Artificial Intelligence (AI) is now revolutionising the retail industry. It is already changing how businesses operate and engage with customers. I have witnessed firsthand the increasing impact of AI on our retail sector. This article investigates how we anticipate the latest generation of AI solutions will transform the brick-and-mortar retail in Australia.

The retail landscape is evolving rapidly, with AI leading the charge. From inventory management to customer service, AI promises to provide solutions once deemed impossible.

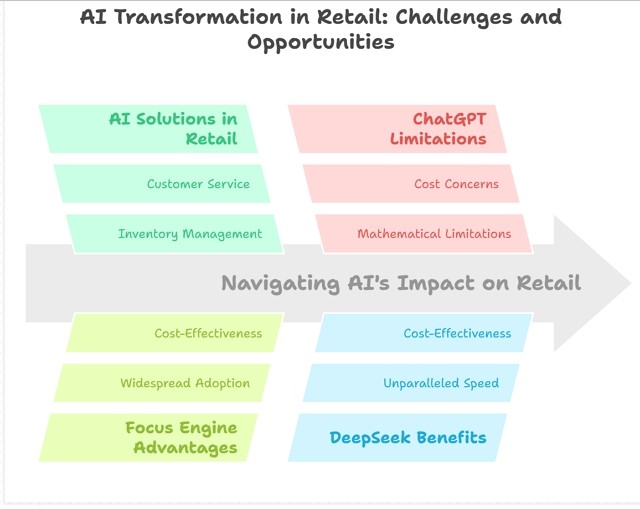

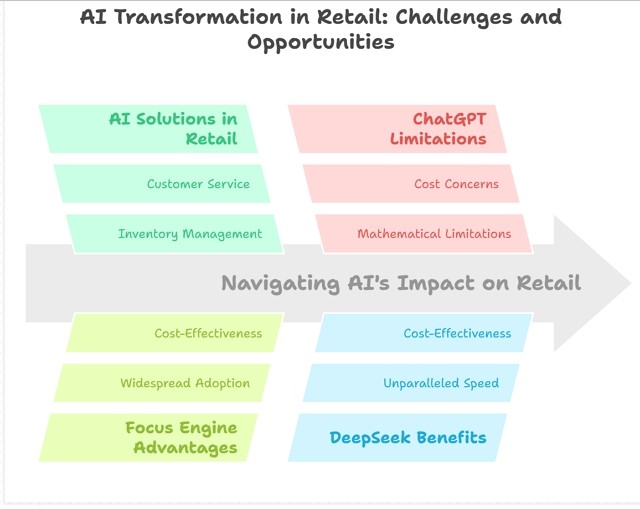

The Focus Engine: Our Early AI Solution

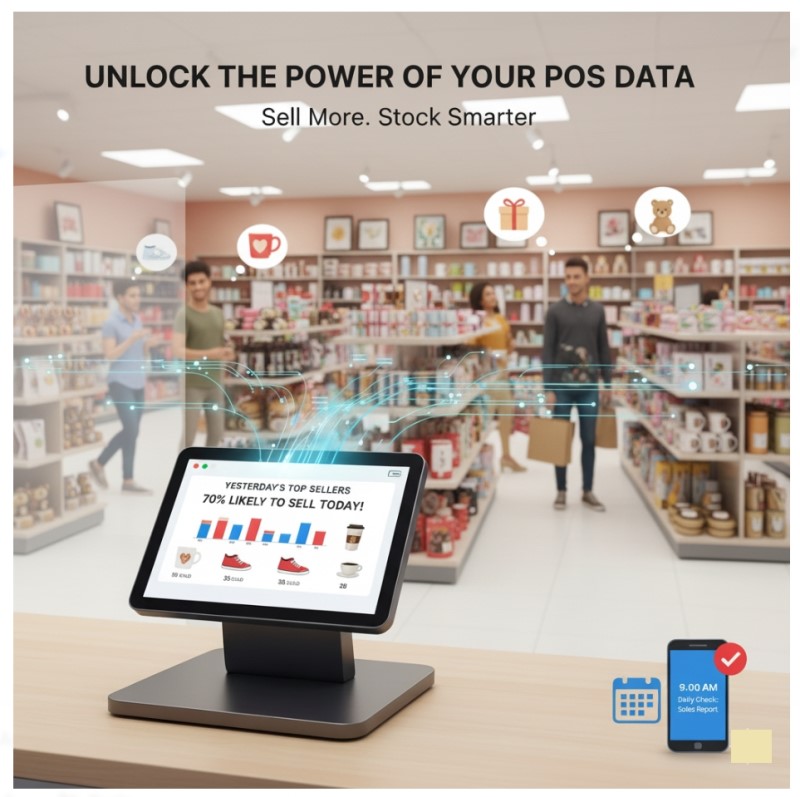

Almost three decades ago, we created an AI solution that transformed stock ordering for our users. Using the Focus Engine, this system has been a pillar of our service offering and has stood the test of time. No one has been able to match it in our market space.

Key features of the Focus Engine include:

- Widespread adoption: Thousands of our clients have used this solution, many in their daily operations; it is a testimony to its effectiveness and reliability.

- Cost-effective: We've always offered this powerful tool free of charge, making advanced AI accessible to all our users.

- Tailored for specific needs: The Focus Engine was designed to address particular challenges in stock order and excels in this specific domain.

The most telling indicator of the Focus Engine's success is the feedback we've received from our long-standing users. One particular comment I liked by one of our users when talking about the latest update:

