How Long Will Cash Remain viable?

Cash payments in Australia are disappearing faster than most retailers realise, with usage plummeting to just 13% of transactions by 2024. Cash usage is rapidly declining and will probably not be viable for many by 2030. We are now looking at a cashless society.

The shift away from cash represents both a challenge and an opportunity for Australian retailers. The question isn't whether this change will happen but whether your business will be prepared when it does.

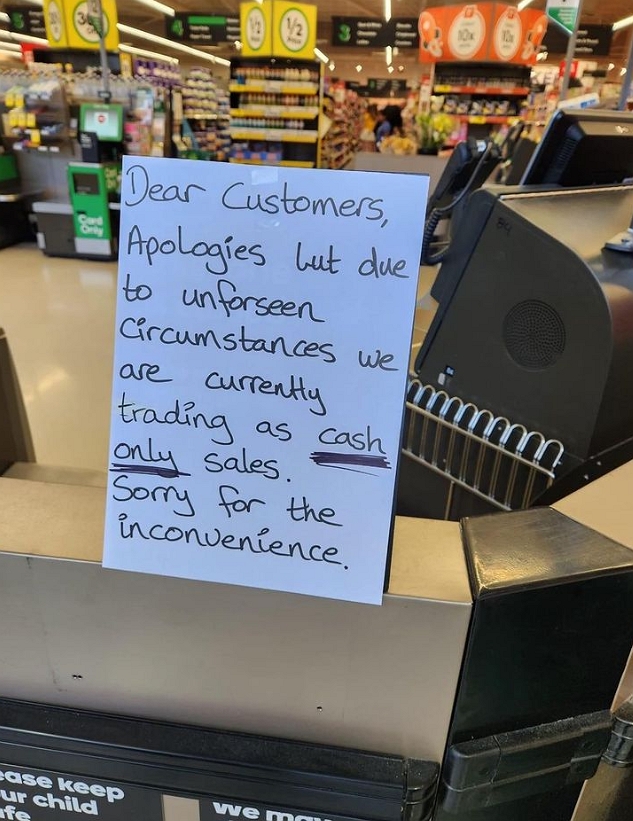

Recently, I attended a major conference that perfectly captured where Australia is heading with payment methods. At this two-day event with hundreds of delegates and speakers from both internationally and in Australia, I witnessed something that would have been unthinkable a while ago. On the first day, I went to pay for lunch with cash and had the exact amount ready. The cashier looked genuinely surprised and told me I was the only person to pay with money all day. Everyone else had paid with a card.

The second day was even more telling. I had a twenty-dollar note and needed change, but the cashier couldn't process my payment because she had no change. The organisers hadn't planned for cash transactions. It was a mainstream event, yet cash had become so rare that my usage caught everyone off guard.

This experience isn't unique anymore. It's happening across Australia, signalling a fundamental shift that every retailer needs to understand and prepare for the cashless society.

The Data Reveals the Scope of Change

The Reserve Bank of Australia's data paints a stark picture of cash's decline in our economy. Cash payments have plummeted from around 70% of all consumer transactions in 2007 to just 13% in 2022, and current data show about 10%.

The Australian Banking Association has projected that by 2030, cash will represent just 4% of all transactions. To put this in perspective, cash usage fell by over two-thirds between 2014 and 2024. It isn't just about younger generations preferring digital payments; the shift is across all demographics.

