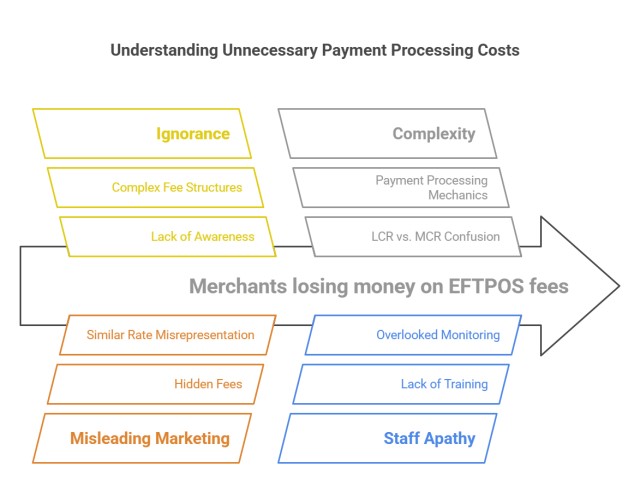

Yesterday, I met with a bank representative about securing better EFTPOS rates for our clients. The subject of least cost routing (LCR) came up after I pointed out that our analysis of EFTPOS fees showed a big difference in fees between banks even though they had similar rates. I discovered that many merchants lost thousands of dollars a year last year in fees because of ignorance.

To understand why these unnecessary costs occur and how to avoid them, we must first understand the mechanics behind payment processing and the critical role of least-cost routing.

Least Cost Routing (LCR)

Least Cost Routing (LCR) is a payment processing feature that can significantly reduce your fees when processing debit/credit card payments.

When a customer taps their card, the payment can go in as an EFTPOS or credit card.

Now, some banks will often do a deal that both go through as 1%. Generally, this costs you more. So it's no wonder they offer it.

What is smarter is to have EFTPOS charged as a flat fee per transaction, say, $0.15-$0.30. Let us work here with 20 cents for this blog post. Visa/Mastercard generally go in as percentage-based fees, e.g., 0.8%-2% of the transaction value, say 1.2%

The exact charges will vary but generally depend on your average transaction value and the amount you send through the system.

Payment processing costs

Let's say I come into your shop, buy a $10 item, and tap. Your cost if it is EPTPOS is 20 cents. Your cost if it's Visa/Mastercard is 12 cents. It is better for you that it goes through as a Visa/Mastercard.

Now, if I brought a $50 item, your cost if it is EPTPOS is 20 cents. Your cost if it's Visa/Mastercard is 60 cents. It is better for you that it goes through as an EFTPOS here.

The EFTPOS flat fee model is usually cheaper for transactions, typically above $30-$40.

Without Least Cost Routing enabled, your payment terminal automatically processes contactless "tap-and-go" payments through Visa or Mastercard networks. If you have it enabled, you can direct them to the cheapest system.

Now, here's the kicker: There are two different types of Least-Cost routing, LCR and MCR, and although banks tend to call them the same, they are not.

LCR vs. MCR: The Critical Distinction

Let's start by untangling the often misunderstood terms.

With LCR enabled

- Each transaction in real-time is analysed

- Fees are automatically calculated for each route.

- The payment is routed through the network that will cost you the least

The key advantage? There's no manual intervention required.

Merchant Choice Routing (MCR)

With MCR, you, as the merchant, have the choice of which payment network to route a transaction. You must understand the costs and select the route manually each time.

Reasons for the Financial Impact

Ignorance

Many merchants remain utterly unaware that LCR/MCR exists. Banks do not automatically set them up; you need to ask.

Misleading Marketing

Some payment providers market the MCR solutions as LCR, leading merchants to believe they automatically get the best rates when they do not.

The Complexity Conundrum

It's another thing to remember in retail when doing a transaction.

Set It and Forget It Fallacy

Merchants often assume that everything is fine once MCR is enabled. They don't realise that they must monitor and train their staff.

The Staff Apathy Factor

This is huge. Even if the owner understands the importance of the payment, if the staff member processing the payment doesn't understand or care about the difference, they will route the transaction through the most convenient (often most expensive) network.

The Hidden Cost of Inaction

The cumulative impact of improper routing is staggering:

- A cafe processing 200 daily transactions could lose $15-20 per day, or over $5,000 annually.

- A retail store with an average transaction of $80 could save up to 1% on each sale through proper routing—potentially thousands of dollars per year.

- For a business with tight margins, these "invisible" costs can be the difference between profitability and loss.

Taking Control: How to Really Optimize Your Payment Processing

Become an Informed Consumer

If you have the least-cost routing, activate it and then find out how it works. If possible, demand LCR.

Work out the best system for a transaction to go through as debt or credit card.

Prioritise Staff Training

Provide your staff with clear, concise training on how to use the EFTPOS system correctly.

Monitor

Go through your statements that your instructions are happening.

Save on transaction fees

You can make substantial savings with a little effort and work.