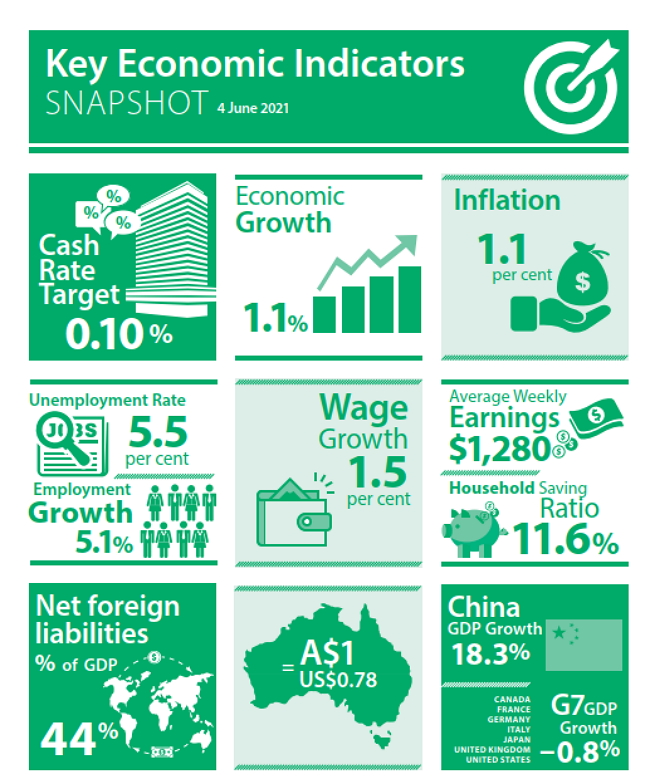

The potential bomb is the inflation rate. Those of us that lived through the massive inflation of the 1970s can relate to how destructive inflation can be. Current at 1.1%, it looks alright now, but I am sure we will hear much about it soon. The reasonably strong Australian dollar will help here. The Chinese GDP growth figure is impossible, no way it is going to be anything like that. It is pleasing that we are doing much better than our peers like Canada, France, Italy, UK, etc.

The unemployment rate is higher for retail than we would like, but it is going down fast. Average weekly earnings are slightly up. Household savings are up. So we can say the Australian public has money to spend. This should help retail as the number of new customers will be going up.

These figures are better than we would have forecasted at the beginning of the year.

Still, it would be nice to get those tourists back. The earliest we can start to see them back if everything goes well is the end of this year.