Today with all these automatic imports and transfers, it is likely that errors are in your GST rates in your stock. Sometimes these are due to rounding errors which can cause some weird figures. Often they are attributable to mistakes made by you or your suppliers. Sometimes it is due to some GST ruling which may or may not apply to you. In any case, you need to examine these rates.

Here is a quick way of doing it, that will take you seconds to do.

It requires either excel or you having OpenOffice, which is free and available here.

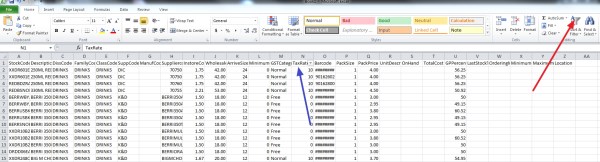

If you have one of these installed, go to:- Cash register> Register reports > Stock > Details Listing (Excel) Although it is faster to check if you do all departments at once many prefer to do it by one department at a time. Now you will get this report.

Now where the red arrow is, click on "Sort & Filter". Now click where the blue arrow is for the "Tax rate" and click all the rates that are not 0% or 10%. Now review these products. For many of you, it pays to do it again only for 0% tax items and check them too. Omit, I find this particularly useful is in tracking down GST errors.

Try and let me know if you have problems.