POS SOFTWARE

A few days ago EFTPOS went down, almost every point of sale software support bay like ours was hit by our clients ringing up asking what is happening. Yesterday Westpac went down in many places because every other EFTPOS provider was working we go even more calls what is happening. Unfortunately, there is little we can do once the EFTPOS goes down.

The reality is that a retailer cannot assume that their EFTPOS will suffer an outage every so often.

Note in England; they have a pretty good fix that seems to work well to stop these outages, they fine banks for outages.

What can be done when it is happening?

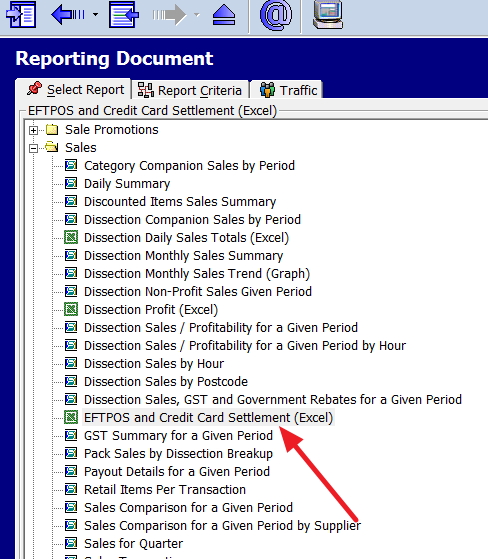

What I do suggest you do first is check whether it is your POS system or whether its a bank problem. Some banks, e.g. tyro have a status page here that tell you whether it is their bank's error. Also if you want you can subscribe so at least you will get a warning if a tyro scheduled maintenance is coming up.

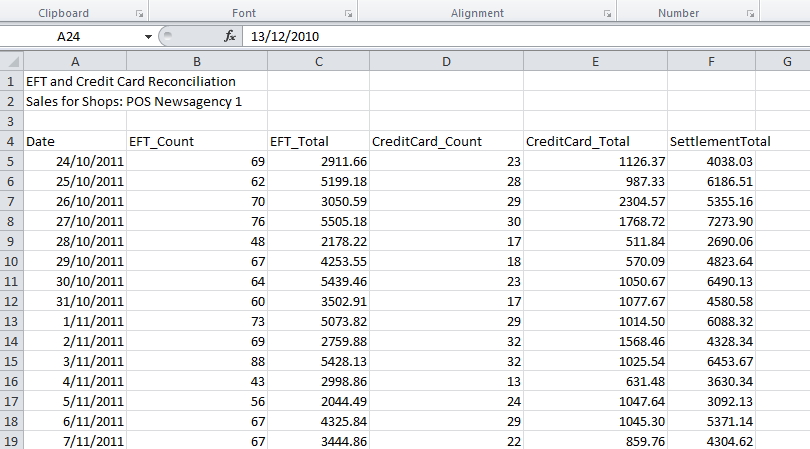

Now also test, whether a payment can be accepted by another channel e.g. sometimes people's credit accounts, do not work but their debit accounts do work.

What can be done before it happens?

You may be able to do something before it goes down so contact your EFTPOS provider and check with them if something can be done.

For example, many EFTPOS providers can supply you with a unit that has an Electronic Fall Back (EFB) mode. If so, this will allow you with some limitation and conditions to continue to process EFTPOS even when their network is unavailable.

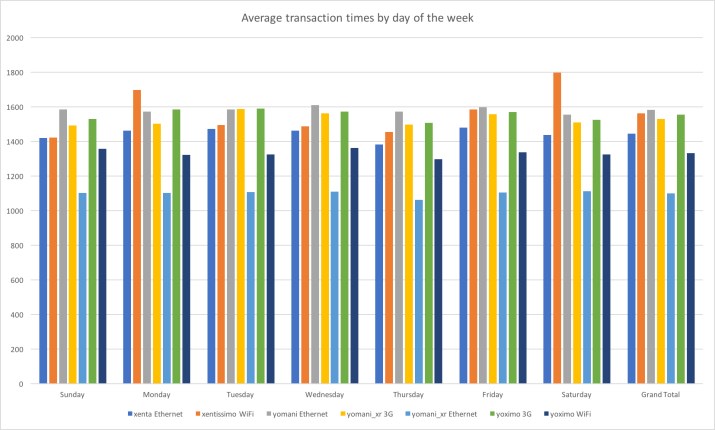

Some EFTPOS units do allow a backup internet so you can switch either to a 3G mobile network as a back-up and/or can use WIFI. So if your internet goes down, the unit can switch to another internet provider. Just make sure it switches back with the outage is over.

Note WIFI is not generally considered secure so you may want to discuss this option with the bank in detail.

Hope this helps.