Today I was hit with several questions from my users about our accountancy link, which is a free product with no cost to them. The next question I was asked was which accounting software was the best.

Well honestly, it has to be said is that if you are small, you can do this on a spreadsheet. You do not need an accounting program. Simply have one sheet for expenses and another for income. When I first started in business, in a bedroom in my flat, this is what I used for many years. In many ways, it was better than using an accounting package. What I particularly liked was that I could make my own reports as I liked, it's only now with recent developments of our software, the sole one in our market space with this capability that I have seen this flexibility returned.

However, when you start to get bigger, you quickly see that you need more and an accounting software becomes a critical tool in any business to effectively operate.

As Australian accounting standards have not changed much since GST came in, and they did not change much before that either. So it should be said that any accounting software package released since GST should do the job. For example, I have seen multi-million dollar companies using ten-year old accounting packages.

If you have not got an accountancy system and want to try one out free, you will find most packages have a free trial period. If you want to try some totally free ones, two that I think are extremely good are GNUCash.

and Money Plus

I used Money Plus for many years for my personal accounting and was extremely impressed with it. What happened is that Microsoft took on Quickbooks and although they made an awesome program, they could not beat Quickbooks and stopped work on it and released this free version.

Both of these accounting programs are extremely powerful, both come with bank reconciling, profit and loss, budget planning and detailed report generation. Many SME business run fine with either of them.

There is also a free accounting software offered by the ATO too but compared to these two its extremely limited in its use, so I do not recommend it.

