This is what our POS System uses, and I strongly suggest that even if you use other POS Software (some that are wrong here), use these terms instead.

The problem is that there is no standard in retail accounting. Many suppliers take advantage of this and attempt to confuse people to better present their products; 100% markup sounds better than a 50% margin. This has created significant confusion. Even experienced retailers with years of experience muck them up. So please pay attention, even if it feels like I am telling you how to suck eggs.

Retail Price (RP)

Retail Price is the price you offer to sell an item.

Recommended Retail Price (RRP)

This is the Retail price that a supplier suggests you sell their items.

In some states in Australia, in some cases, you cannot sell the item for more than this Recommended Retail Price. If the Recommended Retail Price is too low, this will present a problem.

Cost price

Cost price is the amount of money a business spends to buy an item, including all costs, such as transport. This varies. It depends on factors such as buy rates, delivery costs etc. This is why a supplier's cost price to you can be very different to your calculated cost price.

You must fully calculate the cost price to price your goods correctly.

Margin vs Mark-Up

I will use this example, as both are generally calculated as a percentage to explain this

You sell an item for its Retail Price of $40.

This item's Cost Price is $30.

Markup

It is calculated from the Cost Price and is how much more the Retail Price

[ (Retail Price)/(Cost Price)-1] x 100%

=[ $40/$30 -1 ] x 100%

=33%

Margin

The reverse

It is calculated from the Retail Price and is how much more the Cost Price

[1-(Cost Price)/(Retail price)]x100%

=[ $30/$40 -1 ] x 100%

=25%

I recommend that you only use margin to be consistent throughout the shop.

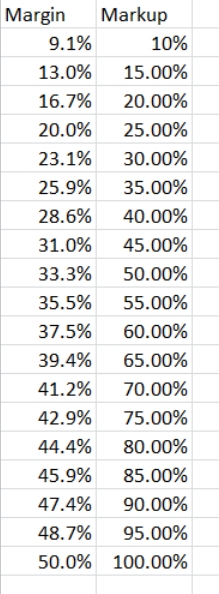

Here is a table for you to get the margin from a quoted markup quickly.