GMROII is one of the best ways to determine how valuable your stock items are to your business. It is used everywhere.

What it determines is how much profit you make for your investment for each item in your stock.

Usually the equation is (unit sold) x (Profit)/ (Average stock cost)

As a rule of the thumb in retail, you need about 3.2.

Say we have two items A & B and we want to determine which is better.

Now item A sells 20 items a year at $2 profit, and you had six items generally in the shop that cost you $6.

The GMROII= 20 units x $2 profit /(6 on hand x $6 cost) = 1.1 which is pretty bad.

Item B, which sold 30 items a year at $1.5 profit, and you had five items generally in the shop that cost you $1.

The GMROII= 30 units x $1.5 profit /(5 on hand x $1 cost) = 9.0 which is very good.

In GMROII terms, Item B clearly is a better product.

To do these calculations with our point of sale software is easy although it does not quite do it the same because our system has exact figures.

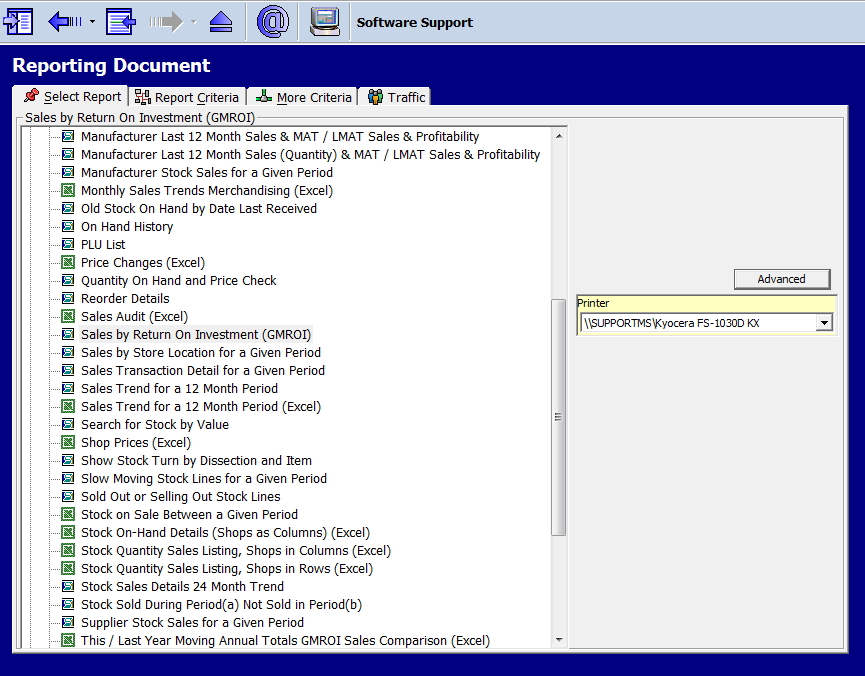

Now click on the selection highlighted in the reports here.

Select the list of options you want, initially I suggest you run a year, although there is no reason why you cannot run say last year's holiday season to see what best sold. It is best to do it by department. A common use is to organise magazines shelves' so the best magazines are in the top positions.

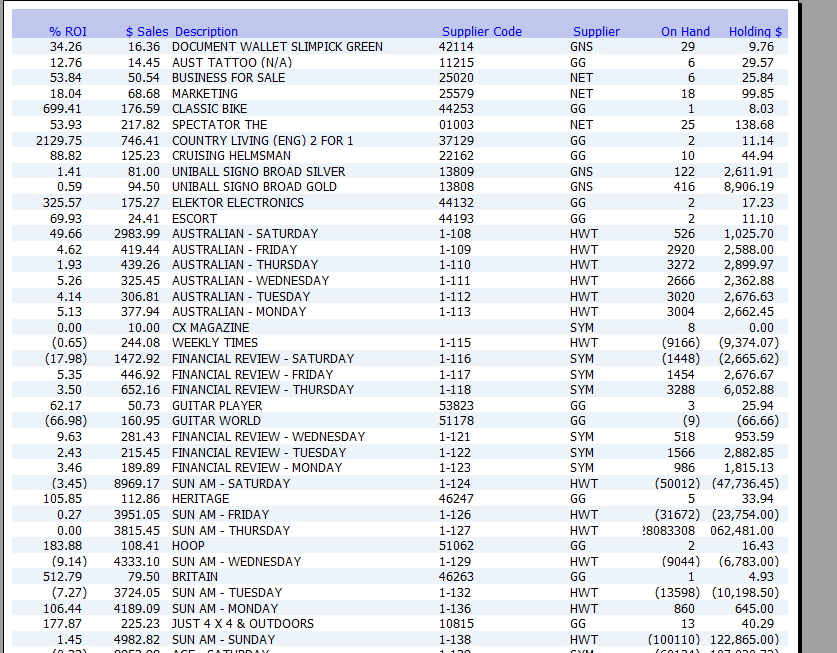

Then you will get a report like this.

As you can see the items are all listed.

One problem with GMROII, I had better warn you of is that items that you frequently run out of appear better than they are, this is because your stock holdings are artifically low. Another problem is that some stock which you sell little has a terrific GMROII figure, that is why we include sales and holding figures to tell you about these items.

Still with all its problems GMROII is considered one of the best tools in retailing.

Like always we need some intelligence when using it.