The November 2024 RBA report here showed significant shifts in Australian retail payments directly impacting retail.

What are the payment trends in Australia?

Card Payments: The Reigning Champion

Card payments continue to grow the most, with total purchases growing by 5.8% in value and 5.0% in number year-on-year. Notably, debit cards are slightly outpacing credit cards, I suspect mainly because merchant surcharges are cheaper.

Key statistics:

- Total card purchases: $87.7 billion

- Debit card growth: 5.9% in value, 5.0% in volume

- Credit card growth: 5.8% in value, 4.8% in volume

I doubt anyone would be surprised to read here that credit cards are used for higher purchases.

Recommendations for merchants

- Ensure your POS system accepts all major card types.

- Consider incentives for debit card usage to align with consumer trends.

- Implement contactless payment options, as 39% of card transactions are now via mobile wallets.

New Payments Platform (NPP): Rapid Ascension

I was stunned by the high growth of Bill Payments and direct bank transfers. Merchants are clearly trying to avoid using cards by conducting direct bank transactions, and I am sure this is especially true of the bigger transactions.

NPP growth statistics:

- Transaction value: +17.7% year-on-year to $168.7 billion

- Transaction volume: +15.0% year-on-year to 142.1 million

Action items for businesses

- We are now working on expanding your NPP capabilities into your POS system

- Get ready for it.

- Clearly, the public now is accepting it. I would look into it with your bank.

Cash

Cash usage is up, not as much as card usage, but still up. Plus, clearly, there are fewer but larger withdrawals. The reduction in the number of ATMs forces people to take out more, and there is inflation.

ATM withdrawal statistics:

- Value: +2.7% year-on-year to $9.0 billion

- Volume: -2.2% year-on-year to 28.7 million transactions

Considerations for retailers

- Maintain sufficient cash reserves for customers who prefer it.

- Do not drop cash as people want it.

The Decline of Traditional Payment Methods

Traditional payment methods show a significant decline, which I doubt surprises anyone.

Cheques: A Rapid Descent

Cheque usage has plummeted; I know that now few people want to accept it.

Cheque payment statistics:

- Value: -22.6% year-on-year to $15.4 billion

- Volume: -30.9% year-on-year to 1.1 million transactions

Interestingly, the average value of each cheque is down now.

Recommendations

- I suggest that you seriously look into phasing it out.

- Communicate with your customers about transitioning to digital payment methods.

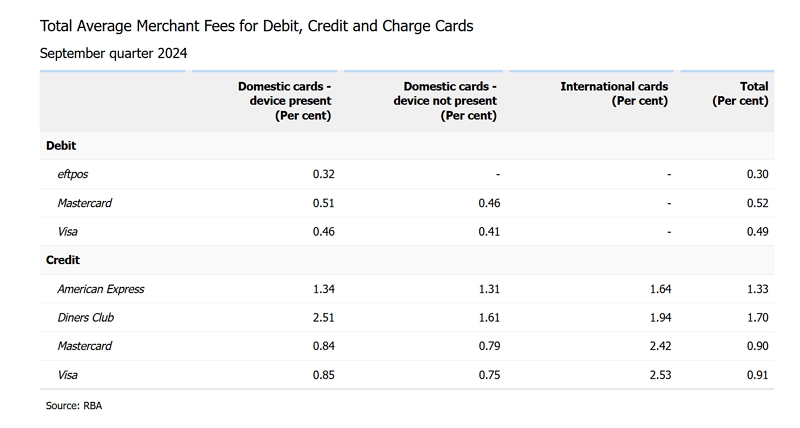

Merchant Fees: Understanding Transaction Costs

This part of the report was particularly interesting, and it's worth your time to compare what you are paying to the average. Note that if the customer is not present, the rate is generally higher.

Merchant fees vary significantly across card types. Understanding this is crucial for optimising your payment acceptance strategy.

Average merchant fees comparison (September quarter 2024):

{table}

Action items

- Review your current merchant fee structure against your costs. You can often get better rates if you take out a contract.

- Consider reducing fees by promoting Cash/EFTPOS as a preferred payment method.

- If you have not done it yet, implement least-cost routing to process transactions through the lowest-cost network automatically. Not having it is costing you money.

What are the future trends in payment systems?

The Australian retail payment ecosystem is rushing towards digital with its real-time solutions.

You must position your business for a digital retail environment.

If you want the details of this report, click here