Implementing effective end-of-day POS procedures is crucial for retail business owners to maintain accurate financial records and improve operational efficiency. I will walk you through some end-of-day options, helping you gain valuable insights from your daily sales reporting.

End-of-Day POS Procedures

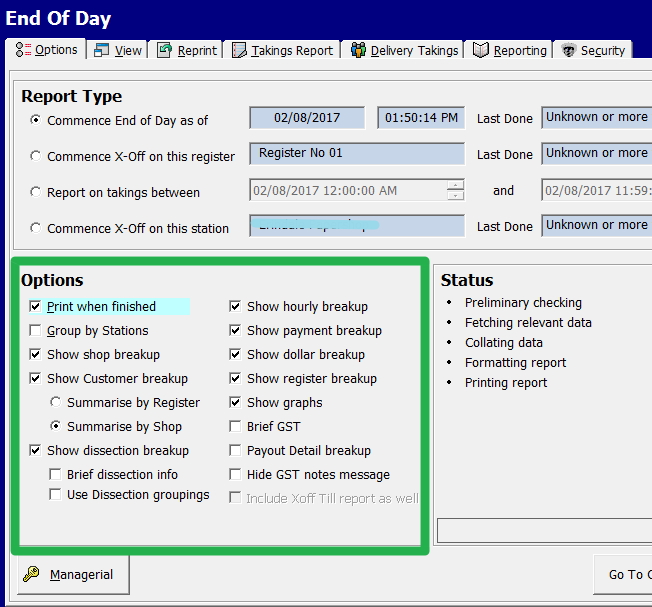

I highlighted those I set up if I am setting up a typical POS system.

- Print: You need to print and store it in case you are audited.

- Customer Breakdown: Analyse customer transactions to identify trends

- Dissection Breakup: Review sales by product categories to understand top-performing items.

- Hourly Breakup: This allows you to examine sales patterns throughout the day.

- Payment Type Breakup: Track various payment methods. They can be cross-audited if you require a check on many of these payment types.

- Register Breakup: Compare performance across multiple points of sale. I find this useful to know.

- Payout: Record any cash paid out for expenses or refunds.

- Show Graphs: Visualize data for quick insights and trend spotting. Experienced retailers, after a while, drop this option.

FAQ

Q: How long does a typical end-of-day process take?

A: With our efficient POS system, the process should take 10 to 15 minutes, it can go up astronomically if something goes wrong.

Q: Can I automate any part of the end-of-day procedures?

A: Yes, but I do not recommend it. The closer you are to the event, the better you can investigate if something is wrong.

Q: How often should I perform these procedures?

A: Every day

Q: What if my cash drawer doesn't balance?

A: Investigate discrepancies immediately. Check for misplaced receipts, incorrect change is given, or potential theft.

By mastering your end-of-day procedures, you'll gain better control over your retail operations, improve financial accuracy, and make more informed business decisions. Remember, efficient POS system closing is not just about balancing the cash drawer – it's about leveraging data to drive your small business forward.