"You can update it however you like. Just make sure that it gives the same figures after the update."

It's hard to beat a dedicated AI specially built for one task. However, it does speak volumes about the trust and reliance our clients place on the consistency and accuracy of our AI solution.

ChatGPT in Retail: Limitations and Challenges

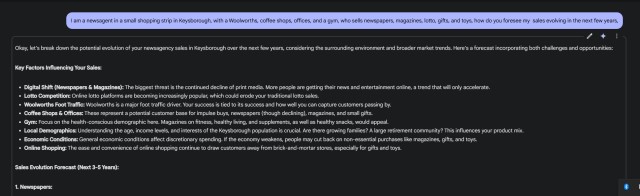

Recently, some of our clients have been using ChatGPT. Unfortunately, in tests, its application in retail has revealed some significant limitations:

- Cost concerns: A significant problem with ChatGPT for many retailers is that it's "not particularly affordable." This poses a significant barrier, particularly for small—to medium-sized businesses operating on tight margins.

- Weaknesses in retail-specific issues: Although versatile, ChatGPT frequently encounters the many nuanced challenges unique to the retail sector in Australia. Most of its information is form overseas.

- Mathematical limitations: One significant flaw of ChatGPT is its struggle with maths and arithmetic, which are essential for numerous retail operations.

- Pattern recognition methods: ChatGPT's strength resides in pattern recognition rather than actual computations, which can pose a significant drawback for retailers requiring precise calculations.

These limitations highlight why solutions like our Focus Engine, designed specifically for retail requirements, remain valuable even against the backdrop of broader AI advancements.

Enter DeepSeek: A Game-Changer in AI

The AI landscape is undergoing a seismic shift with the arrival of DeepSeek, a Chinese AI model shaking up the status quo. It's making waves in the industry, and here's why:

