Just when I thought, we had discovered every type of POS fraud, we discovered a new one.

I've encountered numerous voucher fraud schemes. Here is a cunning fraud method for using discount vouchers, exploiting customers' standard behaviour of discarding receipts.

Understanding the Retail Fraud Scheme

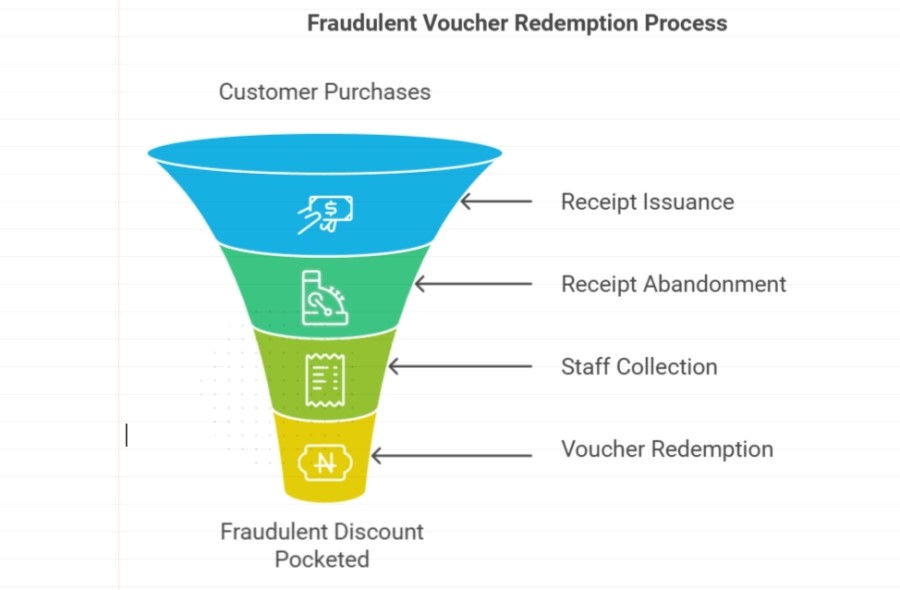

Here's how the scam operates:

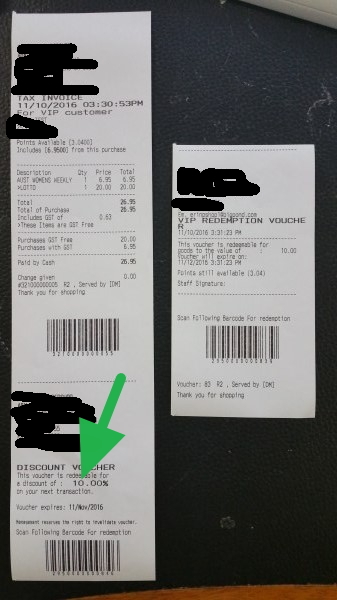

A discount voucher is an offer on a receipt for the customer to claim money on their next purchase instantly, encouraging them to buy more. It is a thriving, though expensive, loyalty program. The voucher is issued on the receipt.

- Customers make purchases, and receipts containing discount vouchers are issued.

- Many customers do NOT collect this receipt.

- Dishonest staff collect these abandoned receipts.

- They process subsequent transactions using these vouchers for customers who do not collect their receipts.

- The discount value is pocketed rather than passed to new customers.

The process looks like this.

The Financial Impact

From my experience implementing POS systems across Australia, I have seen that the potential losses for discount vouchers can be substantial. For example, percentage discounts of 10-20% could lead to monthly losses ranging from $500 to $1,000, while dollar-value discounts between $5 and $50 might result in losses between $1,000 and $2,000.

Preventing POS Fraud

To protect your business from similar incidents, consider implementing these strategies:

Staff Training and Monitoring

Educate your employees regularly about ethical practices and the consequences of fraud. Implement strict receipt handling protocols and conduct regular transaction audits to ensure compliance with company policies. Use cameras to look at the tills.

Leveraging Technology

Here is what I suggest: Transaction Monitoring Monitor duplicate receipt printing Analyze loyalty program usage

By implementing these comprehensive security measures, businesses can significantly reduce their vulnerability to POS fraud while protecting their revenue and reputation.

Real-World Example

I was consulting with a newsagent who was happy with the discount vouchers till we discovered they'd lost over $3,000 in the past few months through this scheme. The employee claimed the discount voucher from customers who still need to collect it. Their experience taught us that even small businesses aren't immune.

Conclusion

Fun fact: Employee theft accounts for 24% of retail losses.

Fraud prevention isn't just about sophisticated POS software. The problem here is the person using the POS system knows it very well. Possibly better than you. It's about understanding human behaviour and creating systems that protect businesses and customers. It's crucial to foster a culture of honesty and accountability among your team. By combining advanced POS features with strong ethical standards, you can safeguard your business against fraud.