyone.

Where this is heading in Australia

The Bunnings decision shows how quickly the conversation around retail facial recognition and crime prevention is evolving, as long as customer notification and other conditions are met.

At the same time, the privacy scrutiny around facial recognition shows that retailers can face serious consequences if they don’t handle biometric data properly.

That mix of “momentum” and “risk” is exactly why small retailers should prepare carefully, not rush.

Next step: strengthen your POS and loss-prevention basics

You don’t need to wait for AI security systems to arrive for your business before you take action. Start by using your Point of Sale (POS) system to tighten stock control, improve reporting, and identify your highest-risk products and times.

If you want help, book a demo and we’ll show you how a modern POS can support smarter loss prevention today (inventory insights, staff permissions, exception reporting), and keep your store ready for future camera and AI integrations when the market catches up.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.