Determining your cash and EFTPOS payment breakup involves reviewing the mix of payment methods your customers use, such as cash, debit cards, and credit cards. We are going to do it directly from your point-of-sale (POS) system.

This matters now so much as in the current climate, with RBA discussions focusing on making payments fairer for consumers while claiming to protect merchants, knowing your payment mix will help you forecast potential impacts. In my view, their proposals will encourage customers to drop lower-fee methods like cash and debit, and push the consumer to premium credit cards with high fees.

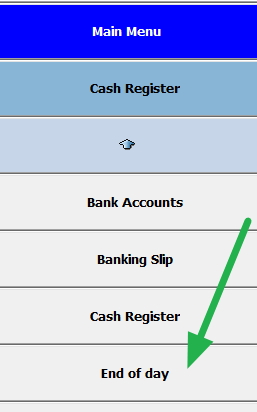

Go to the main menu and select "End of day."

Click where it has a green arrow.

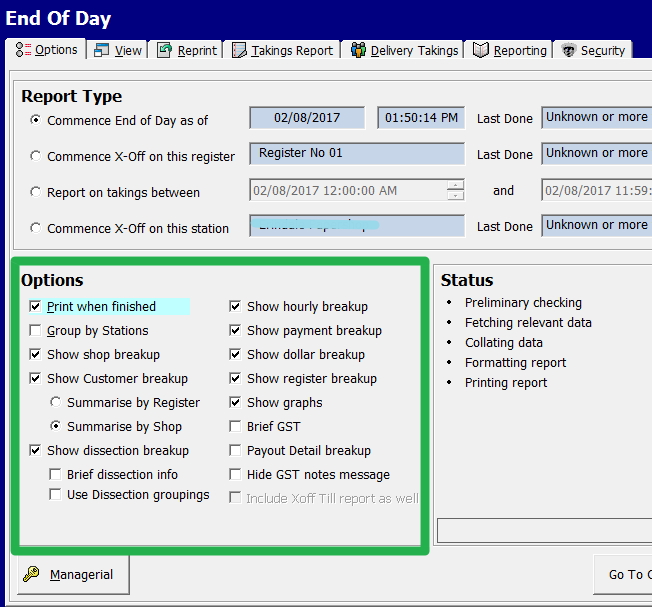

Now, in your Options menu, marked in a green square, tick everything. You will not be sorry if you get too much.

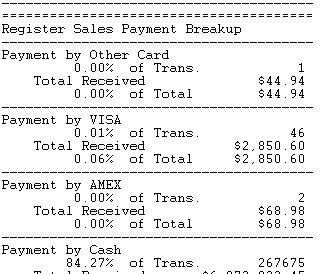

The part of the report you are looking for is the Sales Payment Breakup below.

Pick an appropriate period, generally the last year. Running it a few times with slightly different dates as you may get a better value with different dates. One caveat here is that cash receipts are going up slightly now.

Also while you are there, I suggest checking some of the other great information there such as hourly breakups, to understand peak times for specific payment methods. If your mornings see more cash sales from quick coffee runs, while evenings lean towards cards for larger purchases, you can tailor promotions accordingly. In my experience, retailers who dive into these details often uncover trends that lead to smarter decisions, like staffing adjustments or targeted discounts.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.