The "Buy Now, Pay Later" (BNPL) market has boomed in Australia, and we are now the world leader in adopting this payment method. With the proposed changes to BNPL rules, retailers might wonder what will happen to BNPL. As a decent user of Zip and talking to my clients, here are my thoughts.

The Good Stuff

Well, the upcoming laws will focus on protecting consumers. That's great news for the consumer! It will offer the consumer clearer terms, an easier way to sort out disputes, and protection from excessive fees. The proposed consumer-friendly legislation would make BNPL even more attractive to the consumer.

Happier, More Confident Customers

I am sure that customers will think they will get what they're signing up for and feel safe using BNPL, which will lead to more customers wanting to use it.

Inflation

Inflation is now pushing people BNPL. Do you see inflation going down significantly shortly? I do not.

A Booming Market

Analysts seem to think that BNPL has a strong future ahead of it. They predict a massive 14.8% growth in 2024 alone! That's a vast pool of potential customers, many of whom I am sure would be willing to spend time in your store. Here are some predictions.

- Exponential Growth: BNPL payments in Australia are expected to reach a whopping $25 billion in 2024.

- Sustainable Growth Trajectory: The BNPL industry in Australia boasts a strong medium—to long-term growth story, with an expected Compound Annual Growth Rate (CAGR) of 9.6% from 2024 to 2029.

- Rising Gross Merchandise Value: Australia's BNPL gross merchandise value is estimated to climb to $40 billion by 2029.

Importance for Retailers

Here's the kicker for retailers: most of this BNPL market is spent in the retail sector.

A Wider Audience

BNPL attracts a diverse range of shoppers. By offering BNPL, you tap into this wider audience and increase your chances of making a sale. Bonza!

Catering to Inflation-Driven Demand

Inflation is a reality now, and people are looking for ways to stretch their budgets. BNPL offers that flexibility, making your store even more attractive to cost-conscious shoppers.

Potential Challenges to Consider: Fees and Administrative Burdens

While this picture for BNPL looks promising, there are potential challenges to consider:

Stricter Lending Criteria

The new rules will force BNPL providers to be more selective, potentially excluding some of your customers from accessing BNPL options. This could lead to a reduction in your overall sales volume.

Higher Fees for BNPL Providers

The extra work involved in checking creditworthiness and complying with regulations might lead BNPL providers to raise their fees. While they might absorb some of these costs, I am sure most of these fees will be passed on to you, the retailer. Like everything, you will need to monitor this situation.

Embracing the BNPL Opportunity

Despite potential challenges, the BNPL market is here to stay. I think we can expect it to grow significantly.

-The merchant͏ does not have to ͏wait to get paid.

-BNPL often͏ restricts products th͏at can be sold.

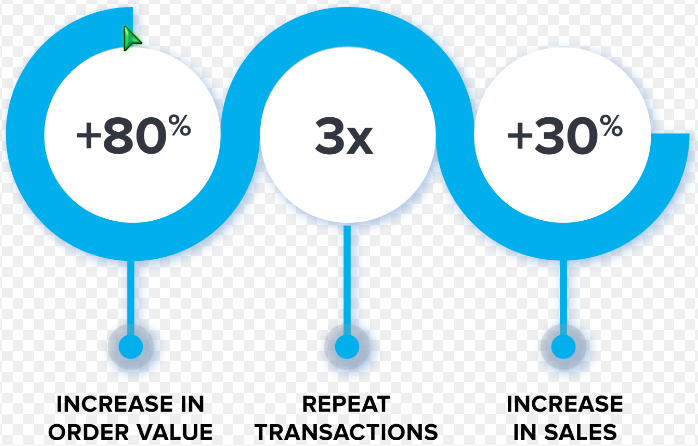

-BNPL promotes merchants, giving them customers they would otherwise never get. Plus, a BNPL buyer tends to be a good customer. A study showed that a shop before and ͏after it accepted BNPL. To the retailer, it gave many customers that they would otherwise not have had as the BNPL did extensive marketing to their customer base. Their market base is over a million people. It did increase customers' basket size, as a typical sale for a ͏BNPL is about $150,͏ which is well above most of my clients' average basket sizes.

Here ͏is an analysis of customers shopping͏ before ͏the͏y went to BNPL and after ͏in the same shops.

Now, whether to embrace BNPL or not is the question.

The BNPL company takes about 5% of the merchant's sales. BNPL generally does not allow merchant administration fees to cover the cost. Items with meagre margins cannot be offered with BNPL. So it would help if you did your figures. Any item sold using BNPL requires a decent margin to cover the fees, or you need to introduce a merchant fee, which may not be possible under BNPL's terms of use.

I suggest partnering with a reputable provider, such as Afterpay or Zip. This will allow you to access their huge customer base. I think this is the mistake many retailers made by partnering with small BNPL providers and then wondering why so few people use it in their shops.

By understanding the BNPL market and adapting to its changing landscape, you can position your retail business to capitalise on this growing trend and cater to the evolving needs of modern consumers. It is not going away soon.