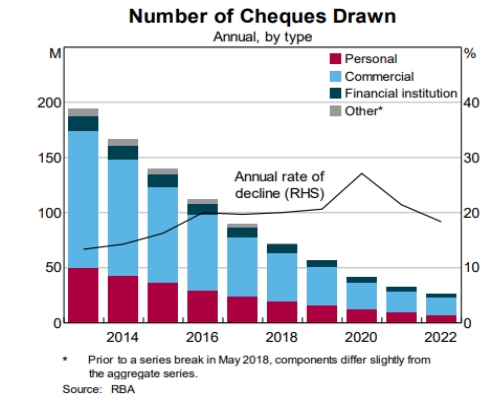

"I'm sorry, but we no longer offer cheque facilities on this account." Imagine the surprise when the Commonwealth Bank of Australia told a long-time client of mine this. I was stunned, yet it's a fact throughout Australia today. Cheque usage in Australia has fallen so much. In the 1980s, cheques were 85% of all non-cash transactions. Today, they make up 0.01% of total payments.

In 2023, Australians wrote less than one cheque per person a year.

The Generational Divide

It's not just the numbers changing; it's the people too. Here's a quick breakdown that might surprise you:

| Generation | Cheque Usage |

|---|---|

| Baby Boomers | Occasional |

| Gen X | Rare |

| Millennials | Very rarely |

| Gen Z | What's a cheque? |

It's not good for the cheque's future.

Cheques in Australia 2030: To Accept or Not to Accept?

Many retail Australian businesses no longer accept personal checks.

As a business owner, you might be torn. On the one hand, it's hard to refuse a payment if the customer is willing to pay, but it comes with risks. Let's break it down:

Pros of Accepting Cheques:

- Cater to older customers

- Rural areas with bad internet

- Avoid some processing fees, which is a huge problem as many of my clients sell low-margin items like lotto products.

Cons of Accepting Cheques:

- Risk of bounced cheques

- Time-consuming to process

- Time to get the payment into your account

- Potential for fraud (counterfeit, lost or altered cheques)

I had a customer whose chequebook was stolen, and it took a while to sort it out. If you have an old, unused chequebook, I suggest you destroy it.

Conclusion

The cheque's last stand is upon us, they are scheduled to be phased out in 2030. This doesn't spell doom for retailers as currently its use is limited.

The fact is that your next customer will be with a smartphone in hand, so make sure you can accept this payment method.