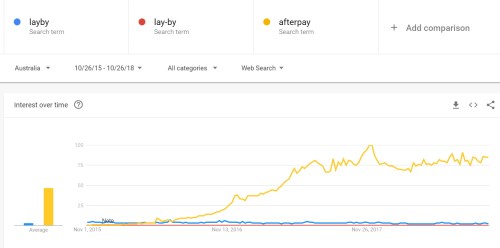

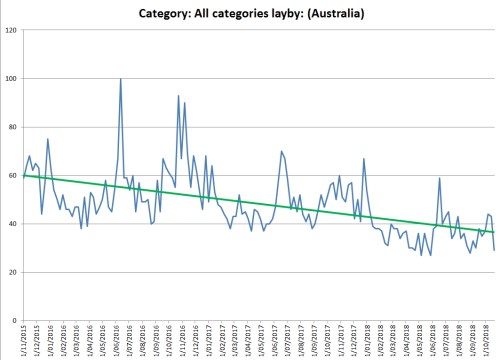

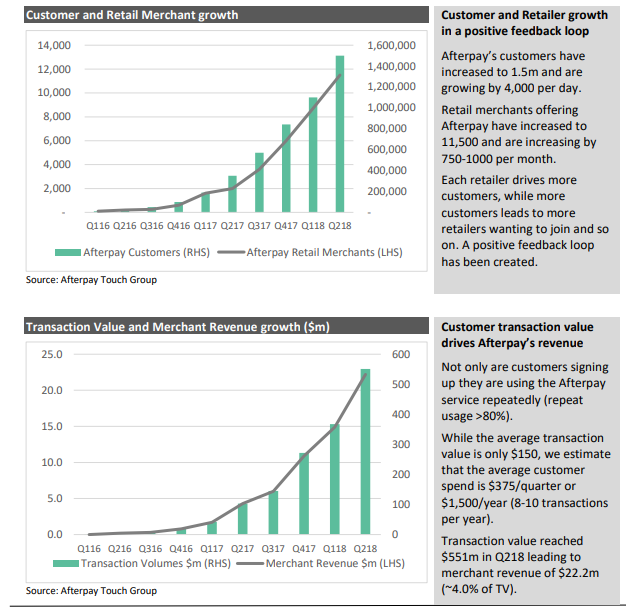

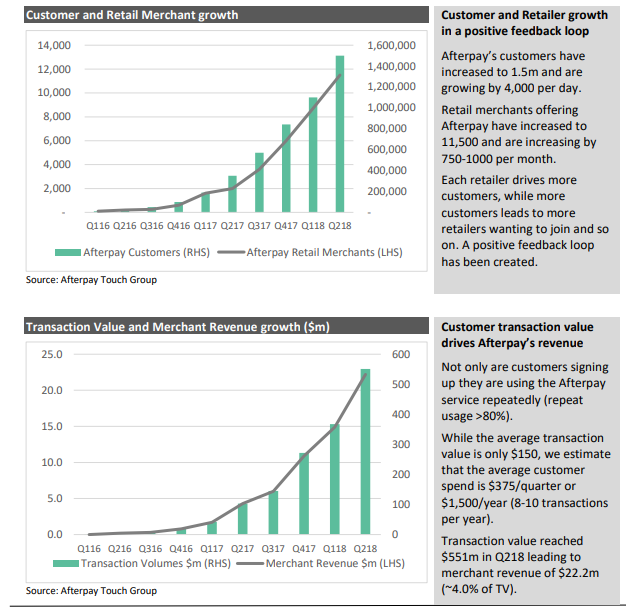

Now about 2 million Australians shoppers use a "Buy now and Pay later" service. That is a lot of shoppers. Because it fills a need, the growth has been explosive.

