This question arises every year and again this year. Here, I will discuss the importance of stocktaking for businesses and address common objections.

We also explore the advantages of performing a stocktake, even when facing challenging circumstances. Additionally, we highlight the potential risks of skipping a formal stocktake and how implementing regular rolling stocktakes throughout the year may offer better results.

Firstly, stocktaking is a critical process for retailers, ensuring accurate management of inventory levels. Despite perceived challenges, I think its benefits far outweigh the drawbacks. Modern POS software can streamline the stocktaking process. It's not just for the ATO; I have seen many retailers whose profits have mysteriously disappeared. We are not talking small figures here. Theft, damage, or errors of the inventory mean a significant time loss to the retailers, which also implies a substantial loss of revenue due to the problems of the businesses. You can substantially decrease the losses and increase the revenue by carefully regulating your inventory.

Objections to Stocktaking:

Stocktaking can be viewed as a tedious and resource-intensive task, with several arguments against its necessity:

It consumes time and effort

It incurs additional costs without generating revenue

Disruptions to daily operations can negatively impact sales

These concerns are legitimate; however, there are compelling reasons to perform a stocktake despite them.

Legal Requirements for Stocktaking:

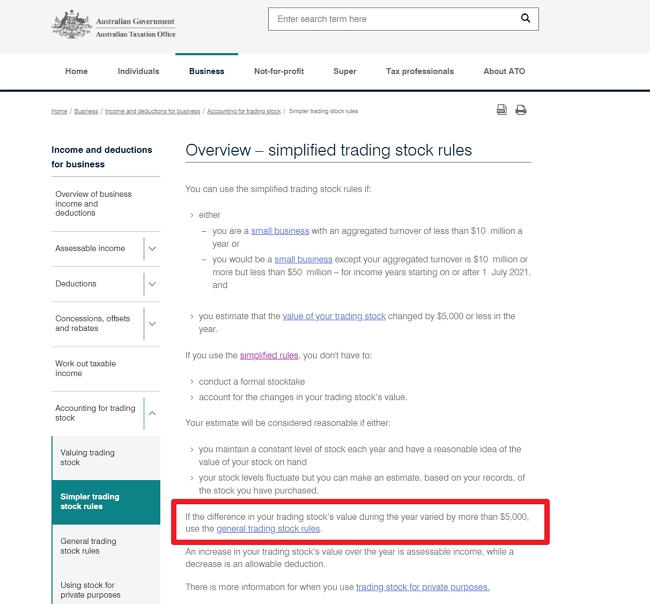

According to the Australian Taxation Office (ATO), businesses must perform a stocktake if they cannot accurately estimate their current stock levels based on historical data and do not meet specific conditions. These conditions include:

The difference in stock values between the previous financial year and the current financial year is less than $5,000

Using a reliable method, you can reasonably estimate your current stock levels and maintain sufficient evidence to substantiate your estimates.

Please read this page from the ATO here on this question and pay particular attention to the square I marked in red.

I am sure every client I have has at least a $5,000 inventory difference between this fiscal year and the previous one.

It is your responsibility to affirm your stock figures to the ATO, at least to their complete satisfaction, so that the ATO will regard your figures as reliable evidence.

Rolling Stocktakes vs Formal Stocktakes:

There's debate over whether to conduct traditional annual stocktakes or opt for rolling stocktakes throughout the year. While rolling stocktakes offer real-time insights, they can be more resource-intensive than formal stocktakes. Both methods have their merits, but accuracy in stock valuation remains paramount for tax purposes.

Advantages of Performing a Stocktake:

A well-executed stocktake offers numerous benefits for businesses, including:

By comparing the inventory on record with the actual stock, one can obtain the data needed to make better stock orders, properly manage inventory, and prevent loss at the premises in cases of theft or things are just out of place. This information can then be used to devise better security measures.

Products are checked to see how many are near expiry and if stock is spoilt and damaged. Often, this allows last-minute sales to recover whatever value is left in these goods.

Getting technology that provides 24/7 visibility of the inventory status and the capability to view, track, and control the flow of goods in and out of the business will ultimately increase operational efficiency, accuracy, and, more importantly, customer satisfaction.

POS Software Benefits:

Our POS software comes equipped with robust inventory management features to simplify stocktaking:

- Barcode scanning: Scan product barcodes for faster and more accurate counting.

- Real-time inventory updates: You do not need to close the shop to do a stocktake.

- Stocktake reports: It generates detailed reports to analyze discrepancies and identify trends.

Conclusion:

With their circumstances, different businesses ought to decide whether to implement a formal or rolling stocktake. The legal aspects and benefits, which must be balanced with each approach, should form the basis for a decision. By taking these necessary steps, you can make wiser decisions.

Whichever way you go, I wish you all the best for your business.