NAB Morning Call: Your Daily Business Intelligence

If you are like me and like to work while listening to interesting discussions, I would like to recommend the NAB Morning Call podcast. It's an Australian business podcast. The podcast is a daily 15-minute business podcast produced by National Australia Bank that delivers market insights specifically tailored for Australian business owners. The NAB bank has clearly put a lot of effort into producing it.

The podcast's strength lies in its real-world examples and data-driven discussions that directly impact business operations.

Memorable Episodes Worth Your Time

Some I found quite memorable, for example, what happened when the bank discovered a man about to transfer $500,000 to a scammer in China. He planned to send the money to his online fiancée, someone he had never met in person despite corresponding for over a year. He was lonely, he meet someone nice online and what do you do, when you know its a fraud, what do you say to such a guy?

Beyond fraud prevention, the podcast tackles critical business survival topics. A standout episode featured 'Back from the brink: How to save a business in distress,' where Michael Fingland, CEO of Brisbane-based turnaround specialists Vantage Performance, discusses what a company can do in the 11th hour to avoid being shut down.

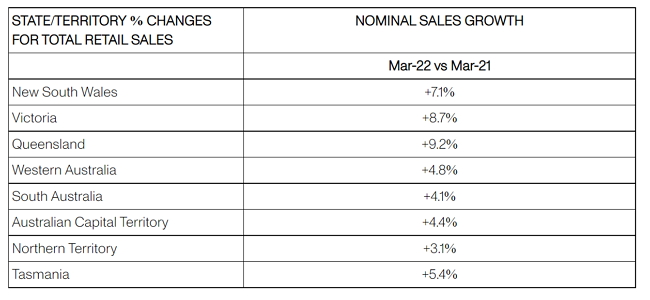

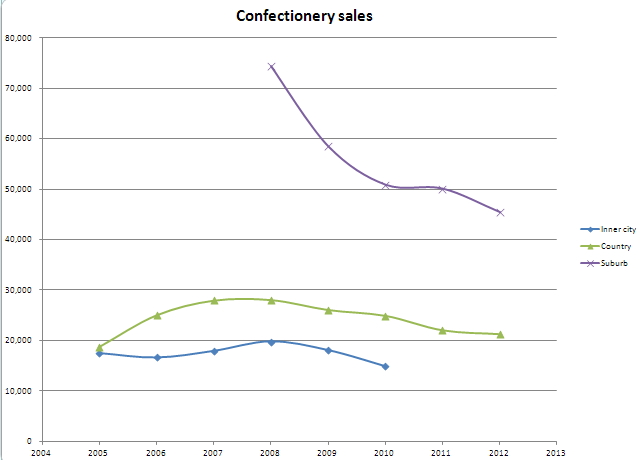

Another one I liked was on what retail customers are now buying in shops. I liked that they had data from people's credit cards, so they knew exactly what people were buying and what their analysts thought the public was going.

Why NAB Morning Call Stands Out

If you are interested in this stuff, I think you will find it helpful (actionable) for SMB owners with SME business advice.

The podcast maintains high production values and has received consistently positive listener reviews, with ratings of 4.8-5.0 stars on Apple Podcasts.

For SMB owners like myself who want to stay informed about economic developments that could impact their operations, the NAB Morning Call provides an efficient and authoritative source of daily market intelligence.

Format and Accessibility

It is published daily at around 7 a.m. AEST is available on weekdays and most major platforms, including Apple Podcasts, Spotify, and Google Podcasts.

You can also get it here if you are not set up for Podcasts.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.