Help shape the Future of EFTPOS Integration

Today, EFTPOS payment plays a key role in retail! We need to hear your thoughts on what you need with FTPOS.

If you're a customer running our POS System, we need your feedback to help us create EFTPOS solutions tailored to your needs, making your business even more successful!

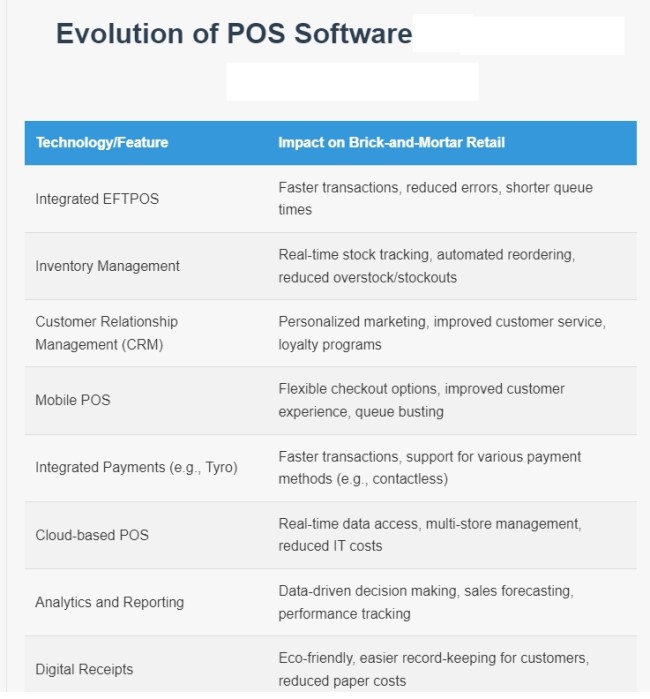

Understanding EFTPOS Integration

EFTPOS integration creates a direct communication pathway between your Point of Sale (POS) and payment systems. This seamless connection eliminates redundant data entry, reduces handling time, and reduces mistakes.

Why Your Input on EFTPOS Integration Matters

Implementing any EFTPOS integration is a significant investment for our team and your business. This goes beyond simply connecting a terminal—it involves creating systems that complement your workflow and work with the new system requirements errors. Each is a few months' work.

Prioritising Your Business Requirements

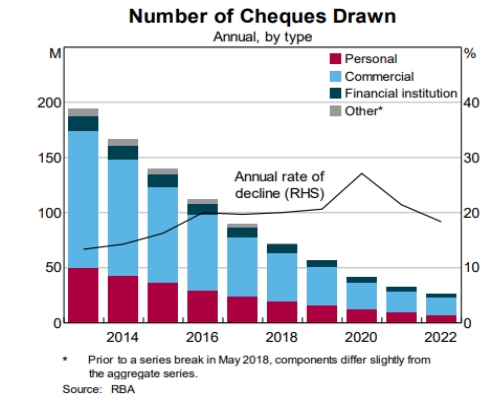

We want your priority for cost considerations, system reliability, support quality, contract flexibility, and feature availability. What factors are most critical for your business currently?

How Your Feedback Will Shape Our Development

Your survey responses will directly influence our approach to future EFTPOS integrations and determine which payment solutions we prioritise for development. It isn't merely a data collection exercise—your input will guide concrete improvements to our EFTPOS offerings for Australian retailers.

All responses remain confidential and will be used exclusively for service improvement.

Survey Completion Time

One minute!!!

We've designed the survey to take approximately one minute to complete.

Appreciation for Your Contribution

Your feedback will shape EFTPOS solutions that enhance efficiency, accuracy, and profitability for Australian businesses.

Thank you for partnering with us to create effective payment solutions.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.