I got many questions about my article here

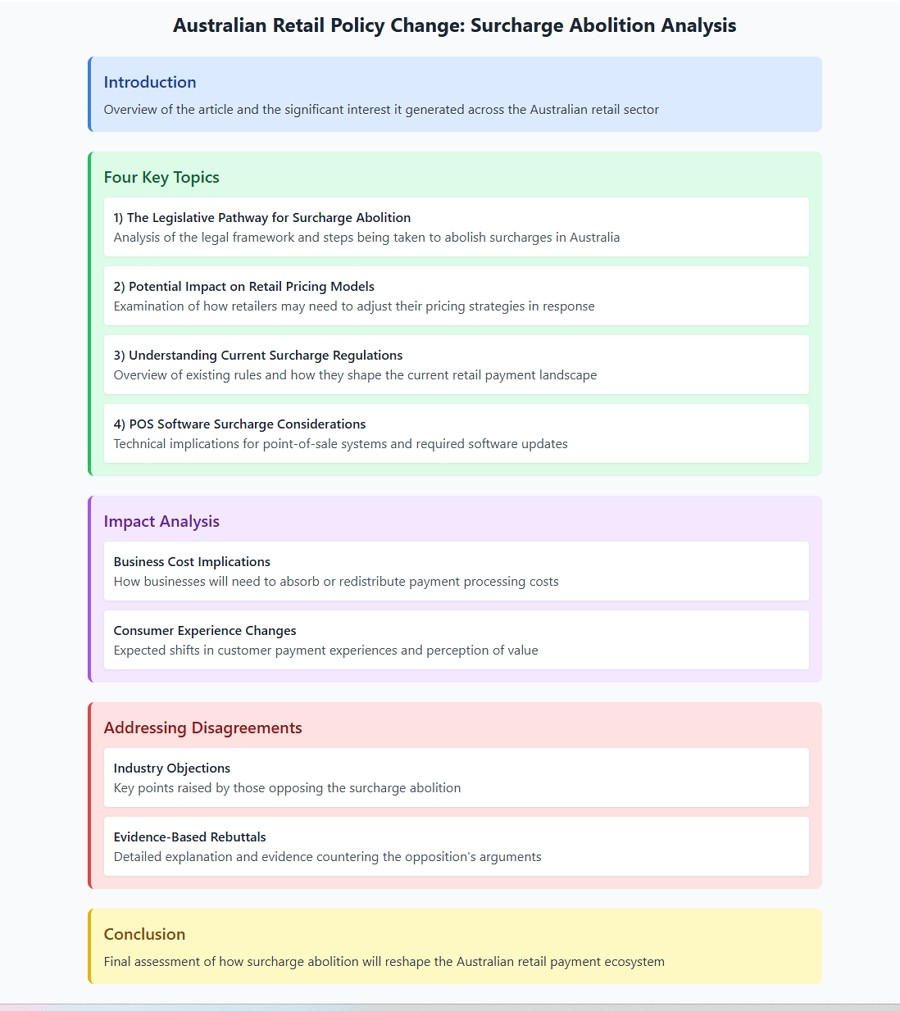

Here are the four questions I received, which generated considerable interest across the Australian retail sector. I explain why I believe this planned policy change will significantly impact how businesses price their products and process payments. I also explain why I think those who disagreed with me are wrong.

1) The Legislative Pathway for Surcharge Abolition

I agree that Labor's commitment to abolishing debit card surcharges will probably require legislation. Now, it was and is Labor policy to abolish these surcharges. Recent polls show strong public dissatisfaction with surcharges on card payments. When I spoke to a senior official in the NAB, I was told 71% of Australians polled. I cannot find any evidence to back this up, but it sounds reasonable to me. This creates significant political pressure for action.

Despite those who argue that the current law blocks a surcharge abolition, I believe a Legislative Pathway for surcharge abolition exists. Labor to put it through will need support from the Greens or the LNP to pass such an abolition through parliament. The LNP and the Greens are now re-evaluating their positions overall as they both lost their leaders in the last election. But before the election, the LNP had stated that surcharges were symptoms of deeper problems in the payment system. Meanwhile, the Greens advocated removing surcharges, with the banks absorbing these costs.

Despite differing policies, there is a cross-party recognition that the current surcharge system needs to be examined and reformed.

2) Potential Impact on Retail Pricing Models

Implementing a surcharge ban, which looks likely, will necessitate adjustments to retail pricing strategies. Most retailers will try to incorporate the cost of debit card processing into their base pricing structure. For example, if your debit card processing cost averages 1%, a product priced at $5.95 would need to be adjusted to approximately $6.01 to maintain margins. There is a marketing problem with making a price of $6.01.

Then there is a bigger problem: this price adjustment creates an unfair challenge for smaller retailers as they typically face higher processing fees than their larger competitors. A supermarket with a 0.5% debit fee will probably keep the magazine at $5.95, while a newsagent with a 1.2% fee would need to charge $6.02 for the same item. This pricing differential highlights the inequitable nature of card processing fee structures across the retail sector today. This assumes the magazine companies are okay with this. The most likely scenario here is that the newsagent loses 1.2%. I doubt any of the three political parties will care about this newsagent.

So, I suggest retailers consider reintroducing cash discounts, equivalent to card processing costs, for customers paying with cash. Our POS System can do that.

3) Understanding Current Surcharge Regulations

There continues to be significant confusion regarding what costs can legally be included in card surcharges under existing regulations. The current interpretation of legislation permits businesses to include only direct costs associated with EFTPOS processing in their surcharges.

This means costs such as:

) EFTPOS terminal rental fees

) Transaction fees charged by payment processors

) Receipt paper for EFTPOS terminals

However, indirect costs cannot be incorporated into surcharges, including:

) Your accounting services related to payment reconciliation, even if done by an outside contractor.

) Internet connectivity costs for payment processing

) Electricity costs for running terminals

The banks will analyse your surcharge rate for you. Our study has revealed that many financial institutions do not comprehensively outline all eligible direct costs when advising merchants on appropriate surcharge levels. This results in businesses underrecovering their actual costs. Check here for details.

4) POS Software Surcharge Considerations

Some retailers use Point-of-Sale (POS) systems that automatically apply surcharges to cover electronic payment costs. We think these surcharges only comply with current regulations if the additional charge is displayed on shelf pricing before the customer reaches the checkout. Few businesses that use such POS systems do that; if your company employs such a system, it is advisable to confirm with your POS provider that your surcharging practices align with current regulatory requirements. Non-compliant surcharging may expose your business to regulatory action from the Australian Competition and Consumer Commission (ACCC). If you do ask them, please let me know their responses.

Conclusion and Next Steps

The proposed abolition of debit card surcharges represents a significant shift in Australia's retail payment landscape. While the exact timeline and implementation details await further political development, Labor is talking of early 2026

Suppose you have specific questions about how these changes might affect your retail operation or require assistance configuring your POS system to accommodate the new regulations. In that case, our team can provide tailored guidance and support. We remain committed to helping Australian retailers adapt to this evolving payment landscape.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.