Pricing products effectively remains one of the most challenging aspects of retail management. It's a problem. You get a product you have never handled; how do you price the item for sale now? Getting it wrong can significantly impact profitability and competitiveness. Many people today have suggested that the new AI Chatbots can help, but none, as far as I know, have shown any proof of this. So, to address this problem, we conducted a comprehensive evaluation of six free AI chatbots to assess their effectiveness in pricing recommendations for Australian retailers.

Our Testing Methodology

We tested a scenario of a small newsagency in Keysborough, a typical Melbourne suburb located in a strip shopping centre. The test focused on pricing a specific product: a Pilot Frixion Ball Erasable Gel Pen pack containing three pens (black, blue, and red) with a fine 0.7mm tip using only free CHATbots.

We restricted the test to free AIs because most retailers are only now experimenting with AI chatbots. Few have purchased an AI Chatbot plan, whose costs now vary from about $25 to $200 plus GST (I have a customer who uses AI in our POS Software and runs a bill of up to $10 daily). Once you get into paid plans, there is a massive difference in what you get.

Free tools can offer an accessible starting point, but not everyone is equal for all tasks, as you will see here.

So, we limited our evaluation to these six popular free AI chatbots:

ChatGPT (OpenAI)

Claude (Anthropic)

DeepSeek

Google AI

Grok 3

Qwen

We wanted to test meta AI, which had announced a significant update, but unfortunately, it was not available when this report was written.

After multiple iterations to refine our approach, we developed a standardised prompt that described the retail location, business type, and product specifications. We then evaluated each chatbot's response based on nine key performance indicators. It all took a lot of time.

