https://walterwrites.ai/

Update: I wrote this article a few weeks ago and was asked about the other free AI model, GWEN, that was recently released. So, I decided to test this one, too, and add it to the list. It's an excellent AI model. Also, for the sake of completeness, I decided to add Microsoft Copilot. So here is the updated list.

No one has talked about artificial intelligence (AI), and now it seems people are talking about little else. We have been actively involved in AI for several years now.

In retail, AI promises to boost sales and reduce operational costs in the POS system. Like everyone else in business, those leveraging AI will stay competitive in a rapidly evolving market.

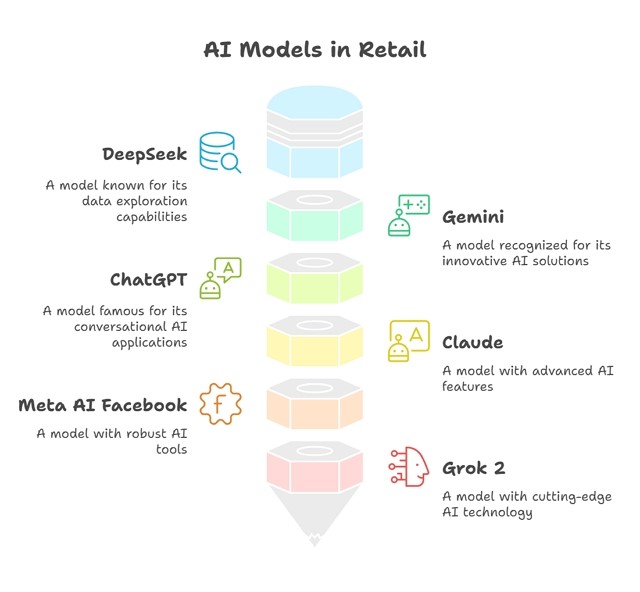

Comparison of AI Models

A good leaderboard of what AI models is available here.

But these are not measured on what our clients now use and the problems they encounter. So, to understand the current landscape of AI needs in retail, we compared several leading widely available AI models:

1) DeepSeek

2) Gemini

3) ChatGPT

4) Claude

5) Meta AI Facebook

6) Grok 2

7) GWEN

8) Microsoft Copilot

We tested these models on real-world scenarios that retailers encounter, such as product descriptions, inventory management, customer service, and sales forecasting. We then combined the answers, amended them by hand and came up with answers that we scored 40. We then compared each AI's answer to this score of 40. All of this took us a lot of work.

Our test results showed that Gemini (Google) was the top performer, scoring 39 out of 40. It also offered a comprehensive package with many additional benefits, making it an attractive choice for businesses seeking a robust AI-powered POS system.

Claude excelled in writing capabilities, scoring 37, which makes it most suitable for tasks requiring explicit and engaging content.

ChatGPT and Grok 2 scored 36, demonstrating their ability to handle various tasks effectively. What we liked about Grok 2's answers is that they contained advanced information on items the other AIs did not have. If, for example, a new game came out and you wanted to see what people thought about it, Grok 2 gave the best response. I cannot wait to see Grok 3, which is overdue now.

DeepSeek scored 35 despite being significantly cheaper. It offers impressive performance at a fraction of the cost of other models, making it ideal for businesses requiring API access.

GWEN scored 34, which is a bit lower than Deepseek's, but like Deepseek, it is free. We weren't that impressed with what the AI model could achieve compared to the other models mentioned; it also lacks an API, which could lead to issues in usage.

Microsoft Copilot scored 32, but like Deepseek, it is free and integrates well into Microsoft products that many of my clients use. Again, we weren't impressed with what the AI model could achieve, but if you use Microsoft products, it fits well into the suite.

However, Meta AI (Facebook) struggled, scoring only 30, but was still included in the assessment due to its potential in specific use cases. Overall, I would not recommend it as your primary AI.

Recommendations

Gemini is likely the best choice if cost is not a concern due to its superior performance and additional features. Google's support and integration capabilities make it an excellent solution for businesses seeking a comprehensive AI-powered system.

However, DeepSeek presents a compelling option for those prioritising cost-effectiveness. At only 2% of the cost of ChatGPT, it delivers nearly comparable results, making it an attractive choice for businesses requiring API access.

Grok 2 is particularly noteworthy, especially with its upcoming update. Its integration with X (Twitter) offers access to a vast source of real-time data, which can be invaluable for businesses that must stay informed about the latest trends and news.

AI in POS Systems: Promises

English and spelling

Not everyone is good at English with AI lousy spelling, and people with bad grammar can communicate in writing better. It also allows them to communicate better with non-English speakers.