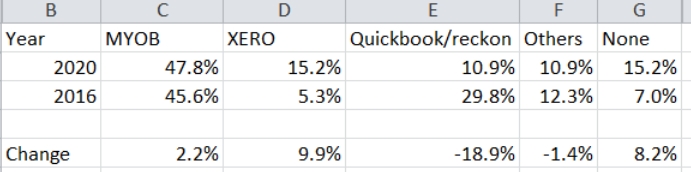

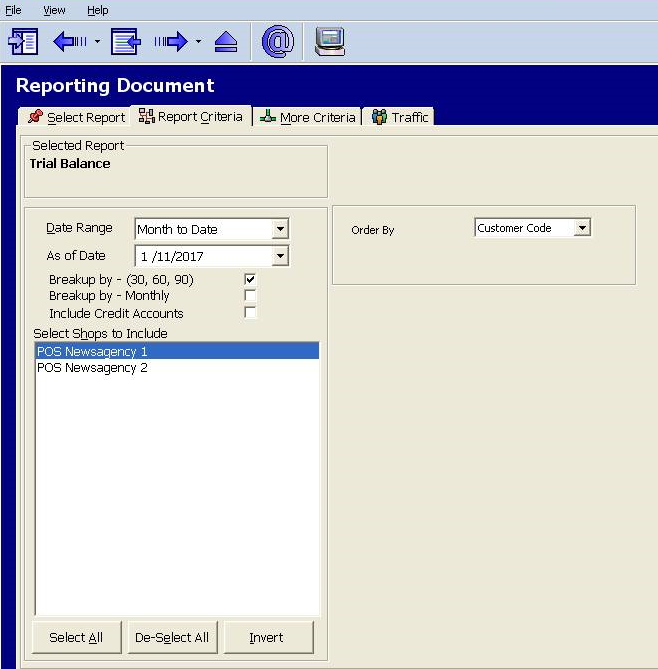

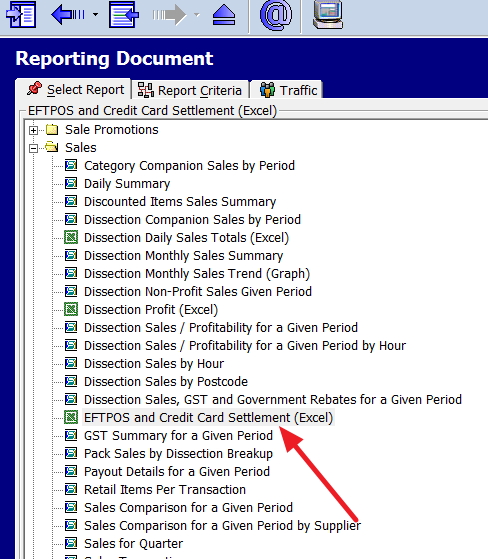

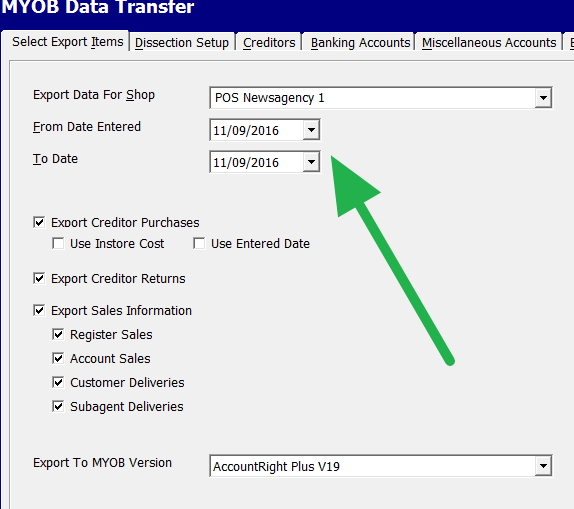

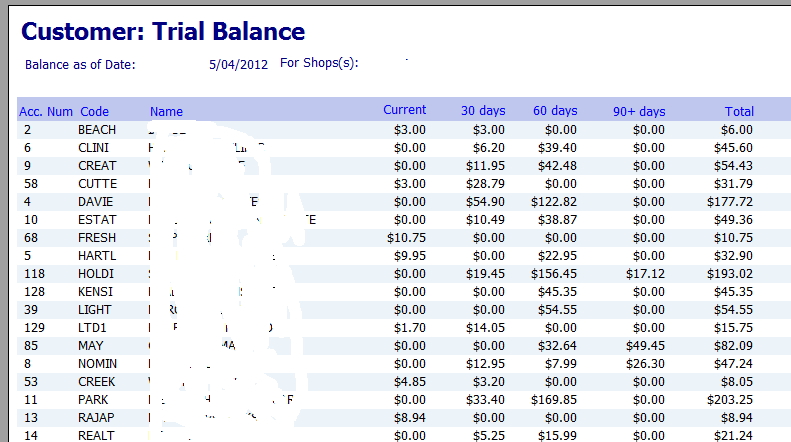

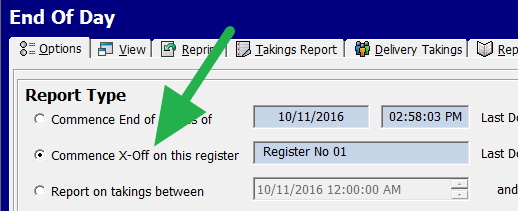

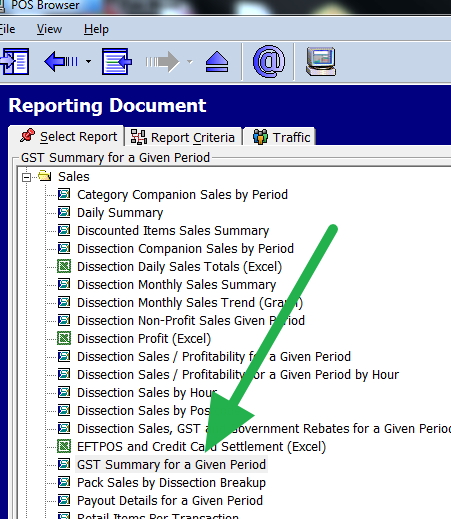

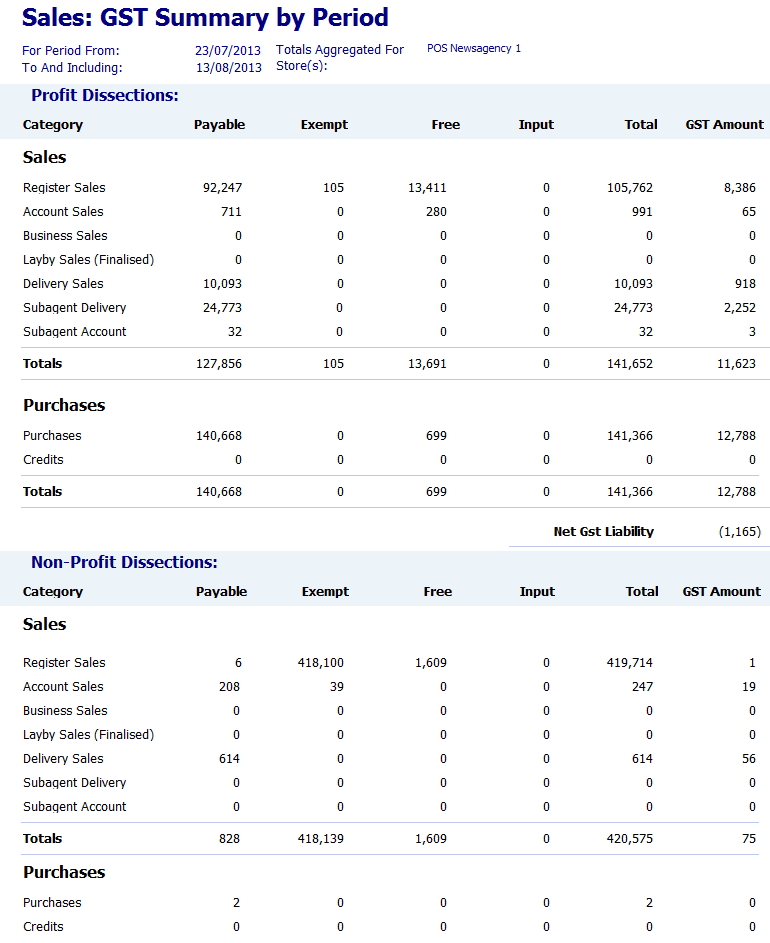

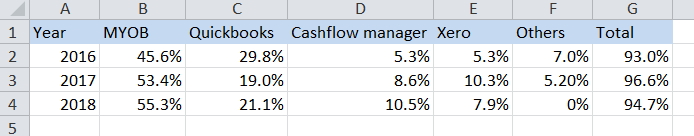

If you are prepared to pay, the two most popular by far in our market space is MYOB (50%) and Quickbooks (35%). The main attraction of these two over the free ones above is that our clients have integration. This saves them about an hour or two of work a month. The big problem with integration is when something goes wrong, and you can spend ages trying to find out why and there is always problems, for example, the tip roll at the end of day does not balance exactly with the banking. It's for this reason some do not like integration even though its free.

Of the two, I think you will find Quickbooks easier to use, the problem most people have with MYOB who don't actually know how to use it, is that without a basic grasp of bookkeeping it is a struggle. Once you get used to MYOB though, its fine.

