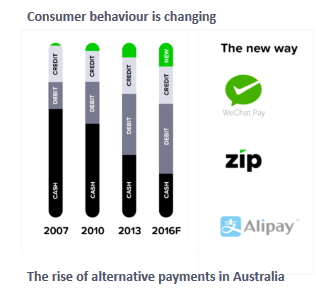

Right now if you go into any shopping centre, you will see almost everyone is offering a buy now pay later(BNPL) option. There is little choice for many shops as Australians are dumping credit cards and going for them. Already more than a million Australians have stopped using credit cards and are using these services. So today BNPL startups are popping up like mushrooms in Australia, and although there are plenty of players in this market already, the interest now is that CBA bank has announced that it is moving in a big way into this market and soon I am sure the other banks will also move into this market.

Although each offering of BNPL is different, I think the following is a fair comment, unlike the credit card most of the fees are paid for by the merchant, not the customer. Most merchants that use these services do so because these services do push their stores thus increasing their sales.

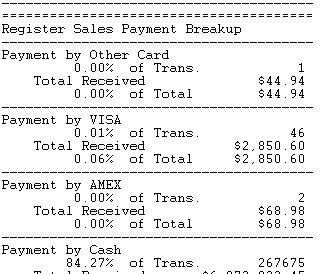

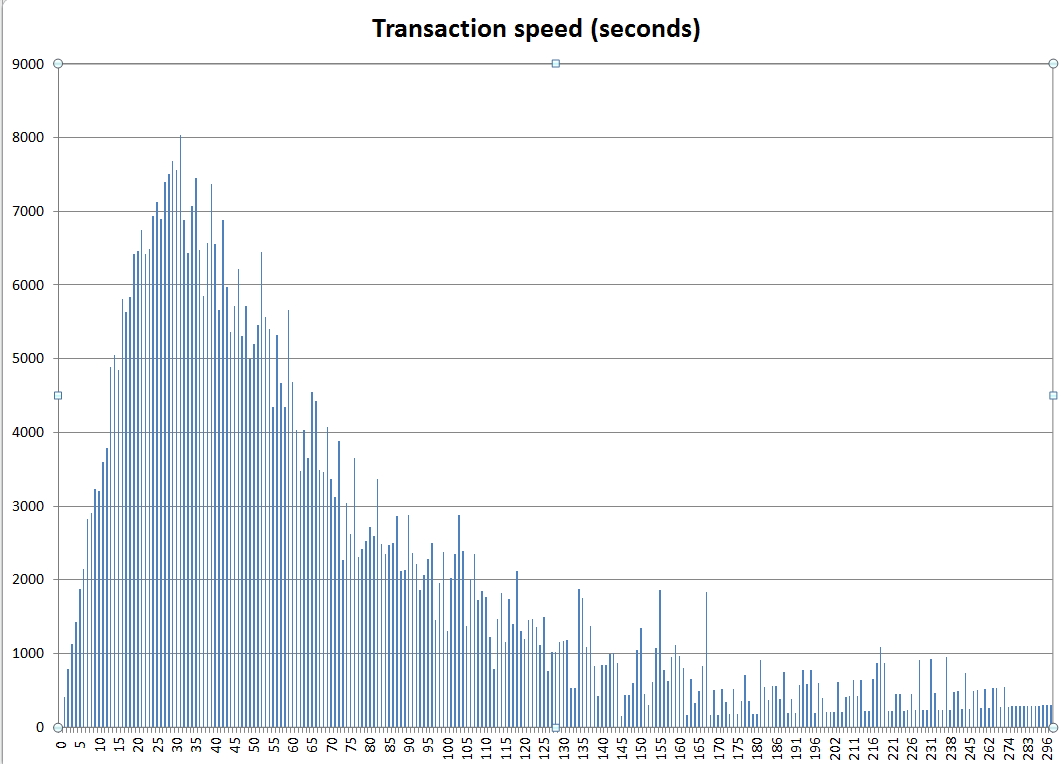

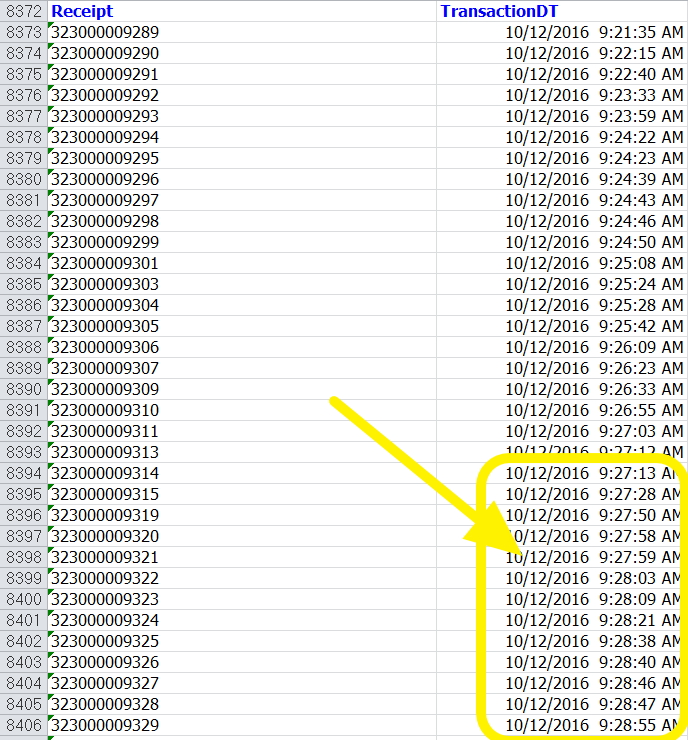