Marketing material

AI can be successfully used to write marketing material. A client wanted to create fancy names for their lotto syndicate, so they used AI to help them.

Real-time Predictive Analytics

AI analyses sales data and market trends to forecast demand, helping businesses optimise and prepare for busy seasons. For example, a retailer can use AI to predict a surge in demand. As trends overseas tend to come first before they hit us, they can tell us where the market is going.

Personalised Marketing

AI could provide tailored recommendations and promotions based on customer purchase history and preferences, fostering loyalty and boosting sales.

Dynamic Pricing Optimisation

We like that it can better set prices in real time based on demand. Companies dealing with marketing events often have goods that sell well in that season, but the demand for the product collapses as soon as it's over. We are hoping AI can help us with this, too.

Implementation Challenges

Implementing AI in POS systems can present challenges. The answers are often not as good as they look. They are often wrong, and it's hard to argue with it because they look so right.

The future

It is unclear where the AI market is going. Will consumers want a low-budget or medium-budget, or are they prepared to pay for an expensive system? One company told me they spend $200/month on ChatGPT, which is $2,400 annually. Will the consumer bear that?

The other issue is whether a business needs a car or a truck in AI. In the context of retail POS systems, AI is not just about speed or luxury; it's about finding a solution that can handle the workload efficiently. Businesses need a reliable truck rather than a sports car to carry a heavy load rather than speed.

I am sure there are privacy issues, too. Some AIs are specially built with that in mind. But this all would involve a deeper discussion of data privacy, security, and compliance (such as GDPR or Australian privacy laws) beyond the scope of this post.

Some industry research shows that over 70% of retailers plan to adopt AI within the next two years. I would not be surprised if it will be closer to 100% in one year, as AI can enhance competitiveness and drive growth.

FAQ: Frequently asked questions

Q: What is the role of AI in POS systems?

A: AI in POS systems promotes boosting operational efficiency.

Q: Which AI models were compared in our tests?

A: The models tested included DeepSeek, Gemini, ChatGPT, Claude, Meta AI (Facebook), and Grok 2. These were evaluated in real-world scenarios such as product descriptions, inventory management, customer service, and sales forecasting.

Q: What were the results of the AI model comparison?

A: Gemini (Google) scored the highest at 39 out of 40, offering a comprehensive package with additional benefits. Claude excelled in writing capabilities, scoring 37. ChatGPT and Grok 2 scored 36, while DeepSeek scored 35 despite being significantly cheaper. Meta AI (Facebook) scored 30.

Q: Which AI model is recommended for businesses with no budget constraints?

A: Gemini is likely the best choice due to its superior performance and additional features. Google's support and integration capabilities make it an excellent solution for comprehensive AI-powered systems.

Q: What about cost-effective options?

A: DeepSeek is a compelling choice for businesses prioritising cost-effectiveness. It offers impressive performance at a fraction of the cost of other models, making it ideal for those requiring API access.

Q: How does AI improve communication in retail?

A: AI helps individuals with limited English proficiency communicate more effectively in writing. It also facilitates better communication with non-English speakers.

Q: Can AI assist with marketing tasks?

A: AI can be used to write marketing material, such as creating product names or promotions. It can also help generate engaging content.

Q: What are the benefits of AI in predictive analytics and personalised marketing?

A: AI analyses sales data and market trends to predict demand, assisting businesses in preparing for peak seasons. It also offers personalised recommendations and promotions based on customers' purchasing history, enhancing loyalty and driving sales.

Q: What challenges are associated with implementing AI in POS systems?

A: Utilising AI can present challenges, such as ensuring the accuracy of AI-generated responses and integrating AI with existing systems. Additionally, although AI responses may seem correct, they can still contain errors.

Q: What does the future hold for AI in retail?

A: The future of AI in retail appears promising, as over 70% of retailers plan to adopt AI within the next two years.

Q: How does the analogy of a "truck" apply to AI in POS systems?

A: In retail POS systems, AI is not just about speed or luxury; it's about finding a solution that can handle the workload efficiently. Businesses need a reliable "truck" rather than a sports car to carry a heavy load effectively.

Q: Are there privacy concerns with AI in POS systems?

A: Yes, very much so. Some AI systems are claimed to be designed with privacy in mind. It remains an essential consideration for businesses implementing AI solutions.

Q: Is a POS system AI?

A: A POS system itself isn’t AI but can be integrated with AI to enhance its capabilities.

Update: The federal and SA governments have blocked access to DeepSeek over its network and directed public servants to stop using and remove it from devices. More details are available here. There are security concerns over the product.