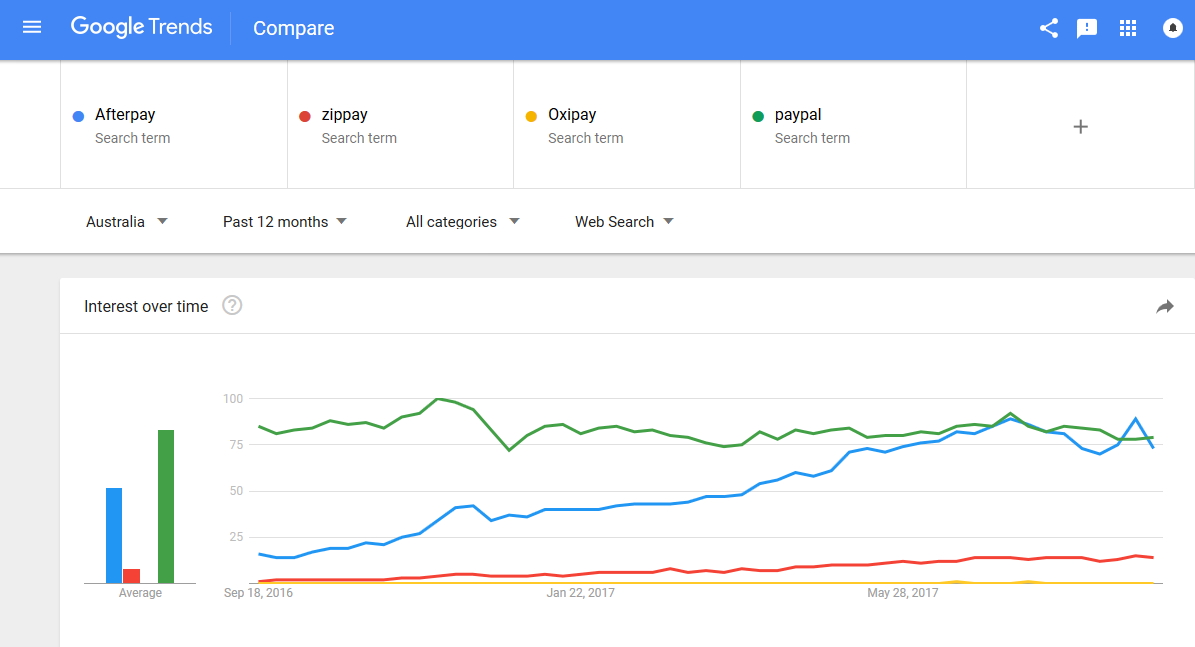

This market is dominated by two big players Afterpay (who are the biggest) and Zip who between them have probably about 98% of the market and a number of smaller and often more specialised ones having the rest if you want to know more about this check out this report.

Here is a graph from the report.

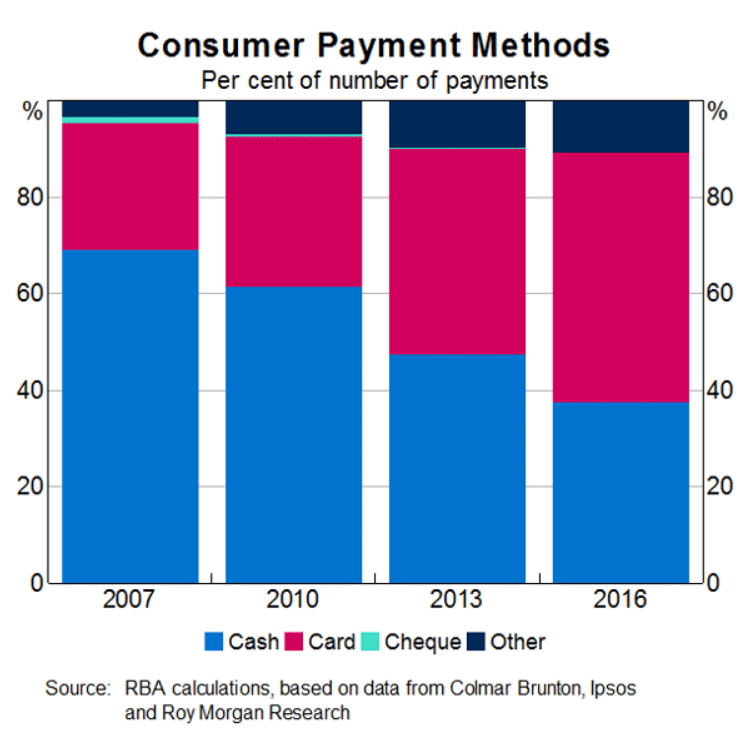

The public is using these products, and there is every indication that this growth will continue. As what it offers a service where the public can have what it wants now and pay interest-free over time.

