I had a client that had some queries about their GST figures coming out on the receipts. It did not seem to be right. What we discovered happened was that while he was importing supplier files, some of the GST rates in the suppliers' files are wrong. These inaccurate figures were imported into their system and so resulted in the problem.

What I do suggest is that you audit the GST figure regularly if you import suppliers' files that do not come from a approved source like us. To many suppliers leave too many errors in their files.

You will find it in here

Cash register> Register reports > Stock > Details Listing (Excel)

It can be much faster to check if you all departments at once but some prefer to do it by one department at a time.

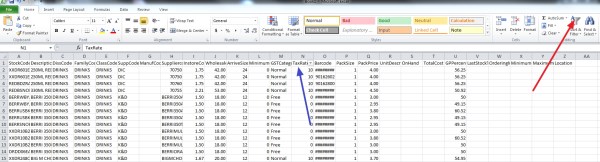

Now you will get a screen that looks like this.

Where the red arrow is click on that "Sort & Filter", now click where the blue arrow is "Tax rate" and now click all the rates that are not 0% or 10% and review them. Then do it again only for 0% tax items and review them too.

Overall, I find this particularly useful is in tracking down GST errors.

Give it a shot and see how you go.