Infrastructure Changes Drive Payment Evolution

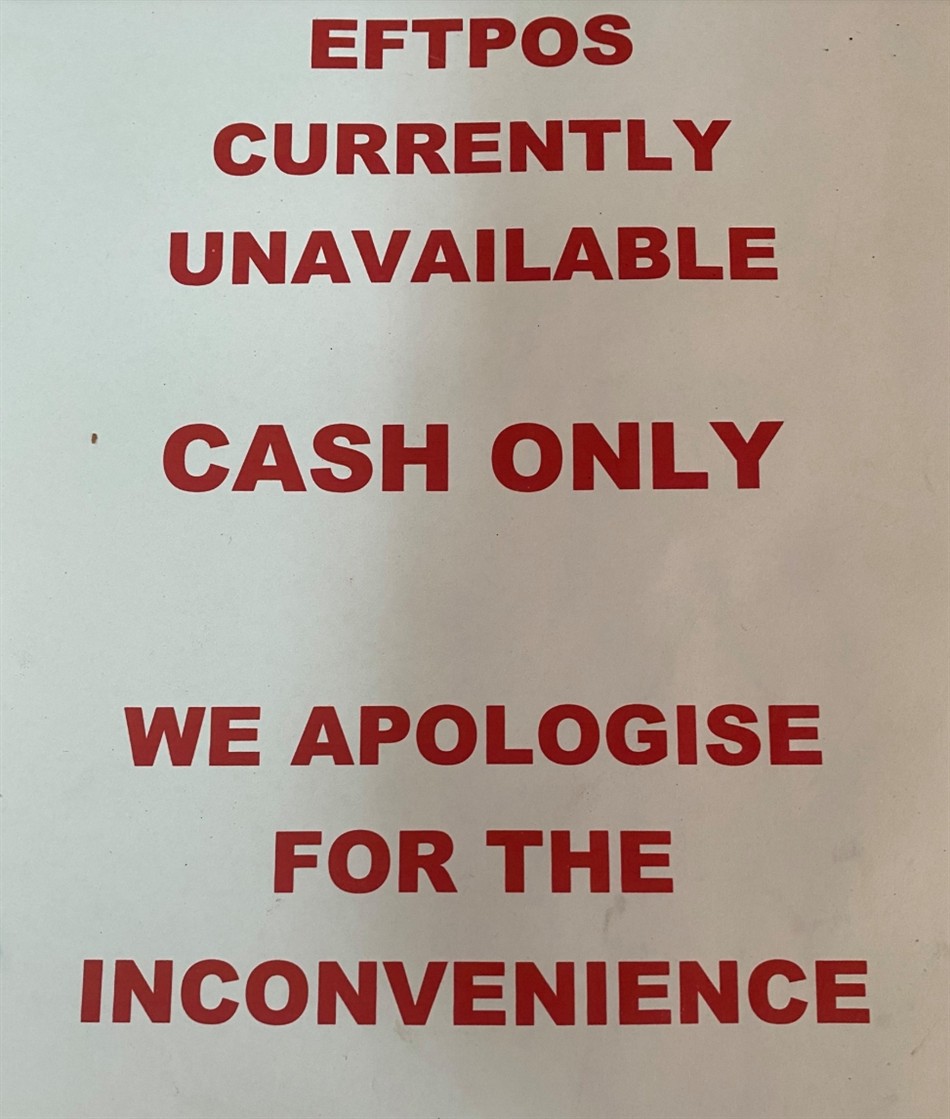

The conference experience I shared highlights a critical issue beyond consumer preference: the infrastructure supporting cash transactions is actively breaking down. Businesses are no longer equipped to handle cash because they don't expect it.

