If you want to compare your current EFTPOS/Credit Card providers with others, there are a few simple steps to do:

Before you begin

I suggest you ask the following:

Speed of Fund Transfers

How quickly does the provider transfer funds to your bank account? This is very important if your main account isn't with one of the big banks. Delays can disrupt cash flow, especially during busy periods. It's aggravating to collect out-of-fund messages from the bank if you have the funds in another bank and are getting them into the required bank.

Service Quality

Poor service from a payment provider can cause unnecessary stress. You can always do an online search on customer reviews for the provider you are looking at. How many stars do they have? I have seen people pull out EFTPOS systems because of bad quality.

Contact terms

You can get better rates if you are willing to commit for a decent period.

Also, as you know, a contract does not lock the provider into terms. I have often seen my clients get a letter from the providers using the rate after a year in a three-year contract, and they are switching my customers to a different rate.

Transparency in Quotes

Please always ask for the total cost in writing for provider quotes. Some providers present attractive rates but do not or underestimate items that add up over time. Could you make sure this is in writing? If you get into a dispute, arguing over one figure in a total cost is much easier than a rate sheet.

Once you get this total cost, you still need to check. It's easy after you have done a few, like me.

Key Information You'll Need to Calculate EFTPOS Costs

To calculate your EFTPOS costs accurately, gather the following details:

Card Mix

You should get this from your existing EFTPOS statements or your total reports. You need a breakdown of transactions by card type: debit, credit (generally VISA and MasterCard), and international cards, e.g. AMEX.

- Monthly transaction volume (number of sales)

- Average transaction value

What the EFTPOS/Credit provider wants is

- Monthly transaction total by type

- Average transaction value

If this data isn't readily available, estimate based on past sales and your experience.

Fee Structure

- Transaction fees: Fixed (e.g., 25¢ per transaction) or percentage-based (e.g., 1% of the transaction value)

- Terminal rental fees: Monthly charges (e.g., $30/month) or upfront purchase cost

- Other fixed fees, account fees, gateway fees, etc.

Additional Costs

- Setup fees for new EFTPOS machines

- Chargeback fees (typically $15–$35 per dispute)

- Stationery costs (e.g., receipt rolls)

- Equipment replacement or repair fees. Stolen EFTPOS units were a problem for our clients a short time ago.

Step-by-Step Calculation

Once you've gathered the necessary information, follow these steps:

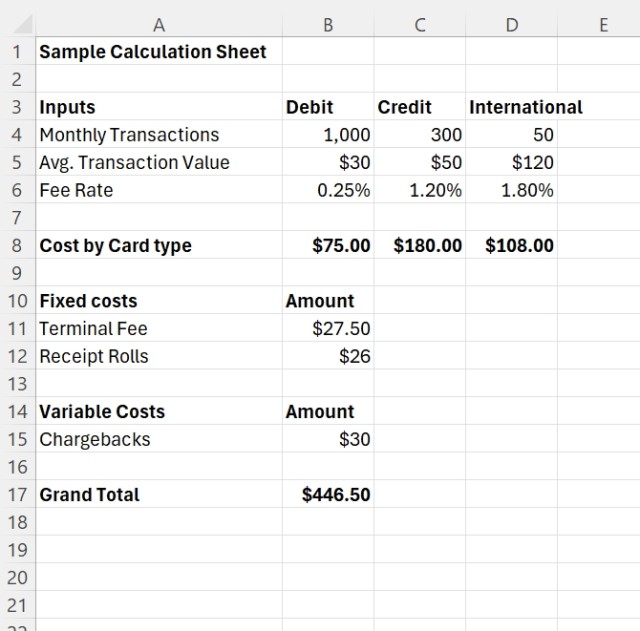

Calculate Debit Card Fees

Debit card fees are often lower than credit card fees. Use one of these formulas:

- Fixed fee: {Monthly Transactions} x {Debit Rate}

- Percentage fee: Monthly Transactions} x {Average Transaction Value} x {Debit Rate}

Example:

- 1,000 debit transactions/month

- Average transaction value = $50

- Debit rate = .8%

Calculation: 1,000 x $50 x .8%

Calculate Credit Card Fees

Use the same formula as above but with the credit card rate, which is usually more.

Example:

- 300 credit transactions/month

- Average transaction value = $50

- Credit rate = 1.2%

Calculation: 300 x $50 x 1.2%

Calculate International Card Fees

International cards incur higher rates due to additional interchange and scheme fees, but the above formula is the same.

Add Fixed Costs

Include monthly terminal rentals and other fixed expenses like stationery or compliance fees.

Example:

- Terminal rental = $27.50/month

- Receipt rolls = $26/month

Total fixed costs: 27.50 + 26

Factor in Variable Costs

Some costs, like chargebacks, are unpredictable; I use a yearly estimate and calculate a monthly average. One point that helps here is having a camera recording the EFTPOS unit.

Example:

If I go about one chargeback a month on average, it might be

Chargeback fee estimate = $30/month

Here is a sample EFTPOS sheet, I made up.

It adds up.

Tips for Managing EFTPOS Costs

Negotiate Rates

Many providers will offer better rates if you commit to a longer-term contract or demonstrate high transaction volumes.

Check Rates

For some reason, and I do not know why, different suppliers quoting the same rate somehow get different figures. When I was analysing some figures for a customer, I found that 1% from CBA and 1% from TYRO gave different results. If this happens to you, I suggest you make some enquiries.

Push the payment methods with cheaper fees.

Do not forget that Cash has many advantages here.

Integration is great

But it does often cost extra

Use Least-Cost Routing

If it's not in effect, please put it on immediately. Check here for details.

Review Statements Regularly

Check for hidden charges or errors in billing.

Final Thoughts

Understanding your EFTPOS/Credit costs is needed to run an efficient business.