Although much of the election still needs to be sorted out, it is clear that now we need to consider the government's announced plan to ban debit card surcharges. It is set to take effect from January 2026. It is being presented as a measure to provide relief for consumers and a "fairer go". However, many of you do not see it this way. Many of you would feel that this will increase your costs, as we face it, it's the retailer that will now have to pay these debt charges. So, let's delve into what this change means, to consider the broader implications for your business.

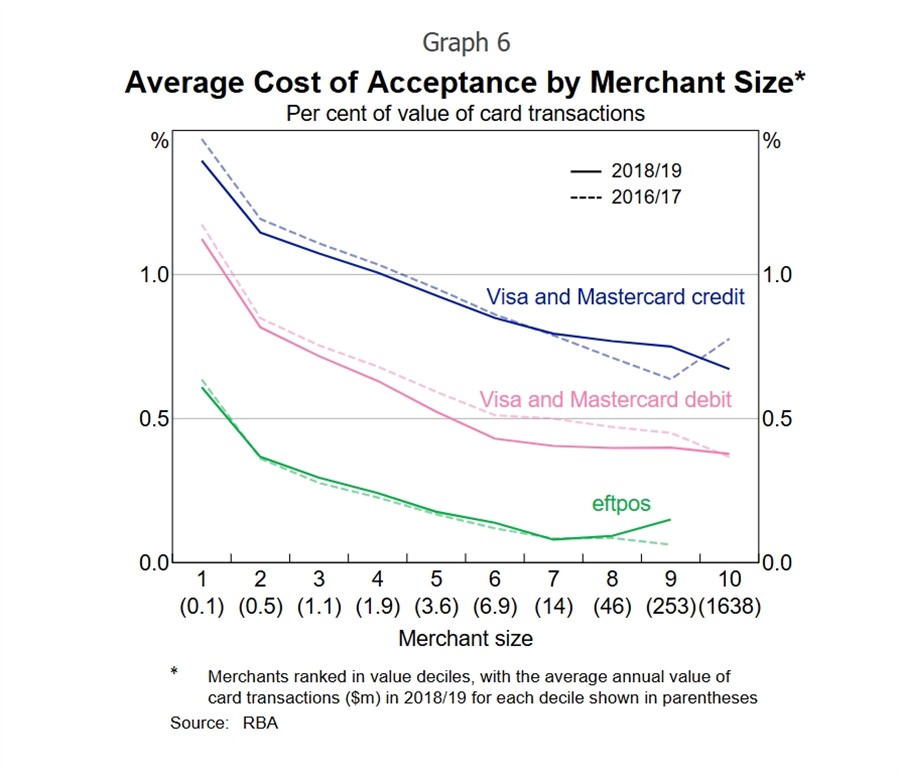

We must speak here: Australia’s card payment system has, for a considerable time, been structured unfairly. Large national retailers, the supermarket giants and major department store chains, wield significant commercial power. This scale allows them to negotiate highly preferential, often rock-bottom, merchant service fee rates with the banks and international card schemes. Their sheer volume of transactions gives them leverage that an independent retailer cannot match. Currently, it's less of an issue than with cash; both independent and large organisations pay no fees to the bank on money. What makes it particularly bad is that in these government promises, there's no explicit, corresponding guarantee or mechanism announced to ensure that the bank charges the debt fees will be fair. This isn't anecdotal; this issue is acknowledged in reports from government regulatory bodies and industry analyses. On average, an SME business can expect to pay merchant fees for debit card transactions, sometimes two to three times more than what a major retailer pays for the same value and type of transaction.

To put this into perspective, a small business may see debit card fees ranging from 0.5% to 1.5%, and sometimes even more, particularly if newer or less typical card schemes are involved. Conversely, a large retailer might secure rates as low as a few cents flat per transaction, or a tiny fraction of a percent. For a $100 sale processed via a debit card, this disparity means a supermarket might incur a fee of just 20 or 30 cents. However, your local boutique, café, or specialty store could be charged $1.00, $1.50, or even more for that identical transaction. This difference isn't trivial.

Examining the Impact

Suppose the government proceeds with banning debit card surcharges without simultaneously legislating a significant and enforceable reduction in the underlying merchant fees that small businesses pay. In that case, the financial implications are pretty straightforward. The cost of accepting debit cards, which you can recover, will have to be absorbed directly by your business. For many independent retailers, this isn't a minor adjustment; it could translate into thousands, or even tens of thousands, of dollars in lost revenue annually, straight from your bottom line.

Let's consider the probable consequences under such a scenario. Prices are often set by suppliers in their RRP. I doubt that the suppliers will adjust their prices to these debit card increases. Then there is the problem of an item that says $4.95. You cannot increase it to $5.05, as inflation continues, you may be able to put the debt charges into the item, but certainly not immediately.

The other issue is that the surcharges explicitly show the consumer the bank fees; if this is hidden, as it will be in the government plan, what is to stop the banks from increasing it more? Debt fees now, compared to many countries, are high; what is to stop them from going up higher?

The Problem Lies with High Debt Fees

The fundamental challenge, which a ban on surcharging alone does not resolve, is the inherently unfair and often opaque structure of merchant service fees in Australia. Suppose the genuine policy objective is to create a more equitable financial environment for small retailers and deliver real savings. In that case, the primary focus must be on tackling these high debt fees. The proposal treats an effect rather than a cause. No one charges surcharges for cash, as it has no fees. The surcharge is there because of the debt charges.

A Call for Genuine Reform: What Should Change for True Fairness?

If the government is truly serious about fostering a fairer commercial environment, then the policy approach must be more robust. Simply shifting a visible cost (the surcharge) into an invisible, absorbed cost for the retailer doesn't solve the underlying problem of excessive debt fees.

We need a meaningful reform that ensures that banks and card schemes are compelled to offer more equitable and competitive rates to all businesses, regardless of their size. Any ban on surcharges, if it is to be fair, must be intrinsically linked with real, enforceable, and significant reductions in the cost of accepting card payments for all retailers. Without this linkage, the policy risks being perceived not as a measure of support, but as an additional financial impost on an already challenged sector, while letting the major banks and large retailers continue to operate with their existing advantages.

The coming months will be crucial as this policy develops. It is vital that small retailers' concerns are heard and acted upon to ensure a truly equitable outcome.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.