The recent legal action by the ACCC against Coles and Woolworths is a shocker. Focusing on allegedly misleading discount campaigns will bring retail pricing strategies under intense scrutiny.

What's at Stake in the ACCC vs. Supermarket Giants Case?

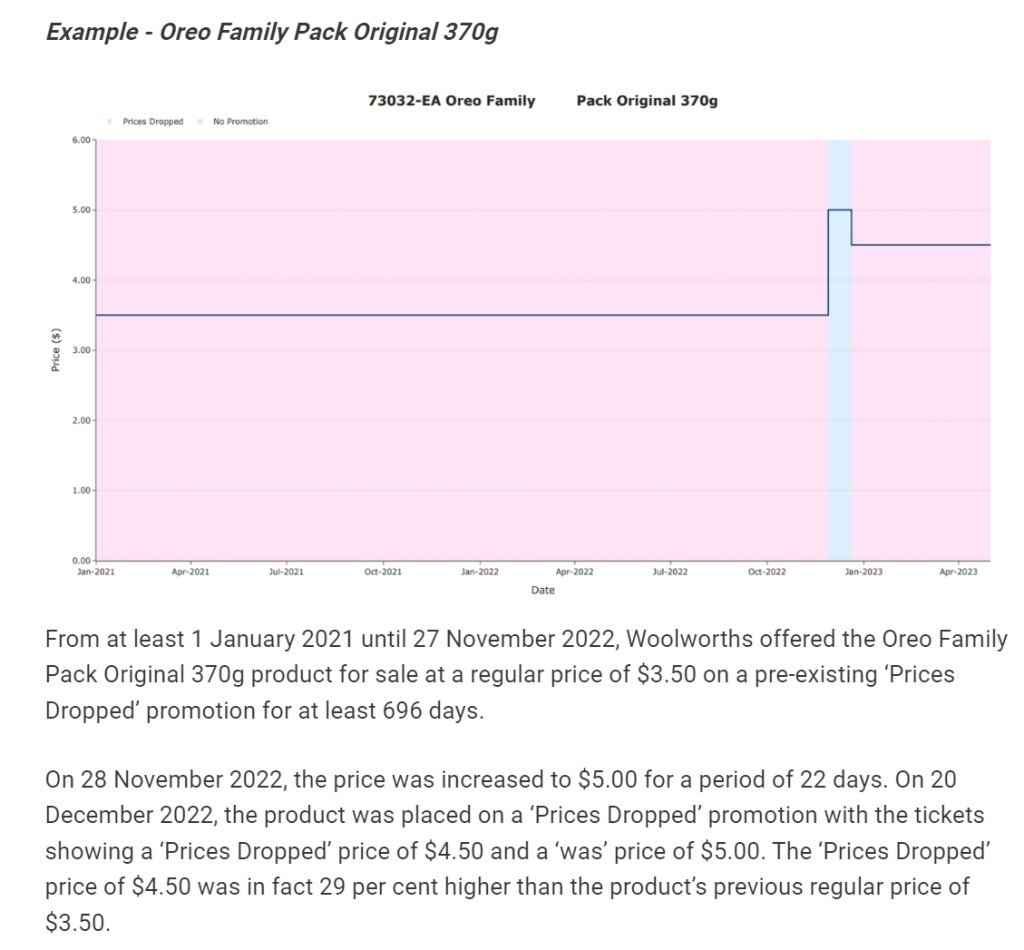

At the heart of this legal battle are the "Prices Dropped" and "Down Down" campaigns run by Woolworths and Coles, respectively. The ACCC contends that these promotions were misleading due to artificial price inflation before the discounts.

Read what they are saying about one item here.

Now, in total, the ACCC is taking to the Federal Court:

- Woolworths: For 266 products affected over 20 months

- Coles: For 245 products affected over 15 months

The outcome of this lawsuit could have far-reaching implications on our pricing strategies, especially in our current never-ending inflationary environment.

The Numbers

These aren't small numbers; the potential penalties are significant, $50 million for each breach. That should be enough to make any retailer take notice.

A Common Scenario

Imagine this scenario: You've been selling an item for $6 for a while. Your supplier increases their price to $5, so you bump your selling price to $10. Then, a week later, you decide to run a 20% "discount" promotion, bringing the price down to $8. In retail, this is relatively common.

Based on what the ACCC is saying, your initial pricing and cost-based increase are standard practices, so that is okay here, but that "discount" promotion could land you in hot water. Why? Because your discounted price of $8 is higher than your original long-term price of $6. A week is hardly a reasonable period.

The Grey Area

The tricky part is determining a reasonable period before offering a discount.

"What if you offer a discount three weeks after increasing the price, a month, a few months, etc? Would that be misleading or fair?" The law needs to be more transparent on this, which leaves us retailers with a problem of what is reasonable.

My Two Cents

Based on my years of experience, it's best to err on caution. If you've just had a significant price increase, think twice before slapping a discount label if the final price is still above your long-term price point. Your POS System shows a history of when you sold an item and for how much. It will also inform you how long the new price has been in effect. I will also supply you with many of the records you may need.

Let's tweak our scenario a bit more:

- Original cost: $3

- Original selling price: $6

- New cost: $3.50

- New selling price: $7

- 20% discount price: $5.60

In this case, your discounted price ($5.60) is below your long-term price ($6), so it will likely be okay.

The Bigger Picture

This case against Coles and Woolworths isn't just about big supermarkets. We must be more mindful of how we present our pricing and promotions to customers.

A Wish for the Future

Would it be great if suppliers informed us about price increases? This would allow us to prepare and communicate proactively with our customers, but we can discuss that in another post.

In the meantime, please ensure that your pricing practices comply with the current legal standards and keep our customer's trust. After all, that's what good retailing is all about.