Everyone is trying to save cash flow. In the past, we all worked with the post and cheques. Today we send electronic invoices. Most customer payments with online banking payments are scheduled in advance.

Have a chew. Is the traditional 30 days system above even relevant today?

One of my clients did a rush job for someone. It was a sizable job, and they sent them an invoice once done. Accidentally it had a 30-day payment term on the payment terms on the invoice. The customer immediately preyed on the delay. Instead of getting paid in a few days, it dragged out to two months.

These are the facts; in general, putting a person on:

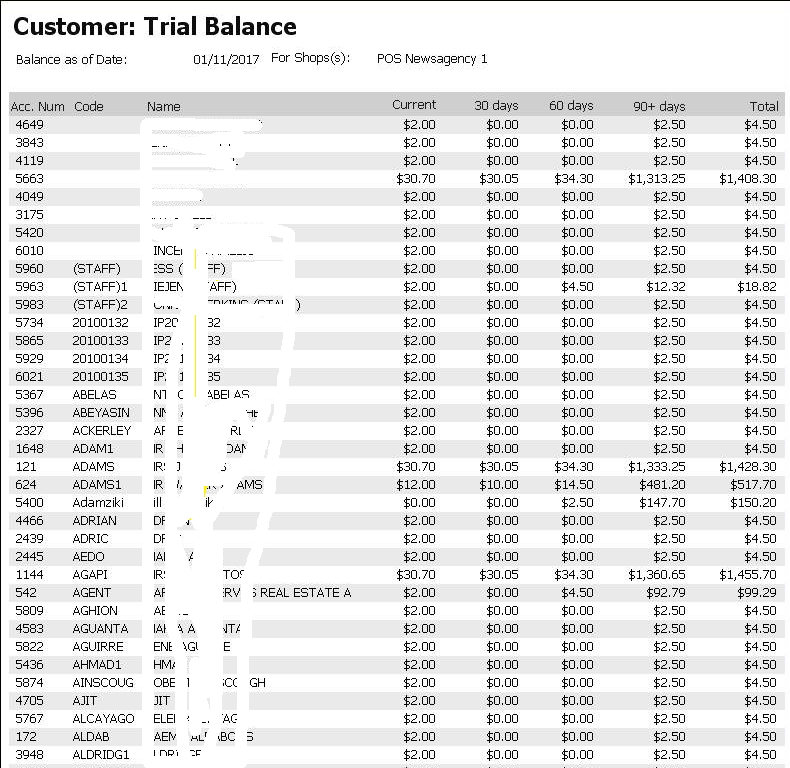

Look here at this report.

One month means payment in about two months.

While one week generally means payment in about two weeks.

Two weeks means a payment in about three weeks.

Conclusion: Short payment terms mean you paid faster!

Here are some tips.

1) Do your billing as quick as possible. If you must do it in cycles, make them as short as possible. In my experience, the longer a debt is outstanding, the harder it is to collect.

2) Set your billing cycles as short as possible.

3) Ensure your customers have the appropriate billing cycle; this is easy in our POS system.

4) Switch your customers to online payment if possible. People want today to pay electronically, so give them your BSB and bank account details.

5) Do not be afraid to follow up if bills are not paid on time. Use your outstanding debt reports in your POS Software. They can be individualised to your needs.

Cashflow is the number one killer of businesses.

So we all need to work smarter.