Managing credit limits for individual customers is vital for reducing non-payment risks as a retailer. The correct settings in your point-of-sale (POS) software make it easy to control these limits.

Why credit limits matter

Credit limits help prevent customers from overspending and building up large debts that may not be paid back. They put limits on just how much money you risk on any customer. For businesses, unpaid debts can seriously impact cash flow and profits. Plus, it's not easy being a bank for your clients. Setting appropriate limits based on customers' payment history and general financial circumstances helps mitigate these risks. Implementing a line of credit system within your POS software can streamline transactions for trusted customers, enhancing their purchasing experience while maintaining control over outstanding balances.

Having control over limits within the POS also allows businesses to adjust amounts as needed dynamically. For example, a limit may be lowered if a regular customer recently pays slowly. Or it could be raised for long-term customers with an excellent repayment track record, as long as you can trust them more.

How your POS software can help

Our point-of-sale system gives you extensive control over handling and managing these credit limits.

To find it in your system, click on the main menu to customer > customer maintenance.

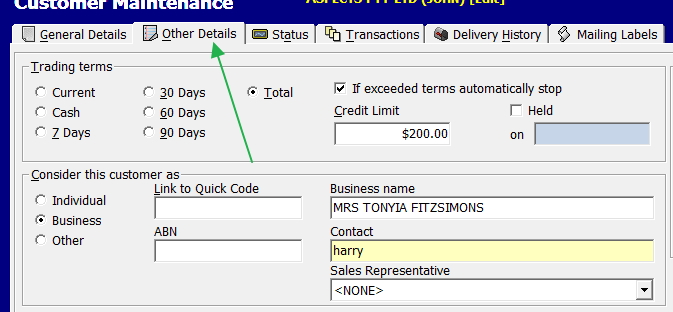

Now, call a customer and click Other Details. (See green arrow below)

Now, you can see trading terms and a question about what to do if a credit limit is exceeded. The answer is either to stop the account or warn you.

Now, what figures do you use for the credit limit? I am unaware of any precise method of allocating these credit limits. A simple policy that works well in retail is

1) Allocate customers into one of the three categories of credit risk (good, average, other) based on past paying history and gut feeling. Some, like the government, can be very difficult to determine here as they are almost always but not always secure, but they generally take a long time to pay.

2) Divide them up into sizable and small. A potentially large customer may need a decent credit limit to trade with you. Consider reducing the trading days for the credit limit. Unfortunately, reducing the trading days may be difficult as large customers tend to dictate their terms to you. You will get this: "This is what we do."

3) Divide them into low- and high-profit customers, e.g., a customer who buys agency items generally because the margins are so small that you may not be prepared to give a credit limit.

It gives you twelve groups to make theoretical dollar limits.

Here, it's crucial to consider Credit Limit Aging. All things being equal, a person who wants longer terms should have a lower credit limit for all things being equal.

Now, consider their trading history when setting up your limits. Beyond setting standard credit limits, our system allows you to make temporary limit adjustments for exceptional circumstances. This feature is handy when a long-term customer needs to make a larger-than-usual purchase or if a short-term event may increase their requirements. A common trap here is that once that period is over, the new customer's limit is not reviewed. Review it.

It's also crucial to consider Industry-Specific Considerations. Specific industries operate with their unique payment norms and terms. These variations can significantly influence how you approach credit limits. For example, industries such as construction often have longer payment cycles, and payment practices are usually subject to contract terms. It has nothing to do with you, but the builder does not have the money as he argues with his customers.

From my own experience, I have found that, while car dealers are generally reliable in eventually paying their debts, the time it can take to receive payment is a concern. While I have never had a car dealer not eventually honour their debt, I am now cautious with these customers when allocating credit limits.

Generally, I suggest you stick to your limits unless you have a particularly pressing reason to change them.

Comprehensive reporting

Our POS system offers robust reporting capabilities to help you effectively manage customer credit limits. We provide a report showing customers currently at or over their limits, which is essential for prioritising accounts needing immediate attention. This report allows you to quickly identify customers who are approaching, at, or exceeding their credit limits. It will let you focus on accounts that need immediate follow-up, such as contacting customers to discuss payment options. It also helps you understand which accounts are consistently over the limit.

In addition to monitoring individual customer limits, I suggest you run a report of credit limits to give you a feel of just how much credit you are proposing to give in total. A beneficial exercise is comparing your total credit limit to your actual amounts owing across all customers to see the actual exposure. These provide valuable insight into your overall credit risk and your total risk exposure. This analysis lets you understand your total credit risk.

Furthermore, run the reports with different months to give monthly trend information, which allows you to see how your total credit is going.

Putting limits on work

One newsagent recently shared her experience using credit limits: "Being able to set spending caps for each customer in my POS has saved me so many headaches. I got tired of always having to chase some people for payments. Now, the system warns me before limits are exceeded and reminds slow payers to clear their balances. It's given me much better control over cash flow and credit risks."

Overall, once implemented, the number of unpaid invoices will go way down, as most people will pay on time if you don't let their balance get too high or drag out too long.

Periodic Review

A well-organised organisation should review all clients periodically, generally every year. I am not aware of any company that waits two or more years longer to review its clients.

Another tip.

It is better not to share your credit limit amount with your clients. Once they know this limit, many clients will hold off on payments until they are reached. Another problem is that there is no way to see how a client will respond to your assigned credit limit in advance. Some get offended if they feel it's too low.

In summary

With our POS system, retail businesses can benefit from managing credit limits granted to customers. It protects both you and your customers from unwanted disputes. Take the time to ensure your system has robust credit limit controls to streamline operations and boost your bottom line.