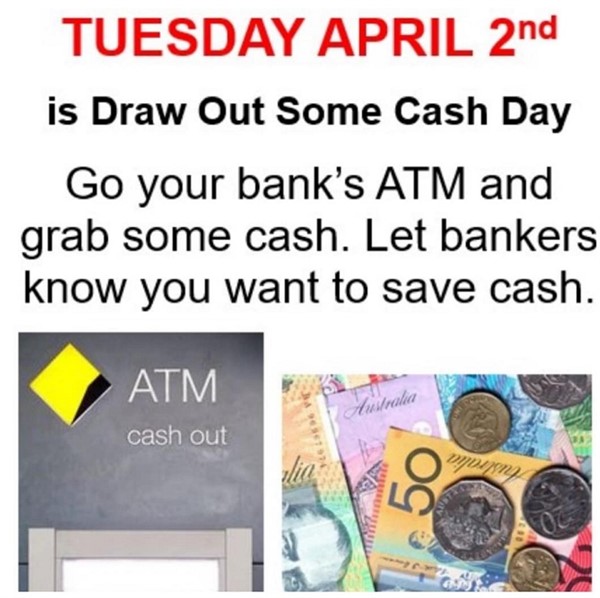

Last week, the "Cash Out Day" protest highlighted a growing tension in Australia's payment landscape: the rapid decline in cash usage and its implications for businesses and consumers. On April 2nd, Australians were asked to go to an ATM and withdraw some money in a symbolic gesture of support for cash. According to social media images, many did. I was one of them. While the exact total amount withdrawn is unclear, from social media, it appears that many did participate. However, the Australian Banking Association (ABA) stated there was no "material difference" in cash withdrawals across the industry on the day. What does that mean exactly? I would like to see figures.

What Sparked "Cash Out Day"?

This movement stems from several factors:

Shifting Payment Habits: Cash now accounts for about 13% of customer payments in Australia, which is a dramatic fall from 60% in 2010.

Bank Policies: Branch closures have created obstacles for cash-reliant individuals and businesses.

Cost of cash: Many people today prefer cash; in many cases, it's cheaper and more manageable, and there are fewer security issues, too.

Banks: Banks make money on non-cash transactions. By closing branches, they are effectively discouraging cash deposits/withdrawals.

Cashless Aspirations: I think the government would prefer to eliminate cash. The Queensland government stated that it envisions a cashless state by 2030.

Arguments in Favor of Cash

"Cash Out Day" advocates cite these benefits:

Inclusivity: Cash requires no bank accounts or technology, making it accessible to all.

Budgeting: Physical money offers a tangible sense of spending.

Privacy: Cash transactions leave less of a digital footprint.

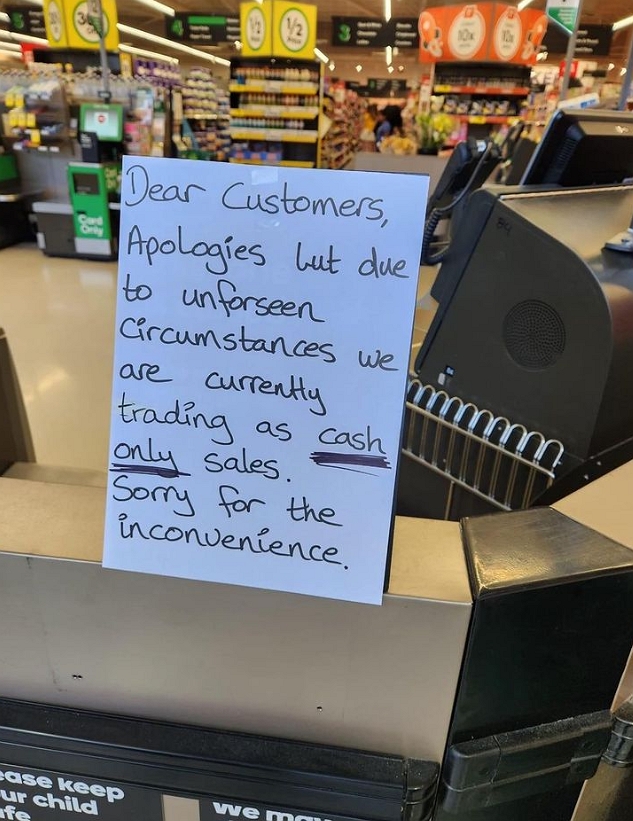

Reliability: Cash functions independently of power grids or internet connectivity. It still happens that EFTPOS goes out, so what do shops do when they switch to cash?

The Small Business Perspective

In Australia, it is legal for businesses to refuse to accept cash, provided that they inform consumers of their stance before entering into any “contract” for the supply of goods or services. If you want to reject cash, you must have a sign in a clear position in your shop saying that. Usually, it is placed at the front entrance.

Smaller retailers, especially those involved in markets or events, rely heavily on cash. My observations within my local newsagency network showed that while most owners knew about "Cash Out Day," its impact on their daily trade was minimal.

The Uncertain Future of Cash

The potential bankruptcy of Armaguard, Australia's major cash transportation company, further underscores the precarious position of physical currency. This raises concerns about the logistical and economic challenges of maintaining a cash infrastructure as usage decreases.

The Role of POS Systems

A robust POS (Point of Sale) system becomes crucial for businesses in this evolving landscape. The right software seamlessly manages cash and digital payments, providing flexibility and detailed reporting while ensuring smooth, secure operations. A great POS system helps you manage it all!

The Bottom Line

"Cash Out Day" serves as a potent reminder that amidst the move towards a cashless society, the value proposition of cash persists. This debate centres on choice, accessibility, and the practical needs of businesses and consumers in an increasingly digital Australia.