For our clients a non-integrated solution will be quite a bit of work and unnecessary as our point of sale software is integrated, they would want an integrated solution. Also what they are looking for is a low cost "Buy now, Payer service" as Lay-by is not a good alternative if a customer needs something immediately and as a possible alternative for lay-bys which has problems and costs of administration.

However, like everything, it has a cost, and if it is not the public, it is the merchant that is paying.

Now in our marketspace, three players are trying to break in Afterpay, Oxipay and Zip. I looked into all three, talked to merchants that were using them and here is my view.

Afterpay, we have an excellent relationship with the holding company touchnet works, but this did not help much as it appears that Afterpay team is not that interested in our marketspace. They did tell me that they had an integrated solution through Tyro, which our clients can use and are looking to expand it to other providers but no timetable. The other problem was costs, Afterpay appears to be the dearest 4 to 6% of the sale, which is a lot to my clients who often work on low margin items. Also if the sale is cancelled these fees are not recoverable by the merchant. So they are not going to get a low cost "Buy now, Payer service" here. Also, the repayment schedule is fixed, every two weeks 25% which often does not suit a typical lay-by customer. Generally, a lay-by customer wants a service where they pay something when they have some spare cash and wants the flexibility to decide when their instalments are done and what amounts to pay off. What we did like is that for the merchant, there is no requirement for no payment up front which in many cases this can help the sale move on. The interest-free/penalty period for the customer works out to 56 days. What we did like is that payment to the retailer was within 48 hours. What we did like was the marketing, Afterpay does lots of merchant marketing and that is a big plus.

Oxipay, the first big problem we felt here is that it is small. Regardless of what the retailer thinks if the public is not using it much so what is the point of pushing it? I think it will be an uphill battle for a merchant to sell it just for this reason. The other problem is that a client of ours using it felt the merchant fees were high about 4.5%, so they switched as much as they could to Zip. Also, they have all the same problem as Afterpay with lay-by in that the repayments schedule and amount were fixed, but here the customer is also required to pay 25% upfront which we felt was often a big issue. The interest-free/penalty fee is I believe only 42 days. The merchant repayment was slightly better in that it is the next day at 4 pm. We did not see much in the way of merchant marketing.

Zip, seems to get over most of these problems. The merchant fees are the lowest about 2 to 5%. The customer repayments can be made anytime the customer wants. The interest-free/penalty period can be up to 60 days, but the bonus here was that the customer only has to pay a nominal fee of $40/month if they are short of cash. The merchant repayment period was the best, the same day at 4 pm. What was great was that Zip does a lot of merchant marketing. I was told they sent over a million marketing emails to their clients for Mother's Day advertising product remember we are talking about half a million people using Zip credit.

Risk. All these companies advertise to the merchant that they are *NO* risk. What exactly does this will mean in practice, I am not sure. In case of fraud, in my experience here often it is *NO* risk to them but *ALL* risk to the merchant. However, it does appear that all of them will accept much of the risk.

There is of course if you are willing to go manual to apply to all of them as there is no cost to the merchant to get any or all of them however from what I can gather most merchants that have Zip and something else, tend to push Zip simply as it is cheaper.

Whatever service you pick of course has to fit into your business which will include your needs, your clients’ needs and your technology before choosing. If you go with Zip, we have a good relationship with them now, and at least our clients are not going with us in alone into this market. However, I do believe that a modern shop today should risk missing out on a sale because they do not offer "Buy now, pay later" method. It is damaging now and will get more damaging in the future. Of course, if you want you can do it alone and carry all the risk if your client runs out of money, at least with this option you do not pay any fees.

Whatever you do, you need to make sure that get some point-of-sale materials to display, for example, a sticker to put on your front window to let your clients know you have that service.

If you want to investigate Zip now, please click here.