Still from what I have seen, they are all fairly similar. They do the equivalent things. They use the same principals, etc. There are points that I like in one and points that I like in another.

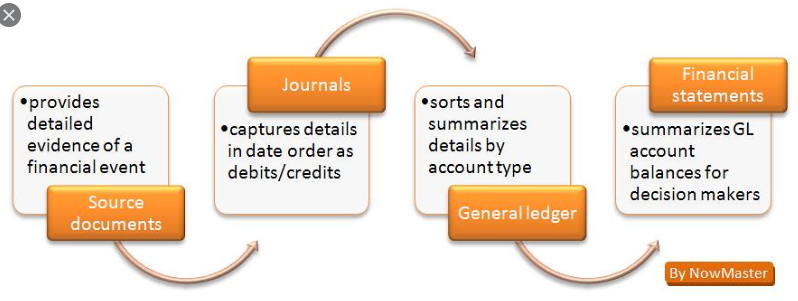

Whatever way you do go, I would recommend that before you start you buy a book on basic bookkeeping using the software you intend to use. Work though it and then start.

In my order of my preference.

Quickbooks

Money Plus

GNUCash

MYOB

The cost varies, one of my clients who uses the full system of MYOB gave me his breakdown of costs per year.

MYOB AccountRight Plus AU 2008 $439.00

2009 $459.00

2010 $493.05

2011 He was not sure.

2012 $714.00

2013 $780.00

2014 $840.00

Take out payroll and his costs would be much less.

PS One point I do recommend is, use your accounting program with dropbox or onedrive from Microsoft so you can get the benefits of being able to use it online for free, anywhere in the world. That way if say you are in your accountant's office, and they need some figures, you can get it from the cloud instantly.