Say an international customer pays using their credit card. If you have activated Dynamic Currency Conversion (DCC), they get a choice of whether to pay in their own or your currency. DCC can be attractive to them. The reason is that generally, they are not interested in your currency. They want to know what it will cost them in their money. Yet, it does open you up to legal issues that I am sure no-one wants. A reasonable discussion on this is here.

These legal problems are severe. Visa was in the Federal Court over it when it attempted to ban DCC. The courts found that Visa acted anti-competitively and fined them. So they re-instate it.

Well, it appears that the credit card providers are now appearing to transfer or notify some of the legal problems to their merchants, so beware.

If you decide to do the DCC!

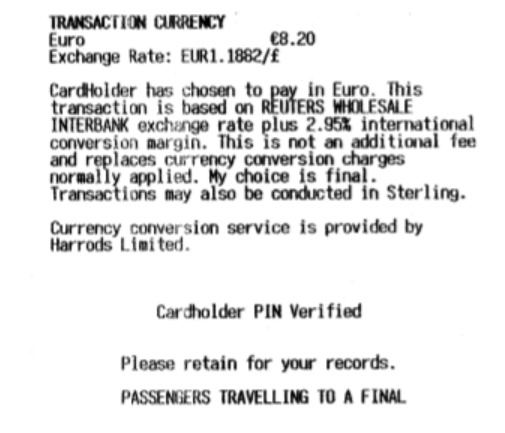

Our POS Software does all the conversions relevant to local currency. It does not know of the legal information now required to give. This depending on what country you are in and the country of the customer's card. It looks something like this.

This has to be given to the customer, so what we are recommending is that if you are using DCC that you give the customer the credit card machine receipt as ours will not have this information.

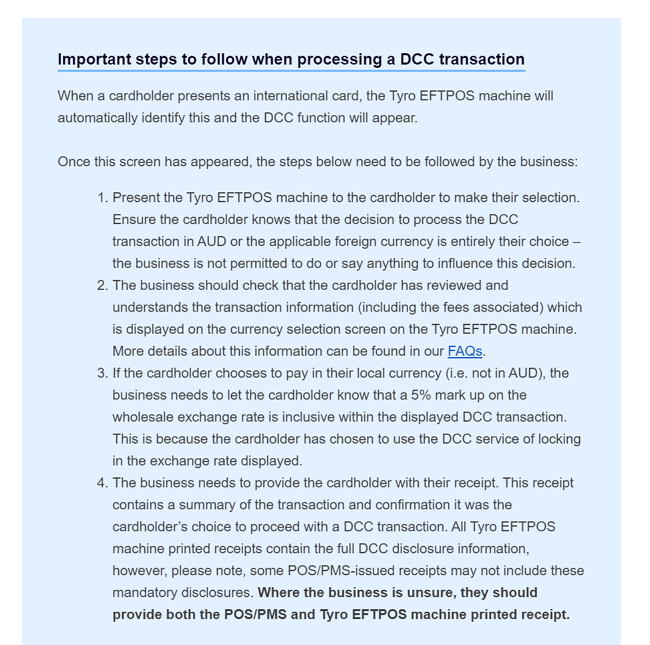

Tyro has put together a checklist that I suggest if you use DCC to follow.

Our advice is that although your customer the DCC maybe sometimes wanted by the customer generally it is costing them more and you now have a legal headache, so maybe it is best now if on to politely turn it off.

If the customer wants to buy they can pay in your currency.