If you charge a surcharge on debit and credit cards, you are required yearly to do a review to justify your surcharge at the end of the financial year. The results from this evaluation will be used as a basis for setting your surcharge for the upcoming year.

What to Consider Before Surcharging

Several essential aspects must be considered when deciding whether to put surcharges in place. These include the potential benefits and drawbacks of such a policy, which must be evaluated before making any final decision. Some key points to keep in mind when assessing the feasibility of surcharging include:

Industry practices

Do your competitors or peers surcharge? If not, you may lose customers or reputation by being the only one who does.

Competition

How price-sensitive are your customers? Will they switch to another shop if you surcharge? You can test the market reaction before implementing surcharging for a short period as a test.

Customer impact

How will the surcharge affect your customer experience and satisfaction? Will it cause confusion or frustration at the point of sale? Will it discourage impulse purchases or upselling? You should communicate with your customers about why you are surcharging and how they can avoid it.

Customer loyalty

How will the surcharge affect your customer retention and loyalty? Some customers may be deterred from purchasing at businesses that charge a surcharge. It can be especially true if they feel unfairly charged or have better alternatives elsewhere. Consider how surcharging impacts your long-term relationship with your customers and bottom line.

Myth

Refrain from believing customers do not care if it is charged. We have done studies that show customers do care.

How to Surcharge in Australia

If you decide to surcharge, you must follow the rules and regulations of the Reserve Bank of Australia (RBA) and the Australian Competition and Consumer Commission (ACCC). These include:

-

The banks will do the calculation for you, but what is a frequent complaint is that many of the fees the banks need to take into account. So it is worth getting the bank to do it and then reviewing the figure. Keep the calculation in case you get asked to justify it.

-

Based on last year's figures, this review must be done by 1 September.

-

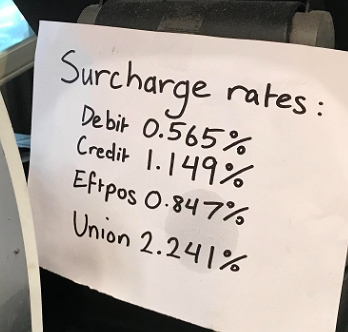

It would be best to display signage to inform your customers about the surcharge before they pay. The signage must specify each card type's surcharge amount or percentage.

BNPL

You better check with the BNPL provider you use. Often, providers enforce a "no-surcharge" clause, prohibiting you from passing on their cost to your customers.

Surcharges. You must not impose a surcharge on the customer or discriminate against the customer in any way for using Afterpay as a payment mechanism. A surcharge includes any charge or increase in the sale price, shipping costs or any other Customer fees and charges that are applied because the customer has elected to use Afterpay as their method of payment. For example, You must not charge the customer a fee in addition to the Sale Price (and any applicable Shipping Costs) on the basis that the customer has elected Afterpay as their chosen payment method. Similarly, You are not permitted to charge a fee (i.e. a restocking fee) to the customer where you accept a Return for a Refund on the basis that the customer's chosen payment method was Afterpay. For in-Store transactions, You may pass on to the customer a surcharge to recover the cost of accepting Mastercard transactions, or such equivalent costs of any other relevant card scheme utilised by Afterpay to facilitate in-Store transactions, if required by Your policies and in accordance with Relevant Law.

So the most expensive acceptance method is the dearest to you in fees. This may present a problem as the customer will know they pay no surcharge on BNPL and must pay it on a credit or debit card.

Conclusion

Surcharging is a viable option for businesses that want to recover their processing costs from their customers. But, it is not a one-size-fits-all solution and requires careful consideration and compliance. Before you use surcharging:

-

Make sure you understand the benefits and drawbacks.

-

Assess your business situation and goals.

-

Follow the rules and regulations in Australia.

Don't hesitate to contact our support team if you have questions about surcharging or need help setting up your payment system. We are happy to assist you.