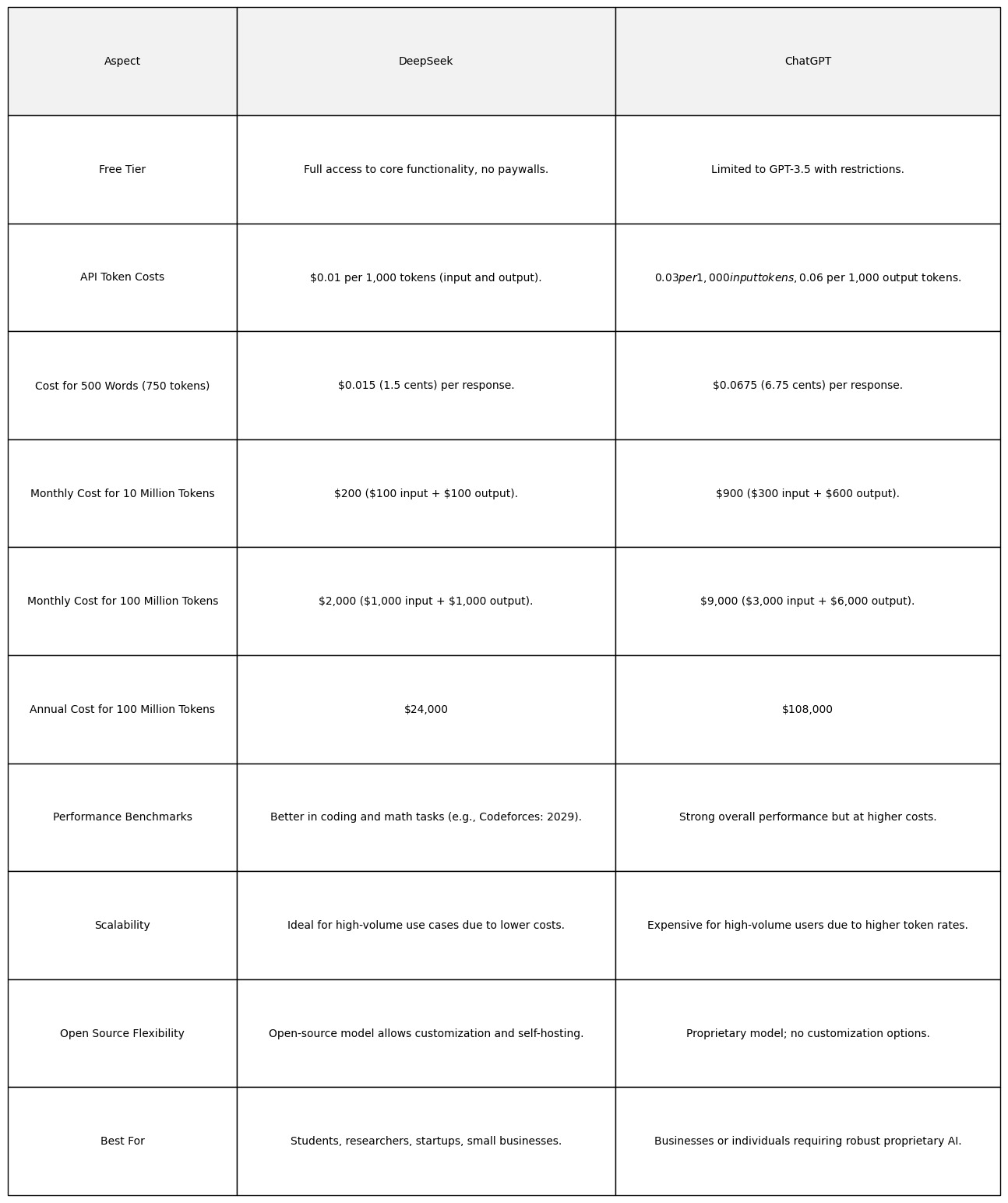

- Unparalleled speed: DeepSeek operates twice as fast as competitors like ChatGPT, allowing quicker response times and increased productivity.

