The goal in retail is ultimately efficiency.

The most common metric to keep track of how well you are managing your stock is how fast you are turning it over - your stock-turns. Often selling it in less than a month means you are not paying for it.

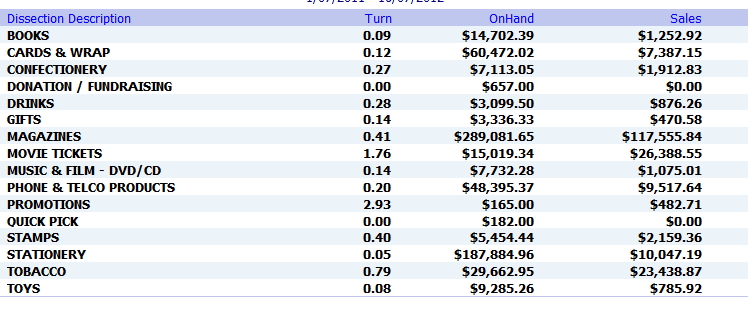

As a rule, a low stock-turn ratio means poor sales compared with the stock you are carrying or high theft. A high figure could mean either good sales, or you are not purchasing enough.

Although it certainly does not give all the answers by monitoring this number, you can make it easier to track how well you’re managing things.

What you will find useful is to compare your stock-turns over time.

To do this what you need to do is get your stock terms, a quick way of doing this is by doing this.

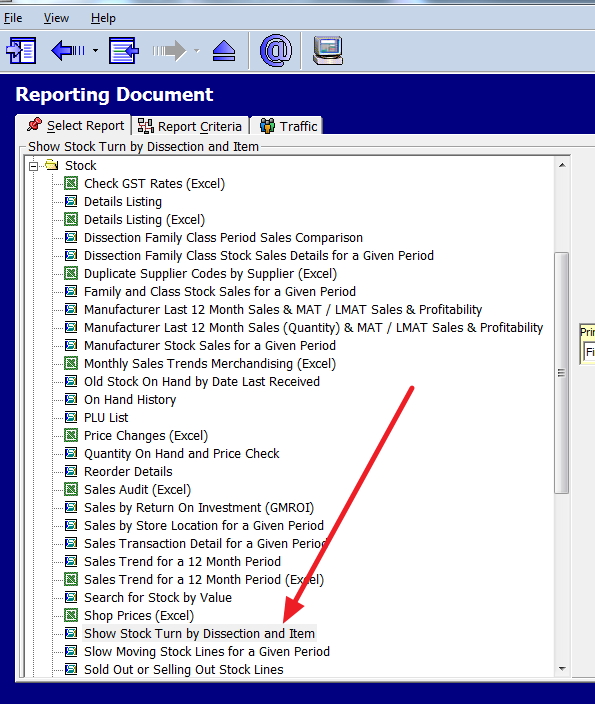

Main Menu > Cash Register > Register Reports > expand Stock > select/double the click the report “Show Stock Turn by Dissection and Item.

Now select the relevant options and then click the View Report button.

A useful exercise is run this report yearly for the last five (5) years, the last year and the last three (3) months and now compare the figures. This gives you a long, medium and short range. See how different departments are going.