Cash Out Day is tomorrow, 22 April 2025. It is a practical reminder that many Australians value cash as a payment. As digital transactions have surged, the movement to keep some money viable has gained real traction. Last year's Cash Out Day drove a 6.2% spike in ATM withdrawals and up to 14% increases in some shopping centres. Most people felt there was no need to withdraw cash unless they went to a place like a shopping centre where they could spend it.

It showed that many Australians still value access to cash.

Supporting Cash Out Day is not just about being opposed to technology (a Luddite); it's about ensuring that cash as a payment method is necessary for our community now.

The Evolving Role of Cash in Australian Retail

Cash usage in Australia has declined sharply. It now represents 13% of consumer transactions, down from 70% in 2007. This shift has created a crisis for cash as the infrastructure needed to support it becomes less viable, e.g. nearly half of all bank branches have closed since 2011, ATM numbers have dropped by over a quarter since 2016, and Armaguard has been struggling due to the dramatic decline in cash usage across Australia. It has been creating a potential crisis, according to the ACCC, for the estimated "one in four Australians who would face genuine hardship or major inconvenience without access to cash."

Does Cash Acceptance Still Matter for Your Business

Customer

The ACCC stated, "Cash is the preferred payment method for approximately 1.5 million adult Australians, who rely on it for over 80% of their transactions." By accepting cash, you ensure your business is accessible to these customers, too.

Financial Benefits

Often forgotten is that Cash payments offer immediate settlement. They eliminate the settlement periods associated with electronic transactions and avoid the processing fees that come with card payments. These fees average around 1.5% per transaction for SMB retailers. These fees are also unfair as they affect SMB retailers more than large retailers.