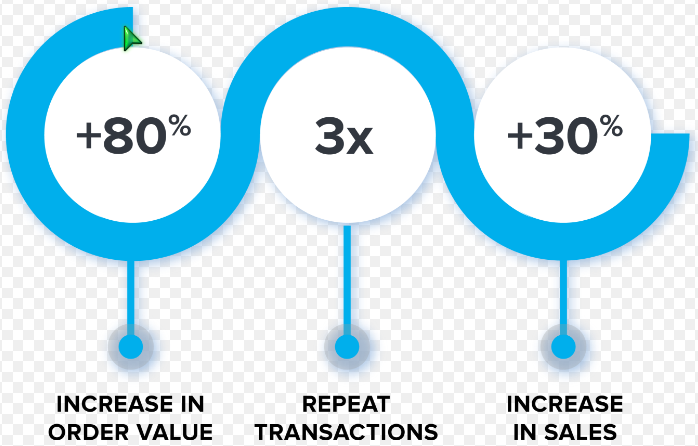

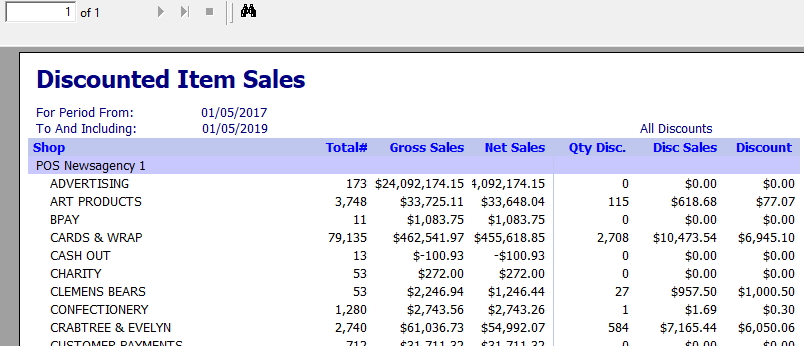

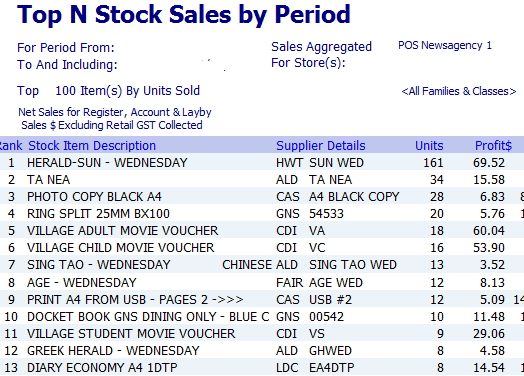

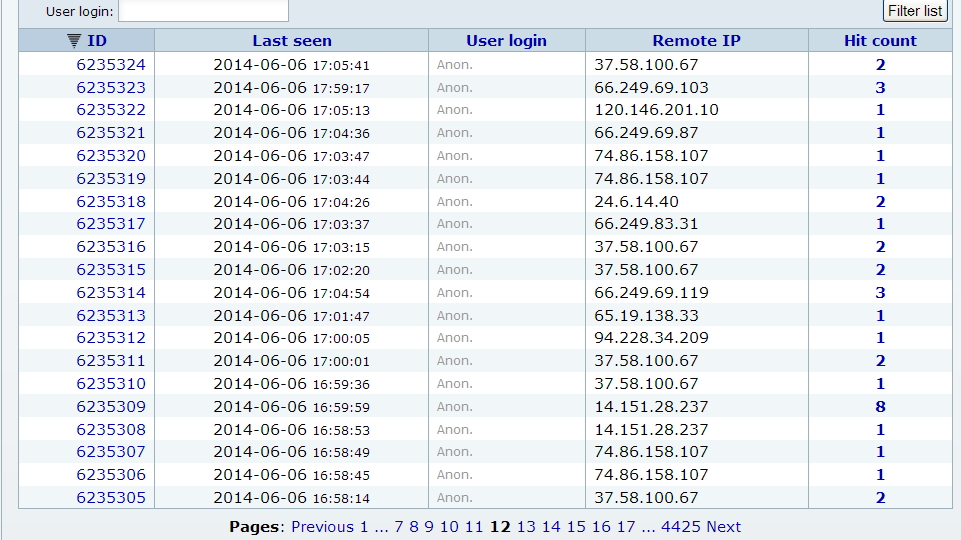

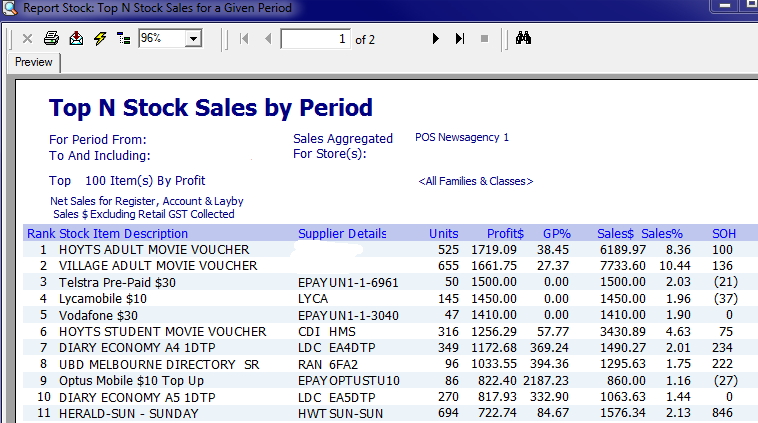

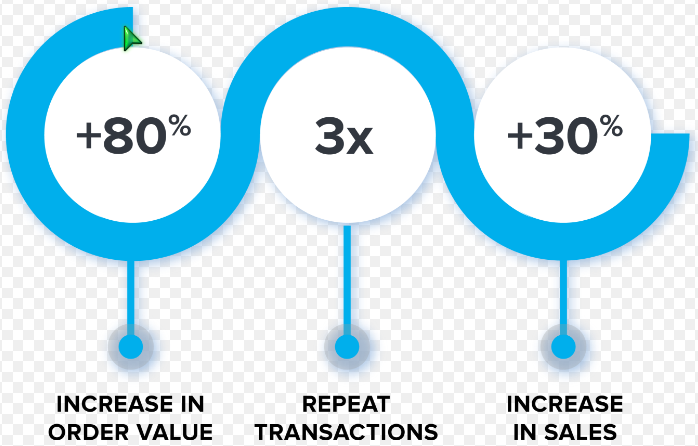

The other issue is that a BNPL customer if you have the right products for them, is a good customer. Here is an analysis of a zip customer

They buy more each time, and they buy more often, the operative point being here, do you have the products for these customers?

