Accounting for 2024-25

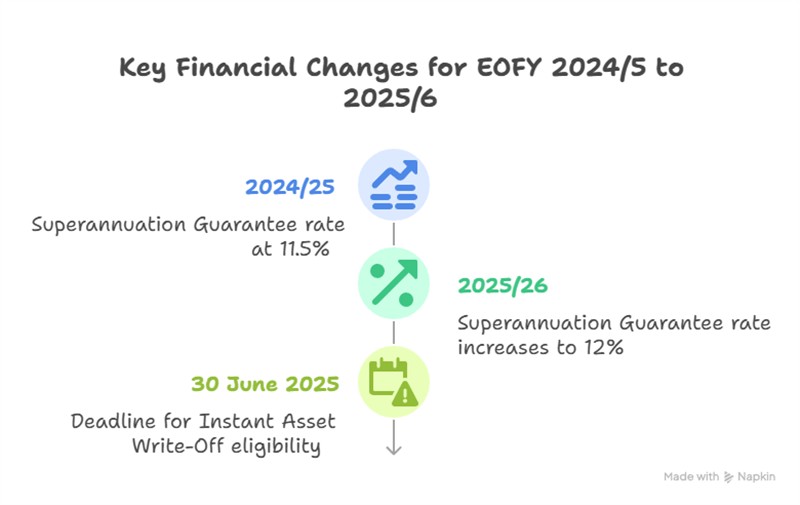

There are few key differences and notable changes for EOFY 2024/5 to 2025/6

As such this is still valid for your EOFY accounting.

The only major change for SMB retails is that you need to adjust the Superannuation Guarantee (SG) rate as it rises from 11.5% in 2024/25 to 12% in 2025/26. This is the final step in the legislated SG increases, so you must update payroll systems and budgets accordingly.

You must act now if you want to use the Instant Asset Write-Off for this year's tax return. The $20,000 threshold for eligible businesses (with less than $10 million aggregated turnover) only applies to assets first used or installed ready for use by 30 June 2025. Purchases after this date may be subject to different rules or thresholds.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.