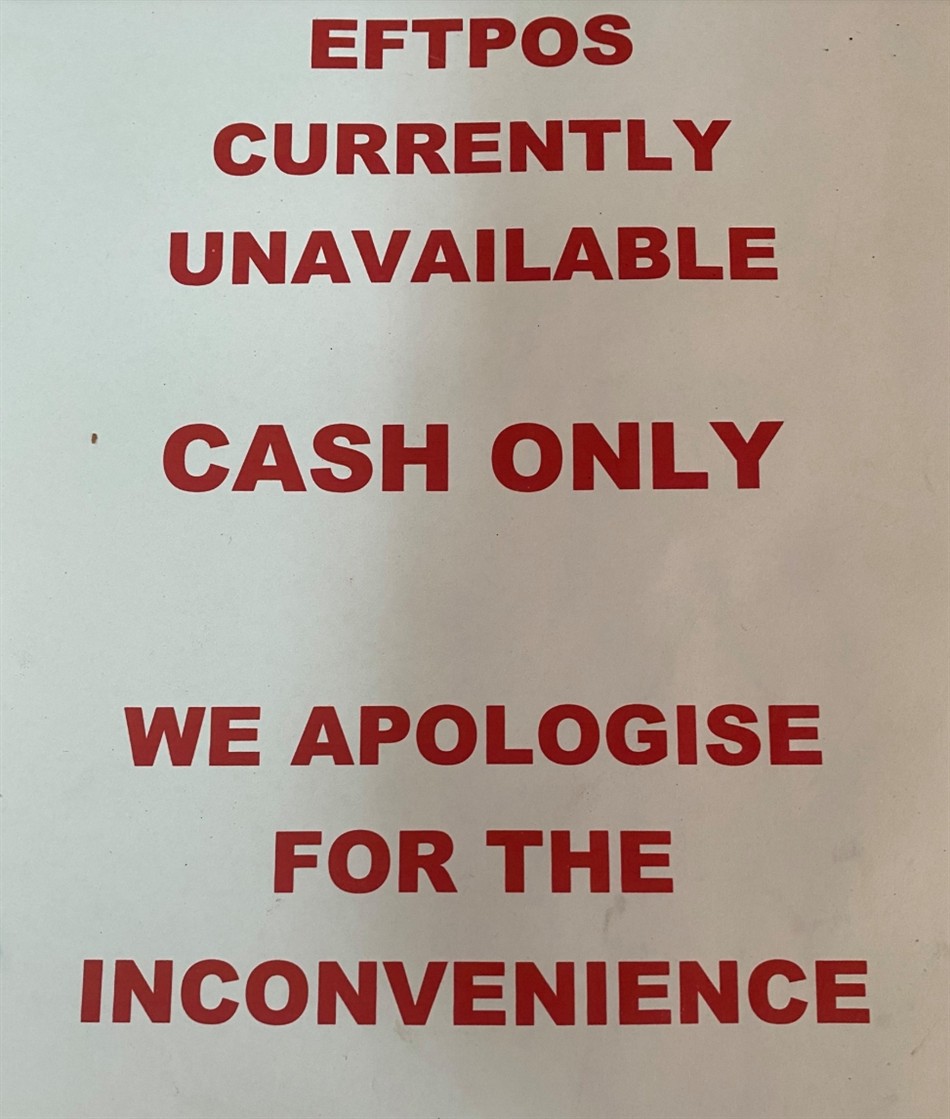

Additionally, cash provides operational resilience. Digital payment systems experience outages. I had a customer who lost over $8,500 when his EFTPOS went down for most of the day. Australia does not yet have the infrastructure to support a cashless society.

Regulatory Developments

The Australian Government has stated it recognises the importance of cash, but no one has seen it do much. Their recent proposal to force businesses to remove EFTPOS surcharges is unfair as it stands as they have not answered who is supposed to pay this cost. I doubt the goverment intends to pay it.

Practical Steps to Support Cash Out Day 2025

If you want to support Cash Out Day 2025 actively. Here are practical actions you can take to demonstrate your cash commitment:

Take some money out of an ATM

It is what the organisers want, and it indeed is, as you can see that this statistic has been widely quoted. Simply go and take some money out of an ATM.

Then tell your friends to do the same.

Display Window Signage

Put a sign on your shopfront stating "Keep Cash" or "Cash Welcome Here." This simple gesture signals that you value cash.

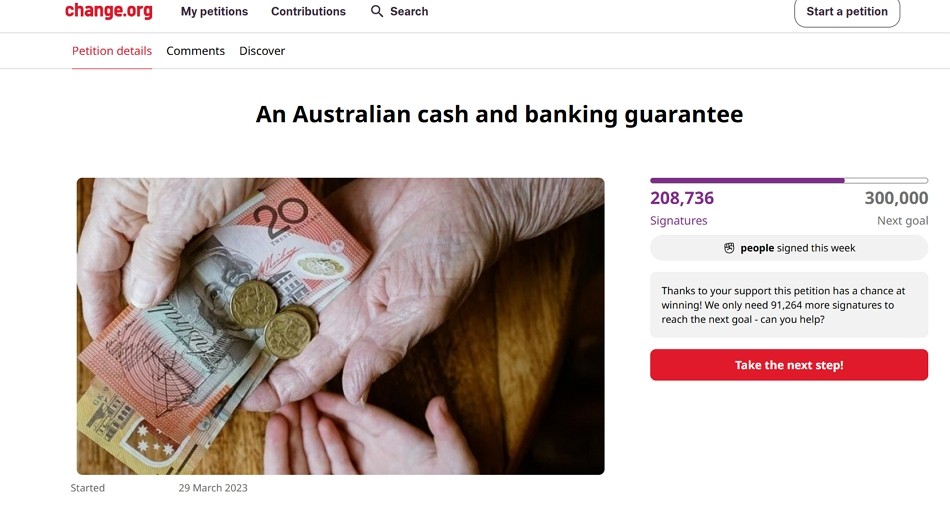

Sign and Share the Petition

The Cash Welcome campaign's petition has gathered over 200,000 signatures advocating for guaranteed cash access and acceptance.

Click here if you want to sign.

Create In-Store Promotions

Consider offering a small discount or bonus item for cash purchases on Cash Out Day. After all, many people will have more cash tomorrow and are looking for where to spend it.

The Future of Cash in Australia: Strategic Balance

While digital payments will continue to grow, I feel, and I hope you do, that cash will remain a vital part of the Australian economy for the foreseeable future.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.