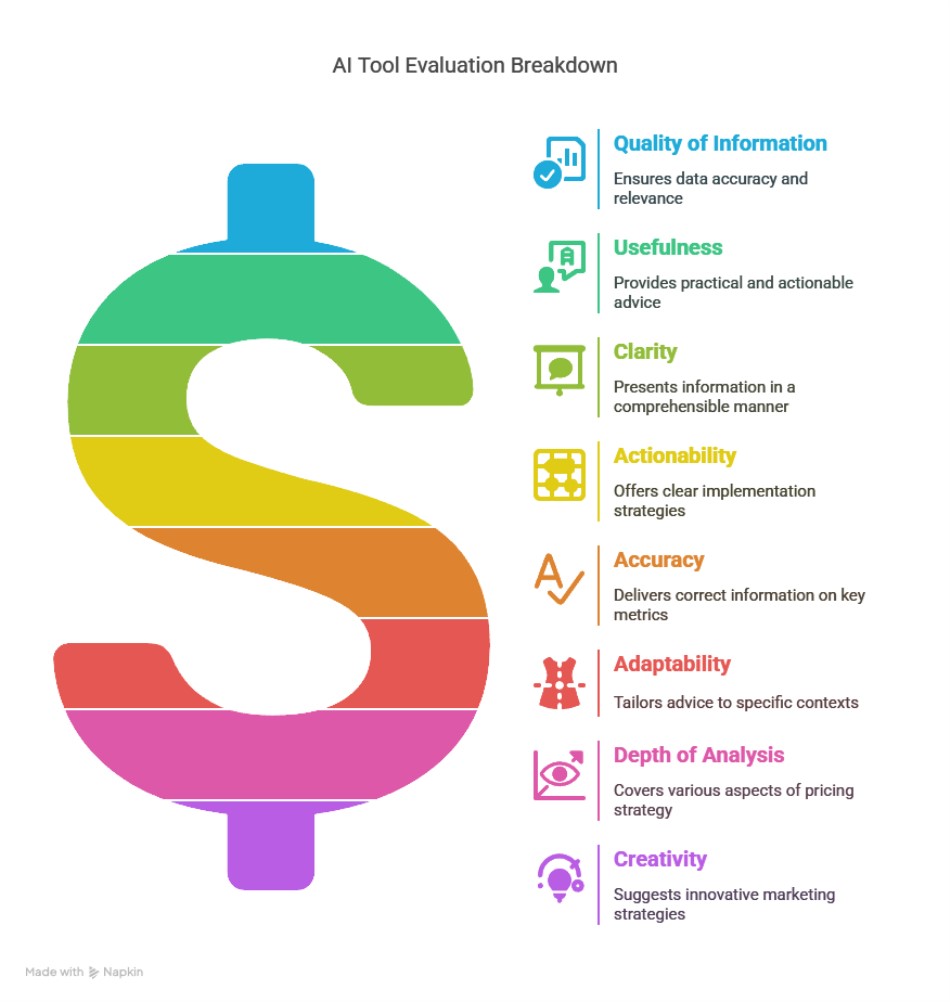

Evaluation Framework

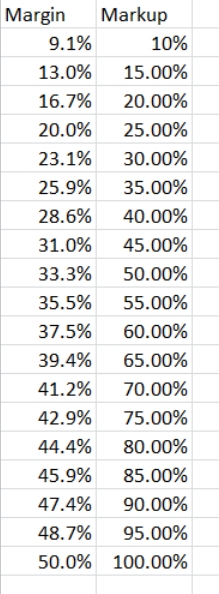

Each AI tool was assessed across nine KPIs, with each scoring out of 10, giving us a maximum possible score of 90.

Accuracy and relevance of data regarding the product, competitors, and market conditions

Usefulness

If the advice is impractical, what is the point of getting it?

Clarity

We are all busy people; we need something well laid out and comprehensible.

Actionability

We wanted clear, implementable recommendations

Accuracy

AI Chatbots do make errors and mistakes. We want correct information on costs, retail prices, and market trends

Adaptability

Not surprisingly, we found that to price appropriately in local retailing, the advice needs to be for a specific location and a store's customer demographics

Depth of Analysis

Besides price, we would like advice on various pricing strategy aspects

Creativity

It would be lovely to get information on innovative suggestions for marketing, e.g. bundling, promotions, or other sales strategies

Customer-Centric Approach

Not all customer segments react to pricing similarly, so we want to know how each responds. You rarely care if you get too much information.