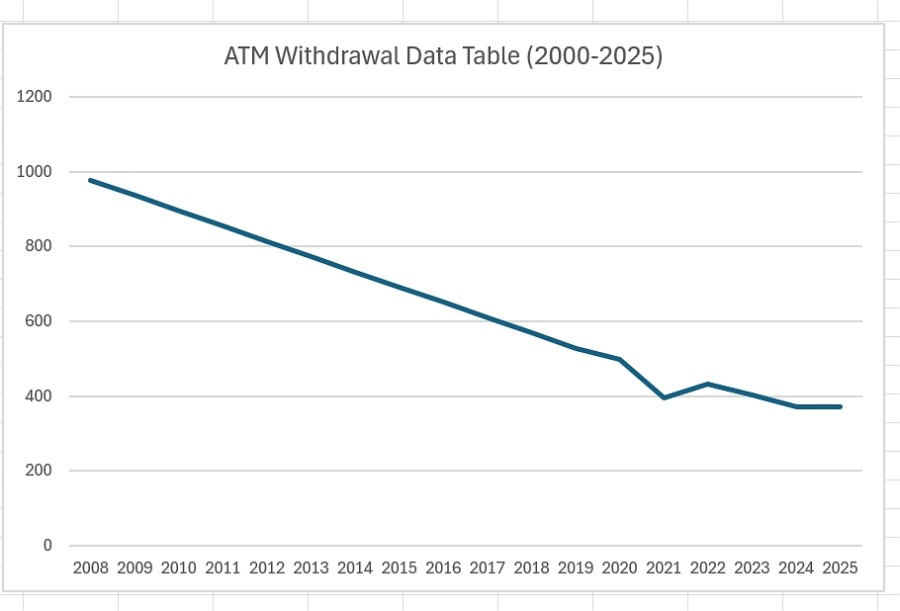

Bank branch closures have accelerated dramatically across Australia. The number of ATMs per 100,000 people has dropped by more than 15% between 2012 and 2021. If this decline continues at the current rate, the last will be switched off by mid-century. ATM withdrawals have crashed from 75 million per month in 2009 to just 28 million today.

It means your business's support system for cash transactions is actively disappearing. Even if you want to accept cash, your customers might struggle to access it, and you will find it increasingly challenging to bank deposits or obtain change for your tills.

The situation with Armguard, Australia's most significant cash-in-transit business, facing financial troubles earlier this year, demonstrates how precarious the cash infrastructure has become. When the company that moved most of Australia's cash around nearly went under, it exposed how dependent our remaining cash economy was on increasingly fragile systems.

Regional Considerations Present Unique Challenges

If you're operating in regional or remote Australia, your situation differs from that of retailers in significant cities. Cash usage remains higher in regional areas due to older demographics and less reliable digital infrastructure.

However, bank branches and ATMs are also disappearing fastest in regional areas. It creates a problem because regions where cash is needed most are losing the infrastructure to support it more quickly. Some communities are becoming genuinely vulnerable to further reductions in cash services.

Regional retailers might experience a slower transition from cash, but the infrastructure challenges are more severe. You might be one of the few businesses still accepting cash simply because your customer base demands it, while struggling to manage the practical aspects of cash handling.

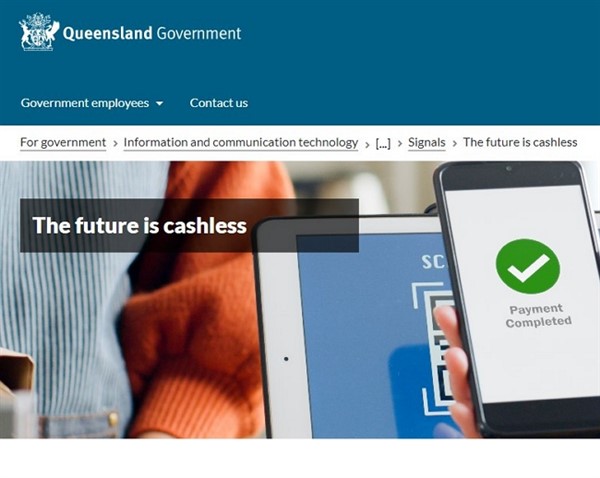

Government Mandates Face Market Reality

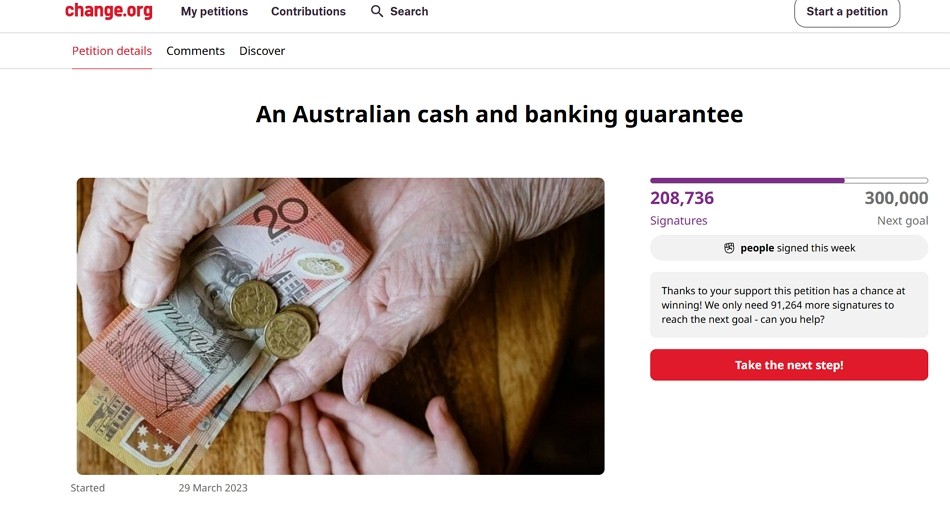

You've probably heard about the government's plans to mandate cash acceptance for essential items like groceries and fuel starting from January 1, 2026. On paper, this sounds like a lifeline for cash. The reality proves more complex.

