Your Rising Debit and Credit Merchant Fees

Rising debit and credit merchant fees are escalating costs for Australian businesses and consumers, with RBA data revealing steady increases since the COVID-19 pandemic.

As I've stated before, the current system is anti-competitive, inefficient, and unfair. This proposal will exacerbate it. Now I support debit as a default payment method, which is Labor policy, but this extends far beyond.

The RBA's figures paint a tough picture of the surcharge ban. Click here for their latest statistics. They assume competition and fee reductions will help SMBs absorb costs. But my analysis shows the RBA's figures show they are rising instead.

Fairness in Payment Defaults.

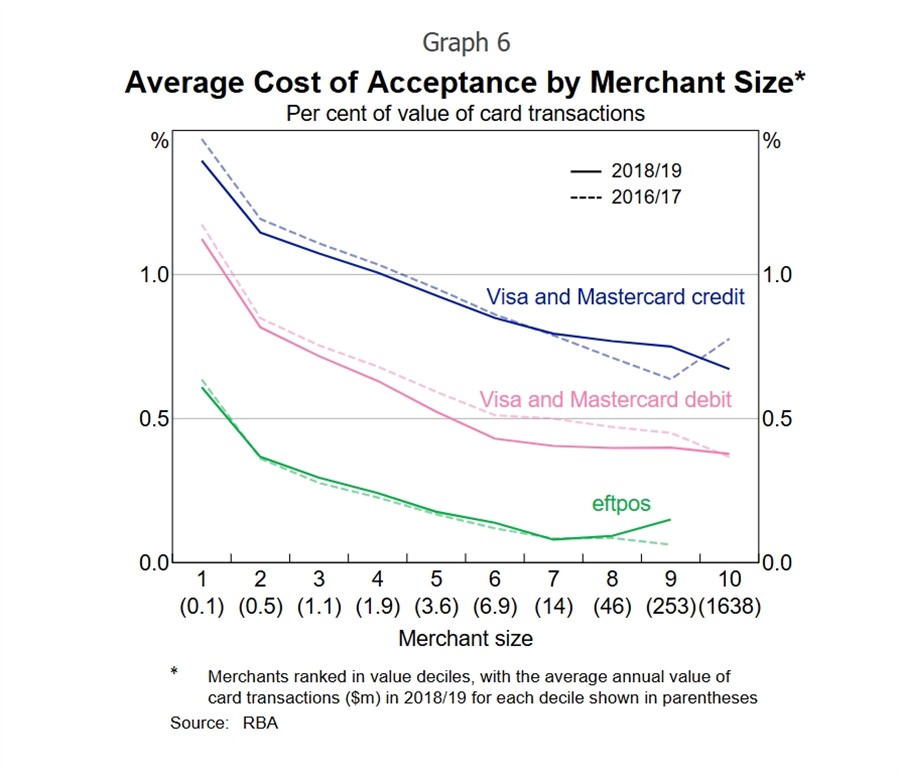

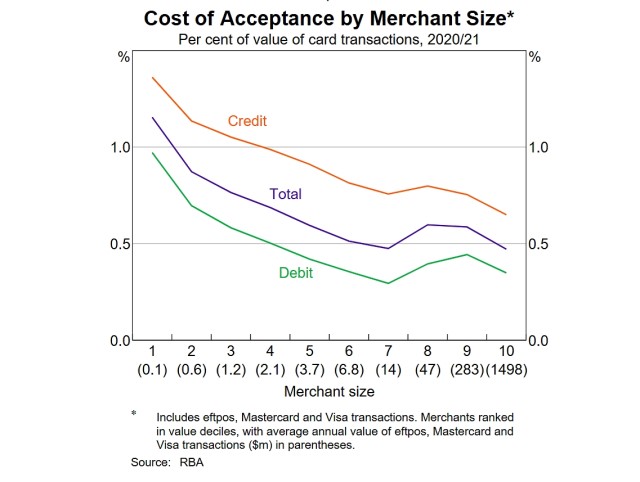

A key issue is fairness: Cash as the default equalises acquirer fees for all businesses, regardless of size. Switching to debit disadvantages smaller ones, as large organisations negotiate lower rates.

