Make your own mind up.

My previous article generated a lot of discussion with its conclusion that modern retailers needed a BNPL option and that layby today is, at best, minor. Not everyone liked my conclusion, but they are wrong. In modern retailing, BNPL is not going to be replaced by layby. There is no layby renaissance coming soon.

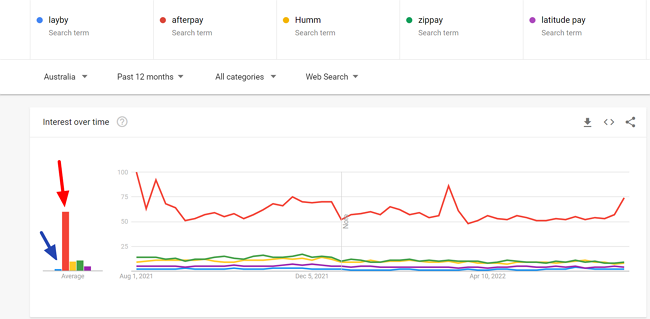

Here is a google trend of interest in layby vs the major BNPL providers over the past year.

In blue, you will see layby and compare it to Afterpay in red. If you want the exact figures, layby has 2% interest, Afterpay 74%, Zip 9%, etc.

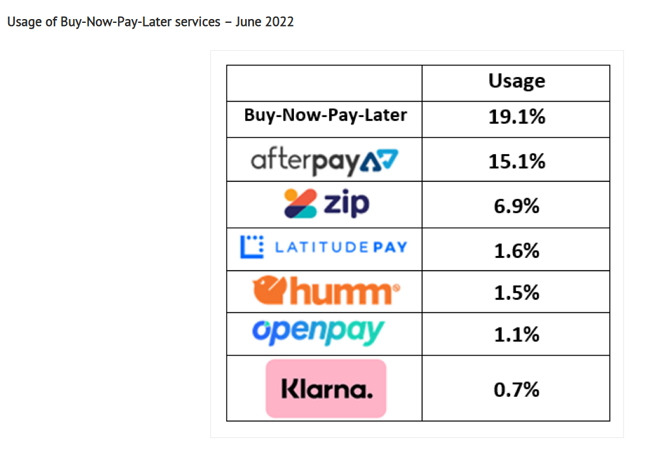

Here is the latest report by Roy Morgan on BNPL.

Summary : The latest Roy Morgan Digital Payments Report shows 17.5 million Australians aged 14+ (82.8%) are now aware of buy-now-pay-later services such as Afterpay, Zip, Latitude Pay, Humm and Klarna.

...

The takeover hasn’t impacted upon growing awareness of Afterpay, now at 81.1%, up 7.7% points from a year ago in June 2021, and up a massive 47.3% points since September 2018.

Here is how it is breaking down today by usage.

Make your mind up. Read the report, available from Roy Morgan 9027-digital-payment-solutions-june-2022

We do not see that a modern retailer can ignore these figures, so our advice is unchanged: you must investigate BNPL. Whatever you think of the Afterpay business model, most of the BNPL business now is there.