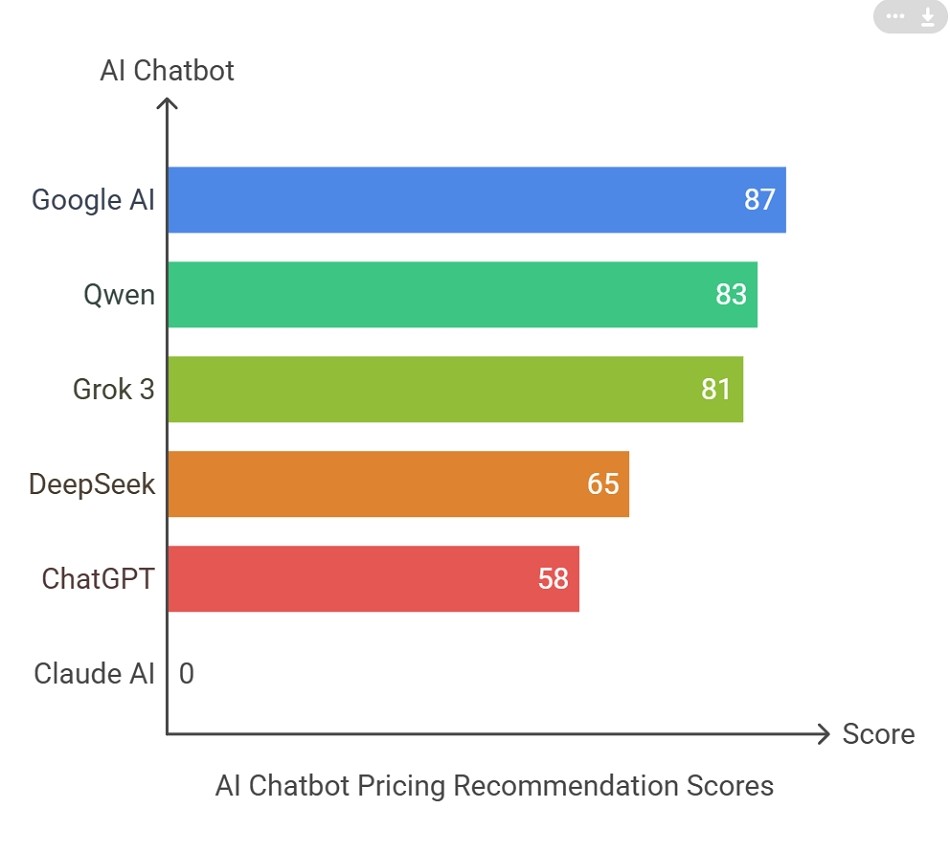

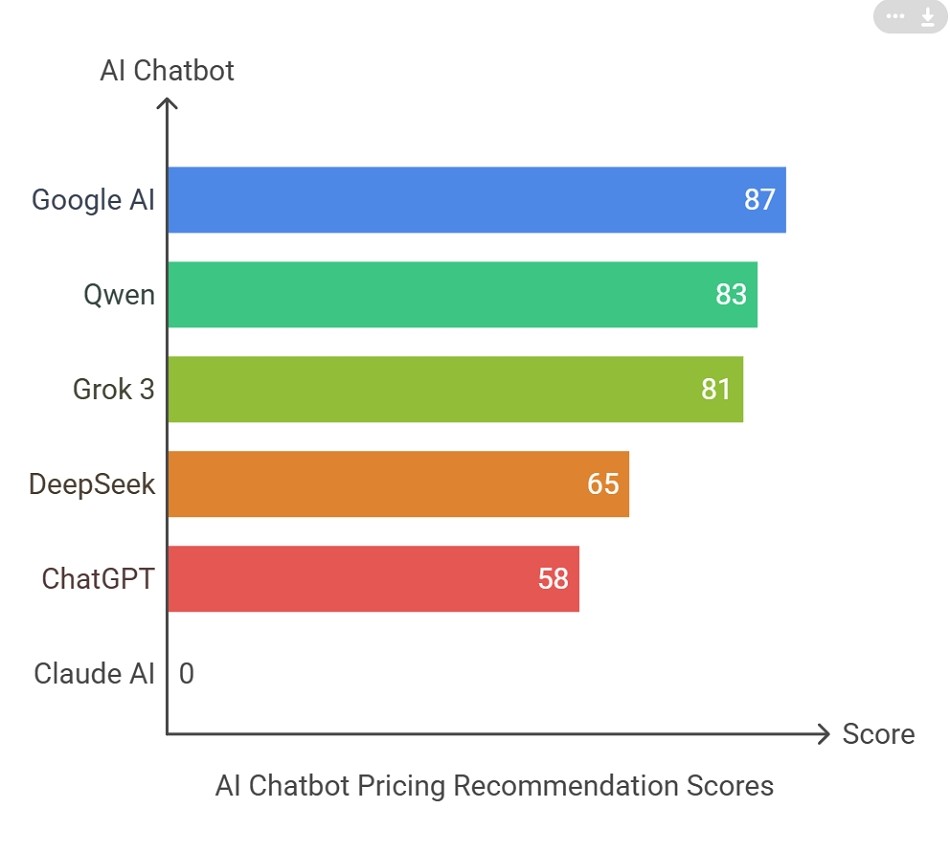

Results Summary

The performance of each AI chatbot is summarised in the table below:

| AI Tool |

Price Range |

Score (out of 90) |

| Google AI |

$9.99–$10.99 |

87 (winner) |

| Qwen |

$9.99 |

83 |

| Grok 3 |

$9.49–$9.99 |

81 |

| DeepSeek |

$12.99–$13.99 |

65 |

| ChatGPT |

$11.99–$12.99 |

58 |

| Claude AI |

N/A |

Eliminated |

Notably, the top three performers delivered remarkably similar price recommendations, suggesting a similar practical use by a retailer on the top tools.

1. Google AI (Score: 87/90)

Strengths:

- Provided accurate pricing recommendations based on local competitor analysis, correctly identifying Coles' price range of $9.50–$14

- Suggested appropriate margins of 35–50%, aligning with industry standards

- Delivered a logically structured report with clear reasoning

Areas for Improvement:

- Some sections contained overly technical markup calculations that would be challenging to understand.

- User interface could be more intuitive for retailers without technical expertise

Key Insight:

Google AI excels at tracking and analysing local competitor prices, making it highly effective for crafting a pricing strategy.

2. Qwen (Score: 83/90)

Strengths:

- Proposed innovative bundling strategies, such as pairing pens with notebooks at $12.99 to increase perceived value

- Included practical promotional messaging suggestions (e.g., "Save $1 vs Coles!")

- Presented information in an accessible, actionable format

Areas for Improvement:

- Assumed a wholesale cost of $6.50, which appeared to be unrealistically low based on market research

Key Insight:

Qwen's focus on bundling opportunities and targeted promotional strategies makes it particularly useful for retailers looking to maximise revenue through upselling techniques.

3. Grok 3 (Score: 81/90)

Strengths:

- Provided detailed customer segmentation analysis, correctly identifying pensioners as a key demographic in the Keysborough area

- Recommended a four-week price testing strategy to refine the pricing approach based on actual sales data

Areas for Improvement:

- Suggested profit margins were lower than industry standards

- Report contained unnecessary repetition

Key Insight:

Grok 3's demographic analysis capabilities make it particularly valuable for retailers to align pricing strategies with local customer profiles.

