Are magazines still profitable for retailers?

Readership vs. Unit Sales

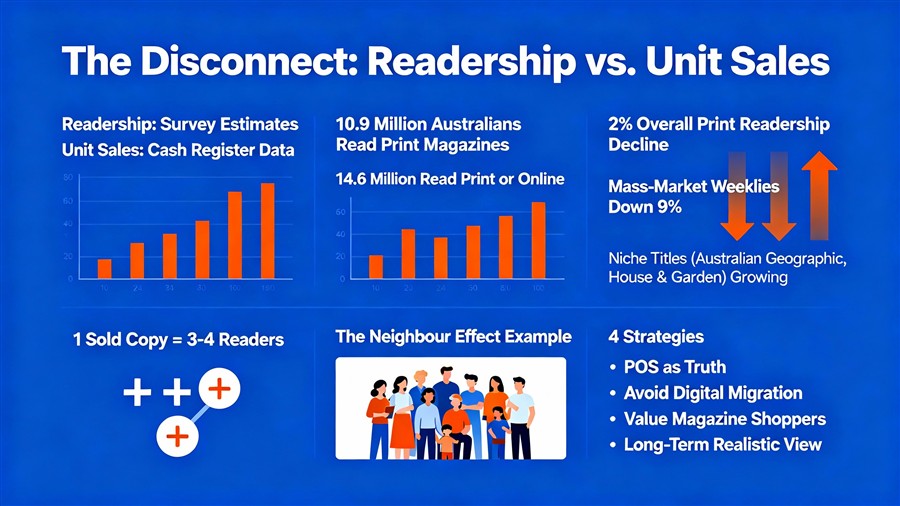

Years ago, I tracked official magazine sales figures religiously. I stopped because the magazine industry shifted from reporting verified sales (copies sold) to readership (estimated readers). The result became increasingly disconnected from retail reality.

The doubts many retailers feel are justified, as readership figures are derived from surveys. Far removed from cash register data. A single sold copy might be counted as three or four "readers" if it is passed around a household. If it is left in a waiting room, it's even better for advertisers who only care about how many people saw their advertisement.

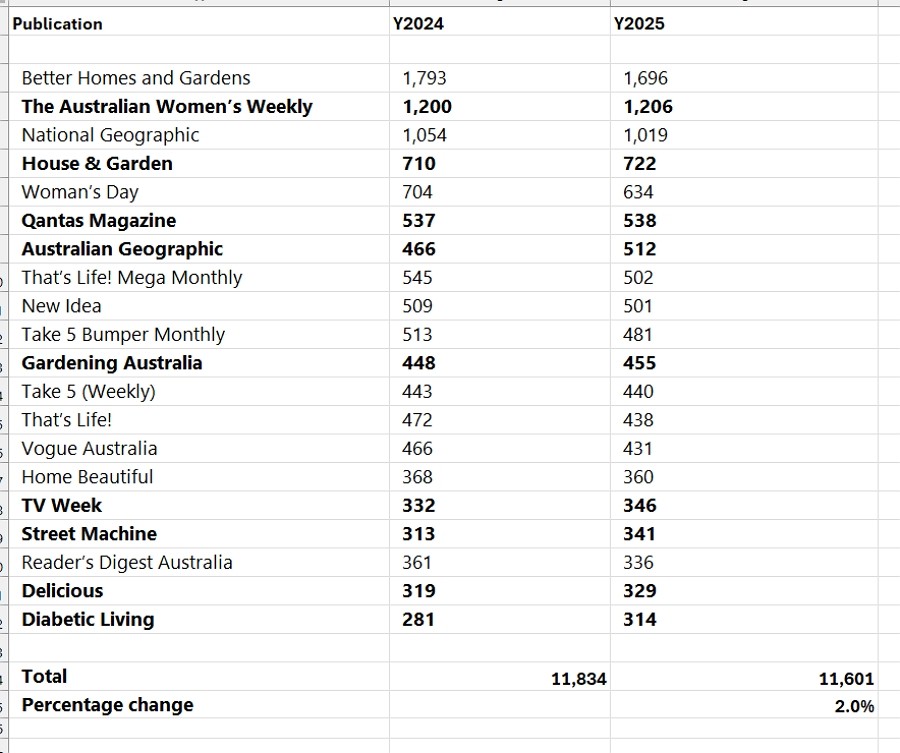

Despite this, we must work with the data we have, so I decided to look into it. So, let us look at the latest Roy Morgan figures for the 2024/25 financial year by Roy Morgan.