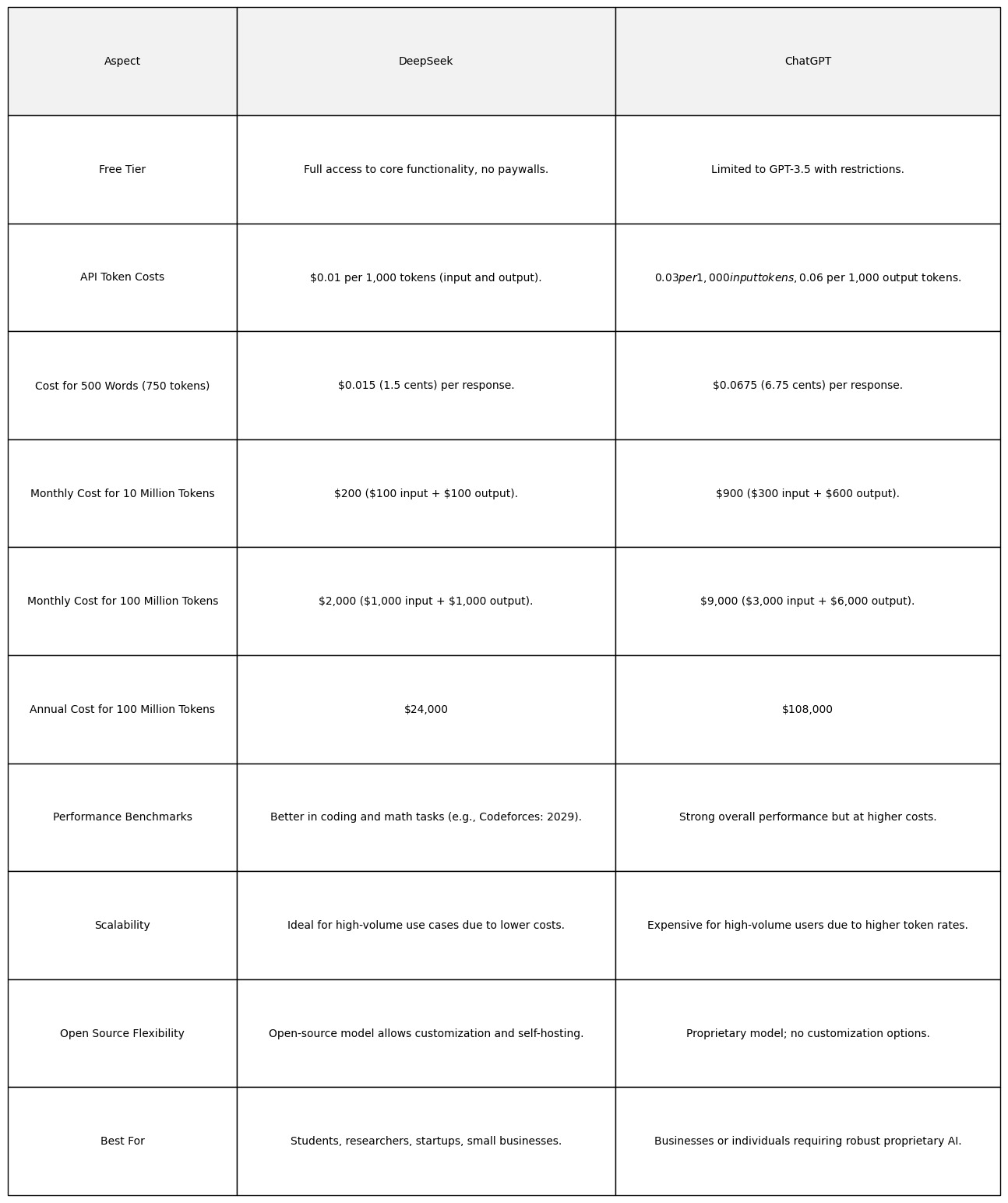

- Cost-effectiveness: Perhaps most importantly for retailers, DeepSeek costs around a tenth of the price of its competitors, making advanced AI more accessible than ever.

- Comparable power: Despite its lower cost, DeepSeek boasts comparable power to the best commercially available AI models.

Here is a table I constructed to show the difference, in particular checkout the costs.

Why DeepSeek Matters for Retailers

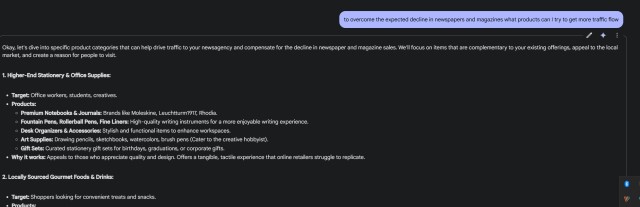

DeepSeek's capabilities are particularly well-suited to the retail sector:

- Mathematical prowess: Unlike some general-purpose AI models such as ChatGPT, DeepSeek excels in mathematical problem-solving, a crucial skill for inventory management, pricing strategies, and financial forecasting.

- Improved efficiency: The combination of speed and accuracy means retailers can make decisions faster and more confidently.

- Cost-effective hardware requirements: DeepSeek is less reliant on expensive Nvidia microchips, allowing it to run on much cheaper equipment. It significantly lowers the barrier to entry for retailers looking to implement AI solutions.

These advantages are already impacting the tech industry. Nvidia, a major player in AI hardware, has lost nearly $1 trillion in market value, indicating a shift in the AI landscape. Moreover, DeepSeek's popularity is soaring, becoming "one of the most downloaded apps in the world".

The Open-Source Advantage

One of DeepSeek's most significant features is that it's the "only powerful AI model in Open-source". This open-source nature brings several benefits:

- Public preference: Users and developers alike prefer open systems. They like to know that the systems they use are open for inspection.