The proposed mandate will apply to businesses selling essential goods and services such as food, fuel, and basic healthcare. Still, there's already discussion about exempting small businesses with an annual turnover of under $10 million. This exemption could cover many of the retailers reading this article.

The critical question remains: even if the government mandates cash acceptance, can it mandate the infrastructure to support it? Legislation can force a supermarket to accept your twenty-dollar note, but it cannot force banks, ATMs or cash transport companies to remain profitable.

The energy for serious legislative action has waned in Australia's political landscape since the failure of the recent cash-out day, which was seen as an informal vote on cash's future. Also, the government likely views the end of the cash economy favourably for many reasons: it's cheaper, easier to track transactions for tax purposes, and reduces the underground economy.

Business Implications Demand you make a Strategic Response

As a retailer, you're now in the middle of this transition.

The costs of handling cash are substantial and often underestimated. You need floats, extra insurance, time for counting and banking, secure storage, and regular trips to deposit some money. When businesses struggled during COVID-19, these inefficiencies became impossible to ignore. Many retailers discovered they could eliminate significant overhead by going cashless.

However, there's a flip side to consider. Recent surveys show that whilst digital payments are rising, Australian shoppers still want the option to use cash. More concerning for your bottom line, in-store debit and credit card fees are now the most hated fees among consumers, ranking even above ATM fees. The government's response to this pressure seems frightening: get rid of debit card fees and make retailers absorb these fees.

Technology Solutions Provide Competitive Advantage

Your point-of-sale systems have evolved to handle this transition seamlessly. Today's POS technology can efficiently manage multiple payment types, including various digital wallets and contactless options. It positions your business for the future while maintaining current capabilities.

Use its reports to determine your business's cash handling costs, including salaries, time, insurance, banking fees, and security measures. When properly calculated, you might be surprised at the real expense. In my experience, many retailers discover that the hidden cash handling costs shock them.

Strategic Timeline for Australian Retailers

Based on current trends and infrastructure changes, here's my assessment of the realistic timeline facing Australian businesses:

2025-2026 Period

Cash usage continues to decline.

Soon, large companies will be mandated to accept it, and many small businesses will receive exemptions.

2027-2029 Phase

Cash usage continues to decline.

Cash access is difficult in many areas as more banks and ATMs are closing. Businesses find compliance with cash mandates growing in cost and time.

2030 Transition Point

We have a cashless society.

Cash will reach the projected 4% of transactions. At this point, cash will move from a mainstream payment method to a niche service, similar to how cheques function today, still technically available but rarely used.

Beyond 2030

Cash persists only for emergencies and specific cases; mass acceptance effectively ends.

Practical Business Recommendations

We need to prepare strategically. Your approach should be measured and customer-focused. Most retailers I've talked to have told me they intend to keep cash going as long as their customers keep using it. I doubt it. As my experience at the conference shows, even though I wanted to use cash they could not accept it.

Assess Your Customer Demographics

If you serve predominantly older customers or operate in a regional area, you must maintain cash acceptance longer than urban retailers serving younger demographics.

Calculate Real Costs Accurately

Track your business's cash handling costs, including salaries, time, insurance, banking fees, security measures, and opportunity costs. One point often missed is that an electronic transaction is usually higher than cash, so keeping cash may cost you lost sales. Many retailers underestimate these expenses. Use your POS system's reporting capabilities to get precise data on transaction costs across different payment methods.

Communicate Payment Policies Clearly

Whatever payment methods you accept, ensure customers know before they reach the checkout. Clear signage not only prevents awkward situations and improves customer experience, but it's also often the law.

Conclusion

Your success in this transition depends on preparation, not resistance. By understanding the timeline, investing in appropriate technology, and developing a clear strategy, your business can thrive regardless of how payment preferences evolve.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.