Many of my clients use financial advisors every year. So we have worked with a few financial planners on behalf of our clients. So the information they need is in your POS system for your shop.

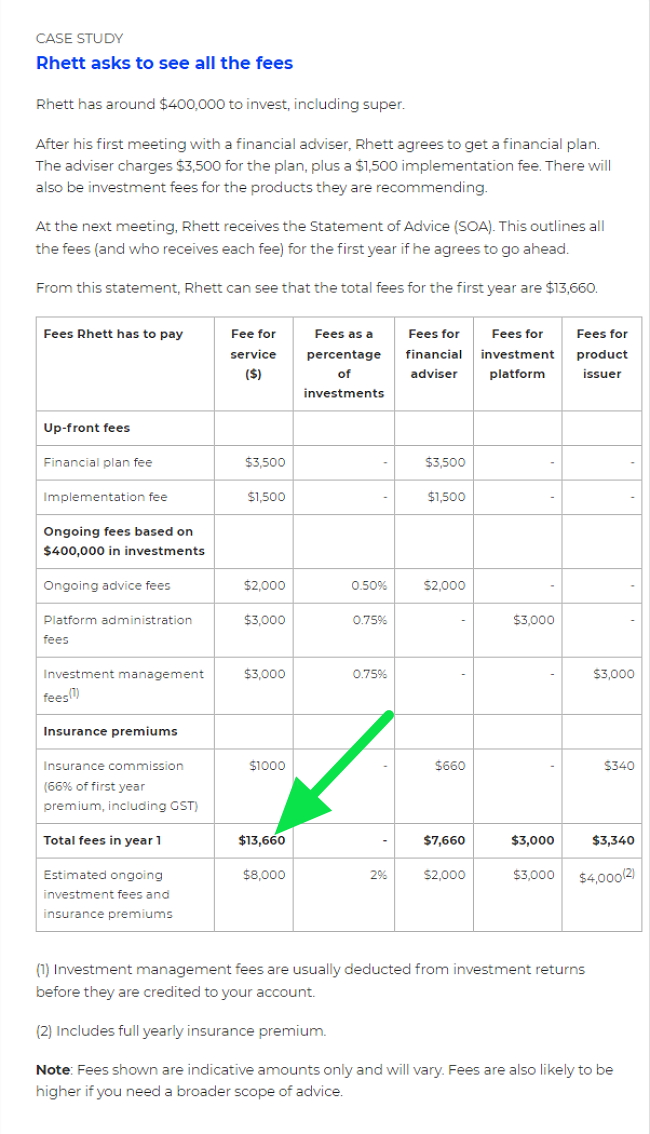

Generally, the cost is between $1,500 and $3,500 a year; yet it can be more. For example, here. Look at the case study below and see the green arrow pointing to the first year fee.

That is $13,660 initially and an ongoing fee per year of $8,000. That is a lot of money on a personal $400,000 investment fund.

There are several reasons why the cost is so high. Part of the reason is that it takes almost as much effort to do a plan of $400,000 as it takes to do one of $4,000,000. The items, decisions and complexity are similar, and all that changes is the amounts. This is a typical problem in accounting.

But the other reason is the time taken by the financial planner to put together the plan. You go to them and say you need this. They then request a heap of information. You then hunt for the information, put it together, and they then examine this information. They interrogate you for clarification, then, as sure as day follows night, they ask for more information, so you have to hunt around for some more documentation, supply it, and only then can they start. Most of the time is spent collecting the information, not doing the actual work.

The result is that you pay much more than you should.

I will give you a personal example of how the price can spiral. I paid $1,500 for a financial plan, which I did not want, but I had to get one for taxation reasons. Then, after paying that, I received another bill of $500 to pay the accountant fees used in the plan. Then, after paying the accountant fees, I found that there were two entities involved, so the other had to be done too. Then it was announced that this was a yearly fee. So a one-time fee went from $1,500 to $4,000 yearly, which was stated as a very cheap fee. I felt that there had to be a better way.

I knew that I could save a lot by being organised and doing much of the job myself.

So I looked at a few online tools. I generally found them of limited use, more for amusement than helpful.

Then I found one I liked "projection lab."

It a professional online tool. You enter in the information. Since its only me, only I have access to the information. Then I could then experiment with it and so model my financial future. I know what I put in will not precisely match real life. But it's better than a vague concept in my head. Plus I can ask it questions and decide what I like about the consequences.

It had enough functions for me but I suppose as I learn more, I will use more. for now its fine.

Best of all, my accountant told me that it should be acceptable for the ATO for my purposes. Of course, if I had to go to a financial planner, I would be better organised as most of the information would be on hand for them.

It is free, so give it a go. At least if it does not work for you, you will have a better idea of what you need.

Let me know how it goes for you.