Roy Morgan 2025 Data: Niche Growth vs. Mass Market Decline

Analysing the "Top 25" magazines by print readership (excluding free titles like Coles Magazine), the market is seeing a slow squeeze rather than a cliff-edge drop. Across a sample of 20 major paid titles, the total print readership declined by approximately 2% year-on-year.

This aligns with broader market data showing that print readership is holding surprisingly steady. As of late 2025, over 10.9 million Australians (nearly half the population) still read a print magazine, and when digital audiences are included, that number jumps to over 14.6 million .

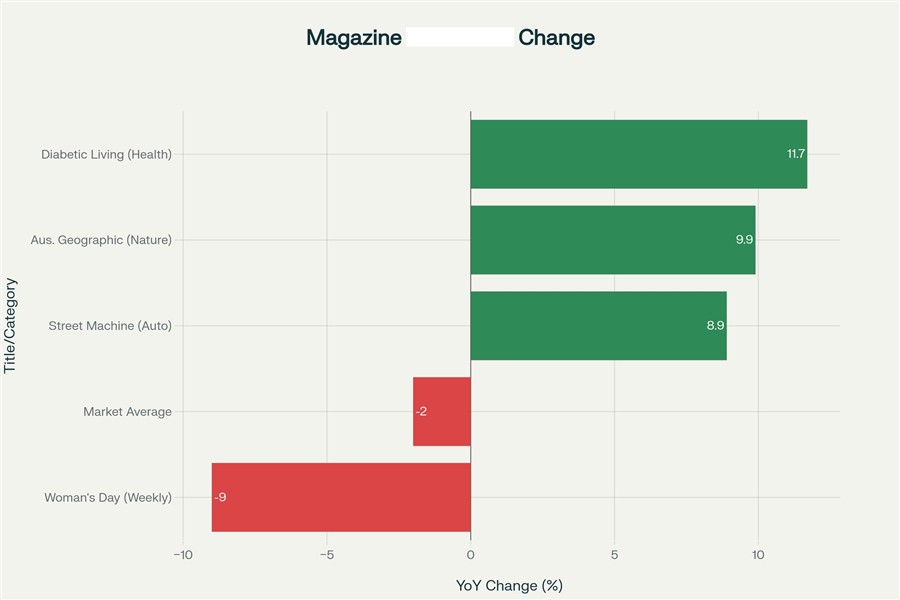

However, the stability is uneven. The market has split into two distinct directions:

- Mass-market decline: General interest weeklies and "catch-all" lifestyle titles are under pressure. For example, major weeklies like Woman's Day have seen readership dips of around 9% in recent reports.

- Niche growth: Specialist titles are thriving. Enthusiasts are still buying content they cannot easily find for free. We are seeing significant gains in titles such as Australian Geographic and House & Garden, as well as automotive titles such as Street Machine .

The "Neighbour" Effect

The 2% overall decline is so minor that most retailers wouldn't notice. The fact is that a store's performance depends more on local competition for retail profitability than on national trends.

Interestingly, here, benchmarks showed more than 50% of newsagents reported magazine sales are up in 2025.

I have seen this firsthand with a client whose magazine sales actually increased this year. Why? A nearby competitor drastically reduced their magazine display, effectively handing those customers over. The demand was still there; the competitor just stopped serving it. This proves that magazines can still be a viable category for those who commit to maintaining a proper range.

4 Strategies to Increase Magazine Profit in 2025

To make magazines work in this environment, you need to look less at official "readership" surveys. The relationship between a half-billion-dollar industry and your own shop is not much. Trust and use your own data.

