Smartpay is one of several Zero-Cost EFTPOS solutions that shift transaction fees from retailers to customers. Many of my customers use it.

I confess we have been wary of these systems. So have others, as you can read here.

Some issues

Government regulatory challenges

The Reserve Bank of Australia (RBA) has discussed restricting such fee payment providers. That could significantly impact Smartpay's revenue model.

Fees

Their fees seemed high compared to other EFTPOS suppliers, and we were dubious of the claim that customers would not care about these higher fees. Your customers are not silly.

Ransomware attack

They were affected quite dramatically; this is no minor issue if you deal with EFTPOS.

However, the immediate issue with them has been some recent market developments.

Market Position and Financial Performance

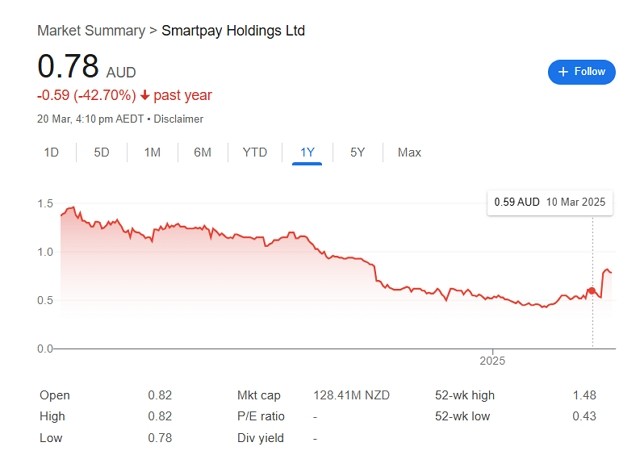

It is not just us who have been wary. Despite Smartpay's strong financial performance, its share price has dropped from $1.42 about a year ago to about $0.55 recently. This decline reflects the market's uncertainty about the company's prospects.

Well, now Smartpay has received a takeover bid from Tyro Payments. Tyro has offered to buy 100% of Smartpay's shares for 91 cents a share, subject to due diligence, promptly driving the share price up to 78 cents. The difference between 78 cents and 91 cents is telling, probably due to the uncertainty of due diligence.

Then, another international buyer appeared to make an offer, and what is stunning is that, with this news, Smart Pay's share price fell. Figure that out!

Implications for Retailers

If Smartpay is acquired, retailers might face changes in their EFTPOS services. While existing contracts may be initially honoured, new terms or conditions will be introduced. These changes could include adjustments to fees, surcharging policies, or even the functionality of the EFTPOS terminals. Tyro systems are very different from SmartPay.

Actionable Recommendations for Retailers

- Stay informed about Smartpay's developments and industry news.

- If changes occur, you must review your contracts.

- Prepare for potential fee structure changes by assessing their impact on your business.

- I would wait until we know what is happening.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.