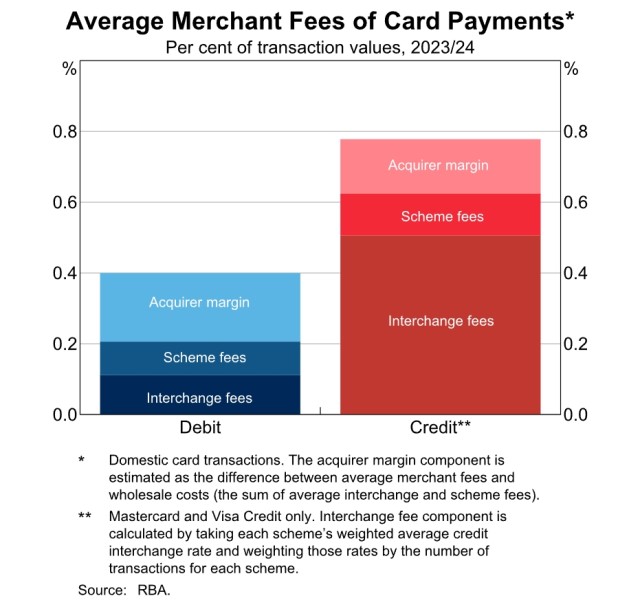

Card Type Fee Breakdown

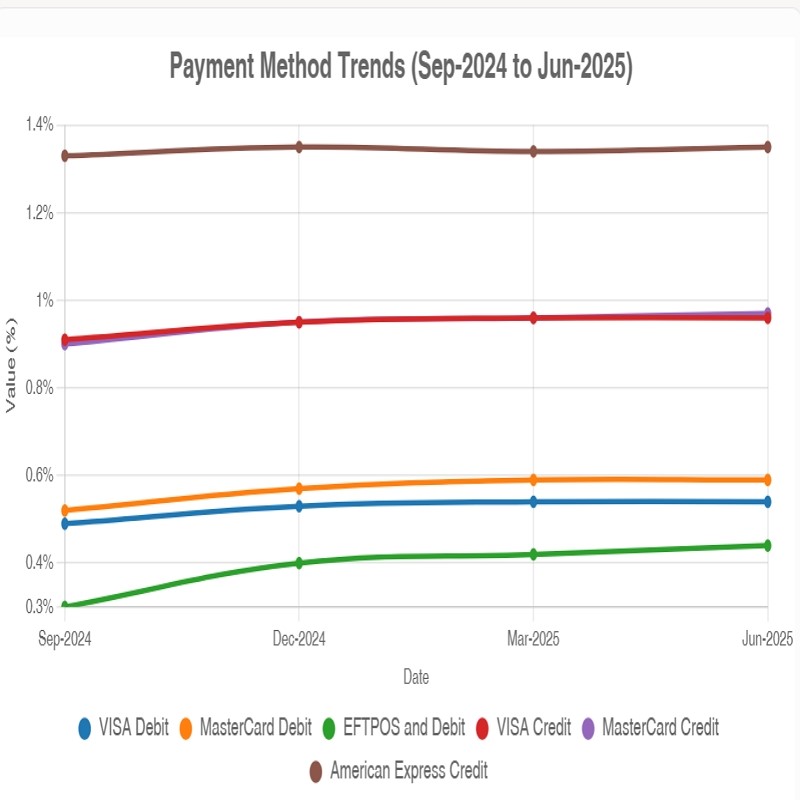

Let's start with the facts. The RBA expanded its merchant fee reporting in December 2024, giving us a clearer view of payment costs. By June 2025, check the table C3 Average Merchant Fees. It highlights increases in fees across the board. These are major blips, and part of a broader trend that's been going on since the COVID pandemic. Now I have gone over these figures, and this is what I can see.

Eftpos

These fees rose 10% in just six months, hitting 0.44% of transaction value. That's mainly due to merchant service fees climbing from 0.37% to 0.41%, while other charges like terminal fees stayed flat at 0.03% to 0.04%. Historically, Eftpos fees have fluctuated, but since December 2022, they've jumped from 0.26% to 0.44%, a 69% increase overall, which looks pretty high.

MasterCard and VISA

Debit fees went from 0.57% to 0.59%, and credit fees from 0.95% to 0.97%. Visa fees are a little better, but still up their debit fees now are 0.54%, and interestingly, their credit rate is held at 0.87%.

Other cards

It's no wonder that so many people do not accept American Express, as its credit fees are 1.35%, and Diners Club is even worse at 1.70%.

International transactions

Now these would hurt as Visa credit international fees are 12.6% from 2.47% in December 2023 to 2.78% by June 2025. If your store attracts tourists, these hikes will hurt.

This challenges the assumptions behind the proposed surcharge ban; interchange fees are only one of several fees, and these fees are going up. This is a big disconnect between policy and reality.

Given these rising fees and the RBA's disconnect from reality, here are practical steps to optimise your operations.

Practical Tips to Optimise Your Operations

Your POS collects transaction details, letting you analyse fee patterns. Compare them to RBA benchmarks. Review the figures, and if they are higher, take them to your providers. There is nothing wrong with you asking them, "My fees are above the 0.41% Eftpos average, why can't we adjust?" I've helped retailers save thousands this way.

Review your international cards. Many have, after doing this, either introduced a bigger surcharge or refused to accept them.

Support cash.

If you are in online sales, check your fees.

(This article draws from the latest RBA data as of June 2025)

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.