Our software has inbuilt a powerful GST auditing tool inbuilt which gives you a fast and accurate audit of your GST.

Now what sometimes happens is that people have some queries about their GST and they want to check in their accounting programs that it is giving the same result as their point of sale software.

Here is how you do it in our software.

Go to the Register reports > Sales > GST Summary for a given period

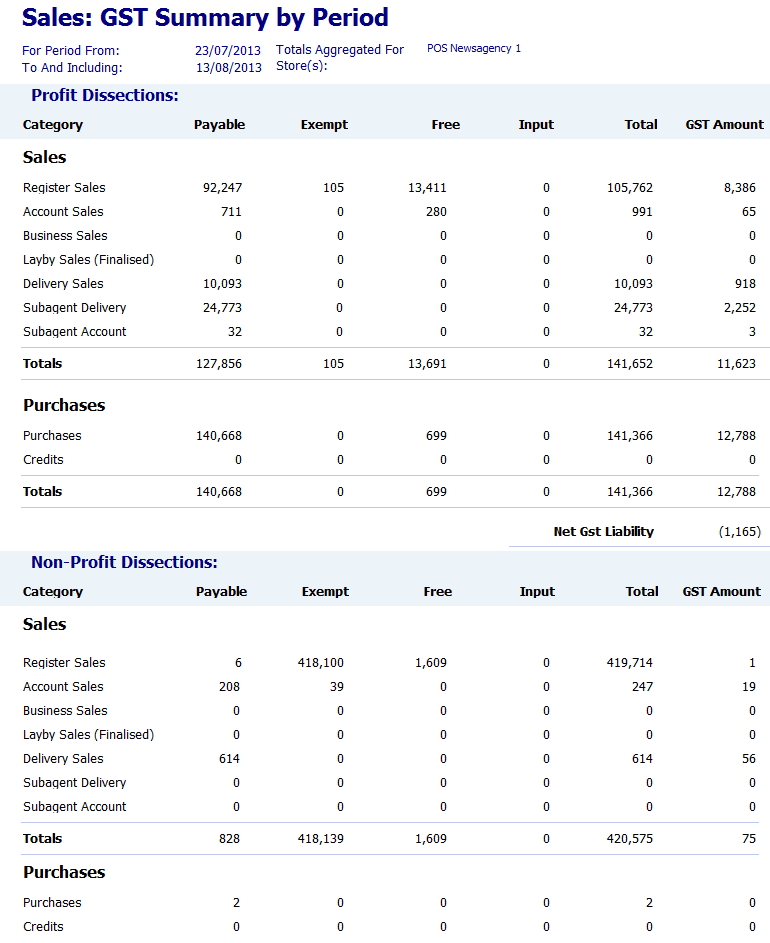

This will give you a detailed report which including this.

Now, this you can check with your accounting program.

If the two are not the same, then what you need to do is track down the incorrect figure. This can be extremely difficult as sometimes, it is not actually wrong in either system. So we need to audit.

The problem here is that three (3) is often a big job to audit in practice. So what we do is try to break it down to a short period, generally a day and audit just that day. This process can take time.

So what we suggest is to run this report for one month, then the accounting program for the same month. If the problem is not noticeable in that month, we go to the next month and run both again. It does not take long in our system as its Microsoft SQL which sets the standard for speed.

If it is noticeable, then we look at the first half of the month and check that with the accounting program and so keep going making the period smaller and smaller until we get to a day where the problem is noticeable. Then I check the transactions on that day.

It will take you using this method about seven (7) attempts to get to that day. Once you get into the rhythm, it is relatively quick.

Sometimes though it can be tough to find, I remember once, I could not figure it out why a $2000 transaction was not there. It turned out that it was an insurance claim that had wrongly been put down in the accounting software as a sale. Doing this check, as a result, saved the retailer $200.