- Wider deployment and development: An open-source model allows for broader deployment and faster development of new applications and improvements as developers can see what it is doing.

Speed and Processing Power

DeepSeek's high processing speed makes it particularly suitable for businesses that require quick, real-time decision-making - a common need in the fast-paced retail environment. No one wants to wait unnecessarily.

Privacy and Security Considerations

While DeepSeek offers many advantages, it's essential to address our privacy concerns:

There are worries about the Chinese government's potential data access. It is also an issue with most AIs, as wherever they are hosted, there is a government with potential data access.

Running DeepSeek locally can mitigate some of these concerns. For those concerned about data privacy, I recommend using DeepSeek "for personal or exploratory use only."

The Bigger Picture: AI Industry Disruption

DeepSeek's emergence is more than just a new product launch; it represents a significant shift in the AI industry:

- It challenges US dominance in AI development.

- It positions China as a strong competitor in the global AI race.

- This competition will drive further innovation and development in AI technologies.

Current Limitations and Strengths

While DeepSeek is powerful, it's essential to understand its current position:

- It is only text-based tasks.

- Its focus on these areas means it can provide better-targeted, efficient solutions for many retail operations.

- Its maths and arithmetic are better, but it does make plenty of mistakes.

Looking Ahead with its Cost-Effective AI retail solutions

The emergence of DeepSeek and similar AI models is set to revolutionise the retail industry. We predict that many more AI models will soon copy its approach, making AI increasingly more cost-efficient and accessible. This democratisation of AI technology levels the playing field, allowing smaller businesses to compete with larger retailers in terms of AI-driven capabilities.

Despite these advancements, there's uncertainty about fully leveraging generative AI capabilities in practical applications. However, the potential benefits for retailers are significant:

Enhanced Customer Experience

AI can dramatically improve customer interactions and satisfaction:

- Provide personalised shopping experiences with 24/7 customer support, handling inquiries and potentially leading to simple transactions.

- Use AI-powered recommendation engines to offer tailored product suggestions, mimicking the personalised service of knowledgeable salespeople.

Improved Inventory Management

AI can revolutionise how retailers manage their stock, particularly in predicting demand fluctuations, automating inventory management, reducing waste, and ensuring popular items remain in stock.

Marketing Optimisation

AI tools can significantly enhance marketing efforts:

- Target ideal customers more effectively, maximising marketing ROI.

- Analyse market trends and competitor pricing to optimise pricing strategies.

- Generate more engaging product descriptions and marketing content.

- Analyse foot traffic patterns in physical stores to improve layout and product placement.

What I particularly like about AI is its ability to scan social media to check out current public thoughts. If you haven't tried it, I suggest you do. You can use this feedback to analyse customer sentiment. I will write another article with a step-by-step approach to show how you can do it now in a few days.

This cost-effective AI implementation means that even small brick-and-mortar retailers in Australia can now access powerful tools. By leveraging these AI capabilities, you can streamline operations, enhance customer experiences, and make data-driven decisions to drive growth and profitability.

The Promise of Cost-Effective AI Implementation

The emergence of DeepSeek and similar AI models is set to revolutionise the retail industry. We predict that "Many more will soon copy its approach", leading to AI becoming increasingly cost-efficient and accessible. This democratisation of AI technology levels the playing field, allowing smaller businesses to compete with larger retailers in terms of AI-driven capabilities.

Despite these advancements, there's uncertainty about fully leveraging generative AI capabilities in practical applications. However, the potential benefits for retailers are significant:

Retail technology trends

The rapid advancements in AI technology will transform the retail landscape.

From our early Focus Engine, which has served thousands of clients for nearly three decades, to the latest advancements in AI, we have seen how these technologies can revolutionise stock ordering. Soon, they will move into customer service, inventory management, marketing strategies, etc. Who knows where they will end up?

One thing is for sure: DeepSeek and what I am sure will be similar AI models will represent a paradigm shift in the AI industry.

Its speed, cost-effectiveness, and open-source nature challenge the status quo.

By staying informed about these developments and thoughtfully integrating AI solutions, Australian retailers can boost their competitiveness, enhance customer experiences, and drive business growth.