The controversial Department of Social Services Cashless debit cards is now moving to trial which we are involved in.

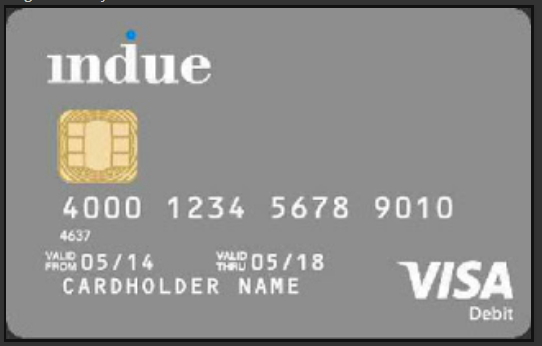

How it will work in a few months is that some people on social welfare are issued by the department of social security with a debit card. These cards look and work like a regular debit card except it restricts the purchase of some goods such as alcohol and some forms of gambling. It also does not allow the user to withdraw cash from the account.

From you the merchant view, if you are on the trial, you will need to mark all restricted items in your shop in your point of sale software. This includes items that you do not sell but potentially could sell. The list will be provided. Now the idea is that when you ring up a sale, your point of sale software at the time of purchase will signal to the EFTPOS unit that a restricted good is on the list. If it is a department of social security debit card, while attempting to process, you will get a message that the sale has been declined. You will not be told why.

Much still has to be determined which is yet to be determined how the social security department will handle it eg if you do not have a point of sale system, if you use a stand-alone EFTPOS unit, if you use stand-alone terminals to sell goods, if you sell many goods by a department, etc.

How big will it go, who knows, currently it is aimed at what appears to me to be a small number of indigenous Australians who have no choice, they must go on it but as about 5 million Australians receive some money from the government potentially it could get that big. For all its worth, I have spoken to a few merchants in the areas who have seen first hand the problems of alcohol and gambling on the trial and they are all in favour of the plan.