Calculating Margins badly Can Cost You Money.

These newsbars highlight a problem: some are still miscalculating margin. A few days ago, I had to spend some time going over this with a client. This one is interesting because no one is trying to confuse anyone here.

The formula for margin is straightforward.

Margin = 1-Cost/Price

People get confused because a supplier often quotes the Cost EX GST while the Price is quoted INCL GST. To make the maths right to calculate the margin, both the Cost and the Price must be EX GST or INCL GST. You cannot mix GST into the calculation.

Say the figures quoted here for a NEWSBAR (chocolate bar) are

Cost per unit: $2.44 + GST

RRP: $4.99 inc. GST. If this is a premium chocolate bar, $4.99 is a reasonable price.

So the cost to you is $2.44 + 10% = $2.684.

Margin = 1 - (2.684)/(4.99) = 46.2%

Now, this is, in theory, your margin.

But margin often varies as it depends on you getting the supplier's price. There are a million reasons why you may have to sell at a different price in practice. However it is easy to find out the actual margin you are getting, but you need a computer to get it.

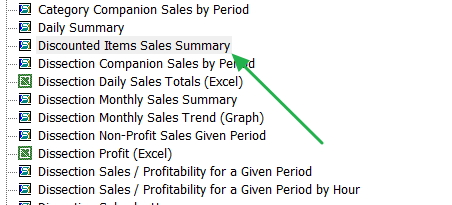

Go to the menu

Now in sales, select the "Discounted Item Sales Summary."

Pick a period. I suggest the last 12 months and run.

Here also pay particular attention to where you are discounting.