What the NSW Government has recently introduced is a mandatory minimum expiry period of 3 years for gift cards and gift vouchers sold to a consumer in NSW from the 31 March 2018. They have also banned any post-purchase administration fees e.g. account keeping fees or telephone enquiry fees but from our understanding, not processing fees so say I have a $100 voucher, and for you to implement it you have to go to the bank and incur a bank fee, the bank fees are an acceptable charge.

Although this is in effect in NSW now, it will almost certainly flow on into other states.

All this I feel is fair enough as a consumer and as a business owner.

However, the next question is does it affect discount vouchers that you have issued.

Discount coupons are when you offer your customer an immediate discount on the next purchase, based on the current purchase. Its supporters claim it encourages people to buy immediately its detractors argue that it is turning full price customers into discount shoppers.

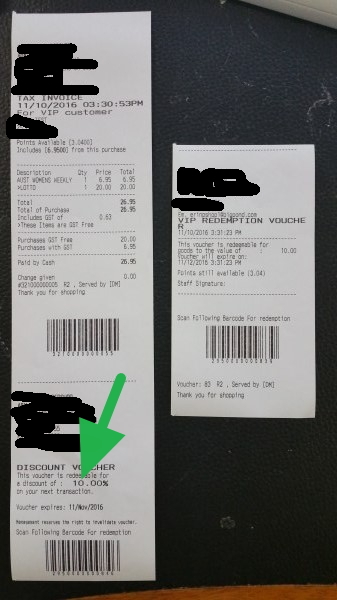

Here is a typical example of a discount voucher, see the bottom of the receipt

Note the date of the receipt is 11/10/2016 and to claim the discount voucher it needs to be claimed by 11/Nov/2016 which is a one-month redemption as the retailer does not intend that the offer be available for the next three years. The retailer wants an instant sale.

Now the NSW law changes say that they only apply to gift cards that are sold and it excludes explicitly cards that have not been sold, such as donated cards or unsolicited discount vouchers handed out on the street. I am not sure if they are donated, but they certainly are not "handed out in the street".

Now if a discount voucher is issued to every sale in the normal course of events, surely it can be argued that as its a standard business practice of that business. It is a term of the transaction that all parties expect and so should have a three-year expiry date too. So I should get my 10% discount if I show up anytime in the next three years. Now here is a real kicker of a question, what if the business has been sold in this period, do the new owners have to honour this voucher too? I think it this is true; the business would have too if it is sold as a going concern. If they do have to accept it, does the old owner have to pay for it, maybe?

So we have asked for clarification on discount vouchers.

I would certainly check this all out if you are affected by consumer law in NSW, for those outside of NSW, it is indeed food for thought now.

Note: I am not a lawyer, and this is only my view.