There seems some confusion over when a receipt must be issued. So I decided to check on behalf of our clients.

In some places eg Victoria under consumer law it states that a receipt must be issued if the transaction is over $75 EX GST, which is where people are getting confused.

So if someone purchased $80 worth of goods in Victoria, the merchant would probably be okay under Victorian consumer law not to issue a receipt.

However, if they purchased the same $80 worth of goods in QLD, the merchant is required under their consumer law to issue a receipt as it is over $75.

However, in all of Australia, the retailer under ACCC is required on all sales over $75 to issue a receipt

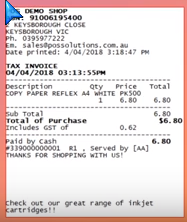

So I think that our software is correct.

You need to issue a receipt if someone purchases over $75.

Another point to consider here is that regardless of the amount, all state consumer laws and the ACCC agree that a receipt must be issued on any transaction if the customer demands one.

I hope this clears up the confusion.