4. DeepSeek (Score: 65/90)

Strengths:

- Effectively highlighted product features (such as erasable ink) as unique selling points

- Suggested strategic product placement near complementary items to encourage cross-selling

Areas for Improvement:

- Recommended pricing ($12.99–$13.99) significantly exceeded competitor rates

- Technical terminology like "left-digit effect" was used without explanation. A left-digital effect charges a $10 item as $9.99. Did you know that? We did not know until we looked it up.

Key Insight:

DeepSeek appears better suited for premium or specialty product pricing than standard retail items with established market positioning.

5. ChatGPT (Score: 58/90)

Strengths:

- Provided a well-written, easily comprehensible report

Areas for Improvement:

- Wrong information, e.g. it inaccurately estimated competitor pricing ranges

- Did not check the local pricing of the product

- Lacked depth in analysis and failed to provide sufficiently actionable recommendations

Key Insight:

In our test, ChatGPT's generalist approach proved inadequate for the nuanced requirements of a retail pricing strategy in a shop in the Australian market.

6. Claude AI (Eliminated)

Claude AI was disqualified from the final evaluation due to its inability to access real-time data and lack of localisation features for the Australian market, rendering its recommendations useless.

Key Findings and Implications

If looking at an AI Chatbot, you need to look at:

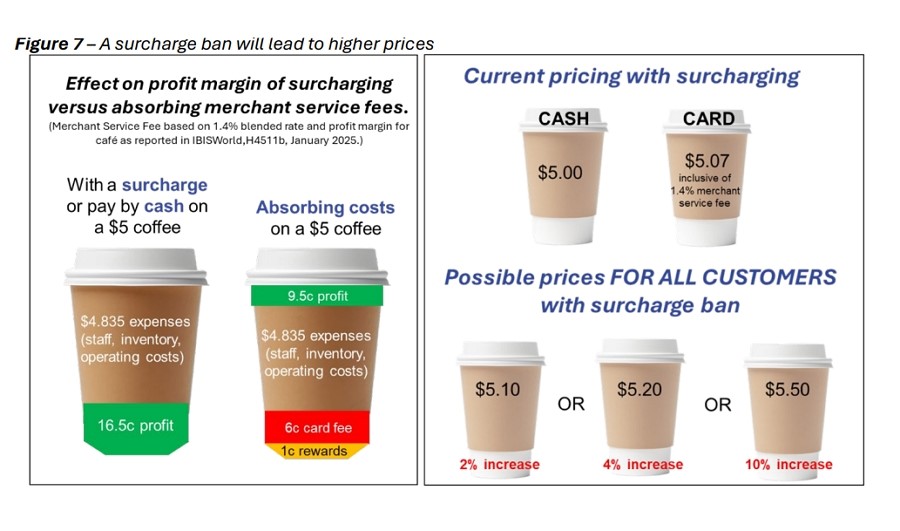

Real-time competitor analysis

You will not be able to do a good job of pricing if you do not have local information; this led to a pricing recommendation by ChatGPT that was disconnected from market realities.

Value-added bundling recommendations

Does it offer ideas to sell the product

Demographic-specific insights

In most shops, there are several different customer demographics, and these when pricing needs to be considered.

Overly technical presentations

Some Chatbots made us feel that the complexity was excessive, making the report difficult even though we told them not to make it complex.

Conclusion and Recommendations

For Australian SMB retailers seeking to use AI tools for pricing, Google AI, Qwen and Grok 3 emerged as the best due to their accuracy in competitor tracking and logical approach to margin calculations. Any of these can do the job well. If I were pricing an item and wanted some advice, any of these three Chatbots would give me good advice. As there must be a winner, Google AI won.

If you are interested in looking into this technology, I would suggest:

- Testing multiple free AI tools to identify which best aligns with your specific business needs

- Please don't assume the chatbot knows your local market conditions; the more you tell it, the better. You are better off assuming nothing.

- Check the AI report, as wrong information was sometimes supplied.

- Gradually expand your AI Chatbot over time.

This research demonstrates that free AI chatbots can provide valuable pricing insights for Australian retailers, though their effectiveness varies significantly across tools. By selecting the appropriate AI assistant and providing relevant contextual information, retailers can enhance their pricing strategies without investing in expensive subscription services.

Have you tried any of these tools yourself doing this type of test? Please share your experiences in the comments below!

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.