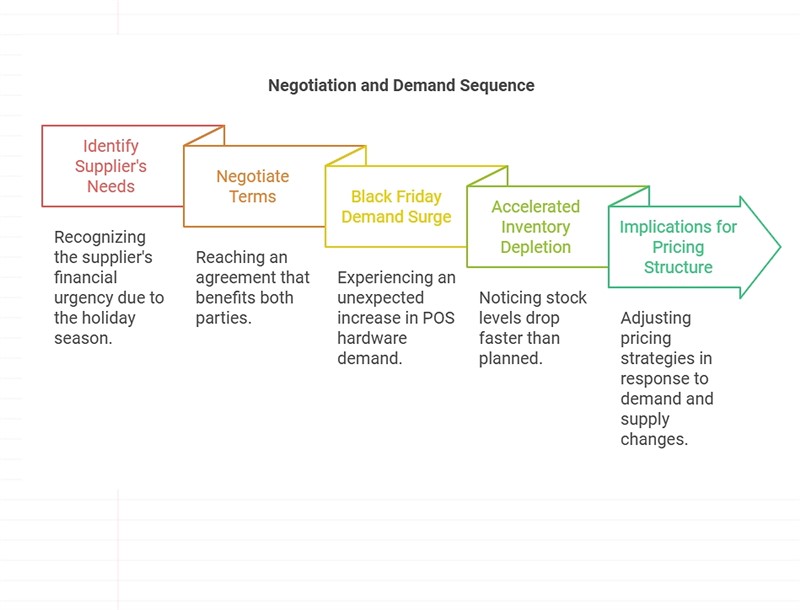

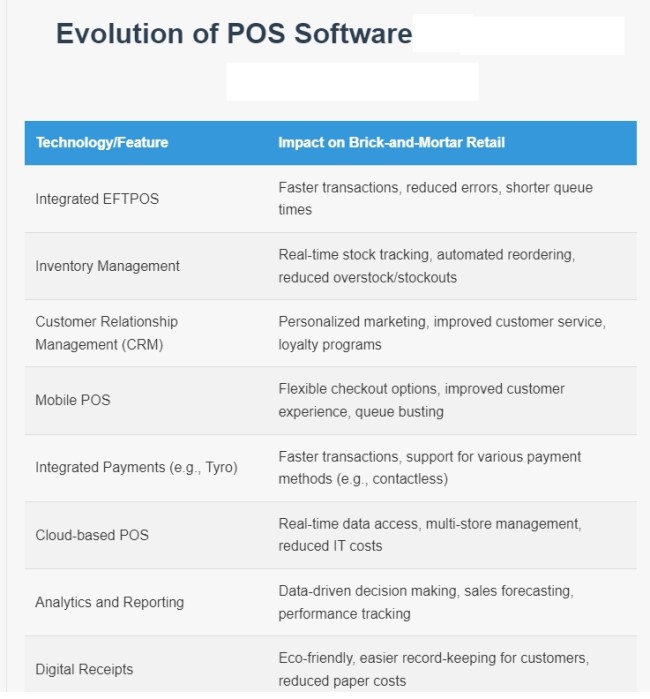

1. Treat Your POS as the Source of Truth

Do not stock based on what publishers push; stock based on what sells. Use your POS system to run a monthly selling report by units sold and gross profit.

- Expand facings for high-performing niche titles (hobbies, health, motoring).

- Cut returns ruthlessly on titles that haven't performed for three consecutive months. These are just taking up space that could be used to sell magazines that do sell.

2. Avoid Driving Digital Migration

3. Value the Magazine Shopper

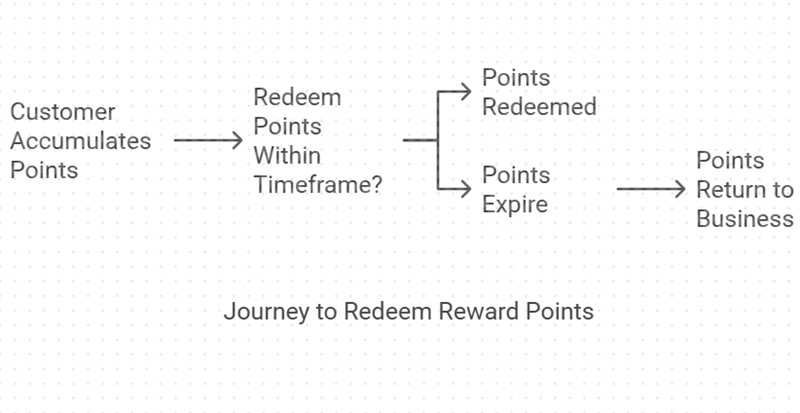

Basket analysis consistently shows that magazine buyers are valuable. They rarely buy just a magazine. They over-index in high-margin impulse items such as greeting cards, stationery, and lotteries.

4. Long-term

Looking at magazine sales over 20 years, it's clear that magazines aren't a viable long-term investment. So I wouldn't suggest spending a lot of money on it based on long-term future growth, I know I would not, but you can still make money from it now.

Looking Ahead

Millions of Australians still pay for print magazines; it's still a big market. A magazine customer can be a good, repeat and loyal customer. We must be realistic: we cannot expect the boom times of the past, but with a data-led range focused on enthusiast niches, we can maintain a profitable category well into the future.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.