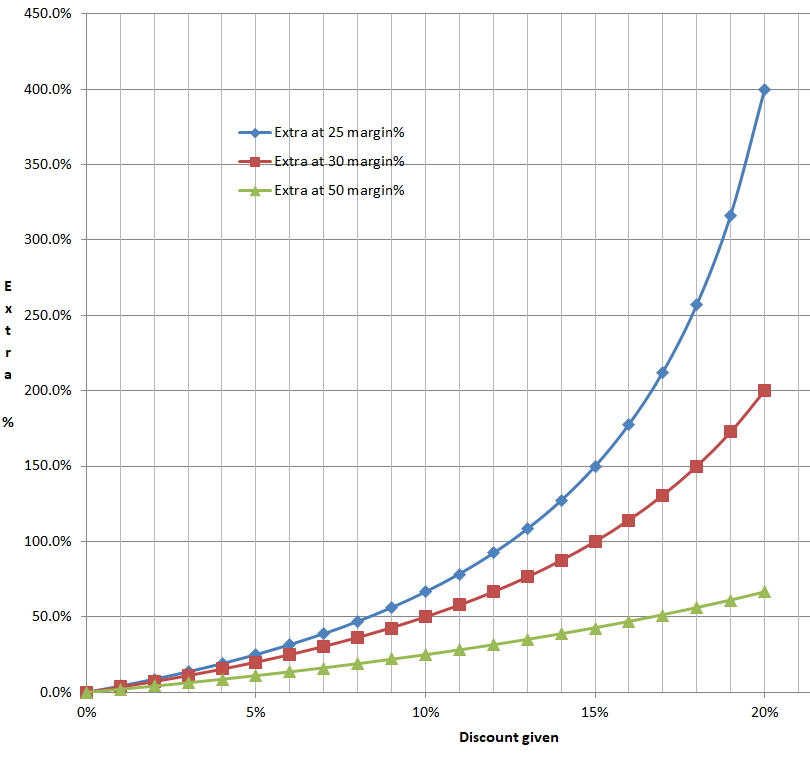

So the big problem for many of my clients is that with credit cards whereas the fees are relatively small and can be either absorbed and/or charged to the client, with a BNPL model, the costs are much higher, about 5% and it can be tough to charge this back to the customer as both the customers and the BNPL do not like it this chargeback. A hairdresser who was my client, charged a woman a surcharge because she used zip, the customer went on social media to complain, within hours zip picked it up the twitter and rang her and asked her to please explain.

This leaves many of my clients with a problem, either give up a large number of clients and a major market or offer BNPL. The answer will be a decision for each store.

If you do laybys, I do suggest that you switch at least for this service over to BNPL. If you do your sums, the extra costs and bother to you in laybys are just not worth this 5% fee.

If your layby customers do not have a BNPL account consider this when I did an experiment, I found that it took me about 2 minutes to get a BNPL account.

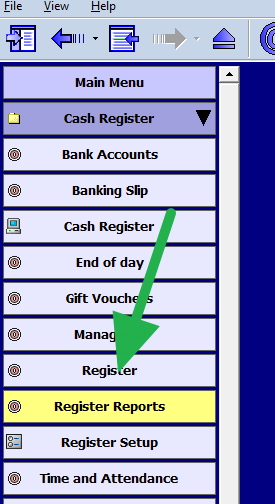

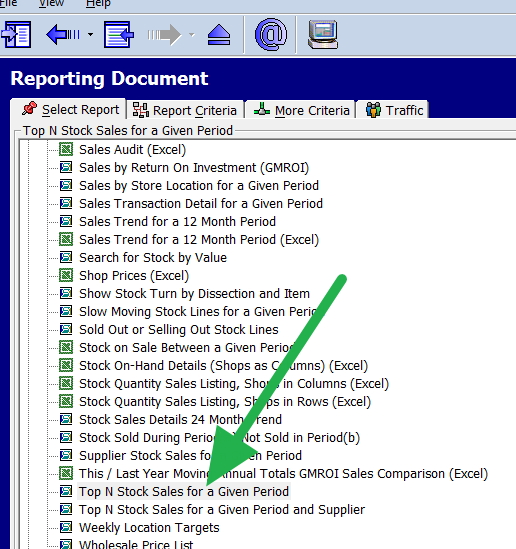

Now assuming you do decide to go into this space well the question is which one do you use. Currently, there are two big ones, Afterpay and Zip. You can go for others but these two you need to look at first. Both are I think are reliable. Both run extensive marketing campaigns which do benefit the merchants that do use them. Both have a lot of followers. Generally users of these services, I find have both.

As a comparison, Zip big plus is that it lets you sell higher-priced items, its costs are a bit lower, and it pays faster. Plus it is easier to get, and they bug you less. Afterpay will put conditions on its use and in fact on all payment types that you use which blew my mind, if you have Afterpay in your shop, if you do a cash transaction you must abide by Afterpay conditions even though it has nothing to do with them. I have never seen Zip do anything like that. This is why I suggest if you are thinking of entering this market, try Zip first. Once you have bedded it down then look at others.

If you want to investigate more, click here.

PS Whatever you do, what you need to consider is that BNPL is clearly the future, soon I predict that all shops will need it.

.

![]()